Should You Buy ARK 21Shares Bitcoin ETF (ARKB) While It’s Under $40?

September 26, 2025

Bitcoin’s six-figure price tag got you down? Cathie Wood’s Bitcoin ETF offers the same crypto exposure for less than $40 per share.

Cryptocurrency headlines can be tiresome. Who cares if Bitcoin (BTC -1.53%) is worth $100,000 or $120,000 per coin, right? Both figures are enough to cover four years of college tuition, or buy a luxury car will all the bells and whistles (yes, even that one!). Sure, you can buy just a small fraction of a Bitcoin at a time, but it can be difficult to wrap your head around these large numbers.

But what if you could get exposure to Bitcoin’s potential upside without dealing with those intimidating five- and six-figure price tags? Enter the ARK 21Shares Bitcoin ETF (ARKB -3.63%), trading at $37.75 per share on September 24, 2025.

That’s enough for a nice dinner, not a tricked-out SUV. Let’s use the lower stakes of ARKB shares to consider the value and risks of Bitcoin investments.

Same Bitcoin exposure, friendlier price tag

For all intents and purposes, buying shares of ARKB is the same thing as buying Bitcoin directly. Cathie Wood’s ARK Invest team is actually buying and selling Bitcoin to reflect the cash being invested in this fund. As an exchange-traded fund (ETF), ARKB brings a couple of small quirks to your Bitcoin investment:

-

There’s a modest management fee with an annual expense ratio of 0.21%. It’s a bit higher than the 0.01% expense ratios you see in Vanguard ETFs, but it’s actually one of the lowest fees in the spot Bitcoin ETF arena.

-

When Bitcoin prices go up, ARKB’s chart will follow. The direct effect remains when the crypto chart is pointing down, too.

-

Bitcoin is the only holding in the single-asset ARKB fund’s portfolio.

-

With $4.86 billion of (pure Bitcoin) assets under management, ARKB is one of the most popular and most liquid spot Bitcoin funds. Investors should have no problem completing trades in this fund at a fair price.

-

The fund currently holds roughly 42,744 Bitcoins in its portfolio, and offers investor access to these assets through 50.3 million ARKB shares. That’s how ARKB can provide Bitcoin exposure at such modest share prices — by dividing a large pie in lots and lots of smaller slices. ARKB will be worth $40 right after Bitcoin passes the $120,000 mark.

Why Bitcoin believers are still buying

Now that you know what the ARK 21Shares Bitcoin ETF is, it’s time for a more direct investing question. Is ARKB a buy below $40 per share, based on what’s going on with the underlying Bitcoin market?

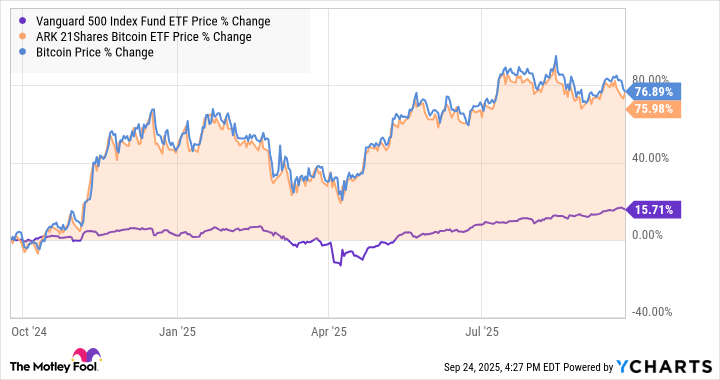

Well, Bitcoin and related investments have been strong performers lately. These Bitcoin bets have approximately quintupled the 15.7% gains of the S&P 500 (^GSPC -0.50%) stock market index over the last year:

That chart includes last November’s election results, which brought a more crypto-friendly administration to Capitol Hill. Excluding that surge, Bitcoin’s results have been comparable to the stock market in 2025. Generally speaking, the cryptocurrency tends to jump when the economy looks strong and fall when investors feel more pressure. Bitcoin is a very volatile asset, and many bulls make leveraged crypto investments with borrowed money. That’s harder to do when interest rates are high, so macroeconomic moves have a direct impact on this sector.

The risks don’t shrink with the share price, though

In a longer perspective, you have to weigh Bitcoin’s potential gains against a plethora of unique risks. Bitcoin maximalists expect the “digital gold” to replace the U.S. dollar and physical gold as the preferred methods for storing and transferring money around the world. If that happens, the sky just might be the limit.

ARK Invest founder Cathie Wood and Strategy (MSTR -7.14%) chairman Michael Saylor both see million-dollar price tags for Bitcoin as early as the year 2030. That would translate into ARKB prices in the $850 range per share — a massive return on your investment of less than $40. ARK Invest would probably split those shares several times before then, keeping the share price at a more digestible level.

If you agree with their ultra-optimistic views, the ARK 21Shares Bitcoin ETF certainly looks like a great buy today. Just remember that the road to large gains surely will be bumpy, and the final payout may not be quite that lucrative.

Image source: Getty Images.

Then again, Bitcoin bears could be right, too.

Other cryptos could steal the spotlight with a better wealth-storage system. Regulators could turn more combative, depending on the results of the next couple of elections. Hackers could find flaws in Bitcoin’s encryption, perhaps using the latest and greatest quantum computing systems. That’s just the start of a long list, any of which could undermine Bitcoin’s value in a hurry.

The ARKB fund can help you manage those risks. Grabbing a handful of $40 ETF shares — or even just one — can keep your skin in the Bitcoin game without risking your life savings. That’s one way to participate in the Bitcoin phenomenon without worrying about fractional coins with massive price tags.

Search

RECENT PRESS RELEASES

Related Post