Should You Buy Ethereum While It’s Down 45% This Year?

April 1, 2025

The crypto market hasn’t been doing well this year, and Ethereum (ETH 3.99%) has had one of the steeper drops. It’s down 45% year-to-date at the time of this writing.

Even after that decline, Ethereum is still the second-largest cryptocurrency by market cap. The glass-half-full outlook is to look at this as a good buying opportunity. But Ethereum is facing some major headwinds as it looks to rebound.

Ethereum’s losing ground to the competition

Because Ethereum was the first blockchain with smart contract functionality, it became the default launching pad for blockchain projects. Five years ago, if you wanted to create your own crypto token or mint a non-fungible token (NFT), you were probably going to use Ethereum. It was also home to practically all the major decentralized finance (DeFi) applications. At the end of 2020, Ethereum was responsible for 96% of the total value locked (TVL) into DeFi protocols, according to data from DeFiLlama.

As popular as it is, Ethereum’s blockchain performance has never set the world on fire. It only processes about 15 to 20 transactions per second (tps). Average gas fees (transaction fees) are currently $0.39, but they fluctuate with network congestion, so they can be much more expensive. Last year, for example, gas fees occasionally surpassed $10.

Those performance issues and high costs have given other blockchains the opportunity to take some of Ethereum’s market share, with Solana (SOL 2.08%) being the most notable example. Where Ethereum processes 15 to 20 tps, Solana regularly processes over 4,000, and with an average transaction fee of just $0.00025.

So while Ethereum used to be responsible for 96% of the TVL in DeFi protocols, that’s now down to 53%. And while Ethereum was the most popular blockchain network for new developers from 2016 through 2023, that honor went to Solana in 2024.

There’s been a recent shakeup at the Ethereum Foundation

Many in the Ethereum community have been unhappy with its direction and leadership, and in particular, the Ethereum Foundation. This nonprofit organization’s mission is to guide Ethereum’s growth through resource allocation, research and development, and developer support. But there has been increasing frustration with it for being slow to act on issues, including the network’s lackluster transaction speeds and declining popularity among developers. Ethereum’s poor returns compared to other major cryptocurrencies haven’t helped matters.

The complaints about Ethereum’s direction haven’t gone unheard. In January, co-founder Vitalik Buterin announced that the Ethereum team was “in the process of large changes to [Ethereum Foundation] leadership structure” with goals of bringing in fresh talent, improving levels of technical expertise at the foundation, and giving the foundation a proper board of directors. He also made it clear that he’s the sole person in charge of picking the Ethereum Foundation’s new leadership team.

A change in leadership could be a good move for Ethereum, as the current path wasn’t working. It’s still too early to know whether this will be a positive change, and a cryptocurrency with this kind of turmoil is a risky investment.

This isn’t a recent dip; it’s a long-term trend

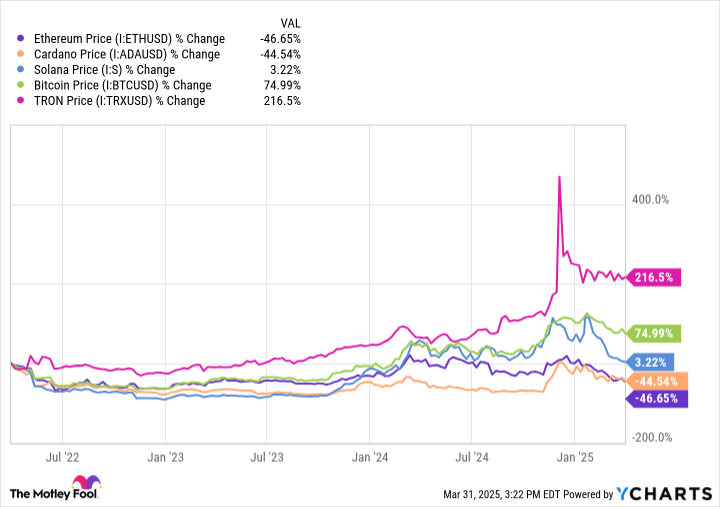

If you’re thinking about buying the dip with Ethereum, keep in mind that its price didn’t just take a tumble in 2025. Over the last year, it’s down nearly 50% — underperforming market leader Bitcoin (BTC 2.16%), as well as Solana, Cardano (ADA 5.73%), and Tron (TRX 0.99%), which are three of its top competitors. Going further back, Ethereum has lost over 45% of its value over the last three years. That’s similar to Cardano over the same period but far behind Bitcoin, Solana, and Tron, as indicated in the chart below.

Ethereum Price data by YCharts

Ethereum could certainly bounce back, as it has the name value and a large user base. However, it’s not just about whether Ethereum gets into the green but how it performs compared to other cryptocurrency investments. At the moment, it makes more sense to invest in the faster, more efficient blockchains that have been cutting into Ethereum’s market share, like Solana and Tron. I’d say wait to see whether Ethereum can improve its efficiency and its reputation with investors before you buy any.

Lyle Daly has positions in Bitcoin, Cardano, Ethereum, and Solana. The Motley Fool has positions in and recommends Bitcoin, Cardano, Ethereum, and Solana. The Motley Fool has a disclosure policy.

Search

RECENT PRESS RELEASES

Related Post