Should You Buy or Sell AMZN Stock as Amazon Feuds with Perplexity?

November 5, 2025

/Amazon%20shopping%20page%20on%20computer%20by%20Thaspol%20Sangsee%20via%20Shutterstock.jpg)

Amazon shopping page on computer by Thaspol Sangsee via Shutterstock

Amazon (AMZN) has sent a “cease and desist” letter to artificial intelligence (AI) startup Perplexity, accusing its AI-powered shopping assistant Comet of violating the company’s terms of service by failing to identify itself. AI shopping agents like Comet are a threat to Amazon’s lucrative and fast-growing digital advertising business. In this article, we’ll examine how to play Amazon stock amid the company’s public feud with Perplexity.

According to Amazon, it has asked Perplexity to remove Amazon from the Comet experience “in light of the significantly degraded shopping and customer service experience it provides.” Perplexity termed Amazon’s cease and desist letter as an “aggressive legal threat” and a “first legal salvo against an AI company,” which it said “is a threat to all internet users.”

Why Is Amazon Going After Perplexity?

Notably, the question over AI agents also popped up during Amazon’s Q3 2025 earnings call. CEO Andy Jassy was quite upbeat on them and said that they would “expand the amount of shopping that happens online.” He went on to add, “I think it’s really good for Amazon because at the end of the day, you’re going to buy from the outfit that allows you to have the broadest selection, great value, and continues to deliver for you very quickly and reliably.”

While it may seem counterintuitive that Amazon is targeting something that only shops on its website on behalf of its customers, at stake are the billions of dollars that the e-commerce giant earns from its digital advertising business. In Q3 2025, Amazon earned $17.7 billion from selling digital ads, up 24% from the corresponding quarter last year. The growth rates surpassed that of the company’s e-commerce and Amazon Web Services business.

As Perplexity said in its response to what it called “bullying” from Amazon, “They’re more interested in serving you ads, sponsored results, and influencing your purchasing decisions with upsells and confusing offers.” While threats from AI shopping agents are not new, it has come to the forefront with the expected legal fight between Amazon and Perplexity.

Is AMZN Stock a Buy?

Meanwhile, even as Amazon and Perplexity battle it out over AI agents, I find AMZN stock a good buy. Here’s why.

- AWS Growth: One of the reasons Amazon shares underperformed Big Tech companies this year was concerns over AWS losing market share to the likes of Microsoft (MSFT) and Alphabet (GOOG) (GOOGL). However, AWS reported 20.2% year-over-year revenue growth in Q3, which beat estimates. Recently, OpenAI announced a multiyear $38 billion cloud deal with Amazon, which was nothing short of an endorsement for the company’s cloud business after the recent outage.

- Grocery Business: Amazon is expanding its grocery business even to rural areas, which would help it increase its addressable market. This, coupled with ever faster deliveries – Amazon is offering 3-hour deliveries in select U.S. cities – will help buoy the company’s top-line growth in the coming quarters. The company has also launched its private label grocery brand to buoy its food business.

- Margin Expansion: Amazon has been a margin expansion story since the company began aggressive cost cuts in 2022. The company’s operating margins, after adjusting for one-time charges, expanded to 12% in the most recent quarter, which is quite encouraging. There is more to the margin expansion story as Amazon leverages AI to cut costs even further.

- AI Initiatives: Amazon is leveraging AI across its business. For instance, Rufus, its AI-powered shopping assistant, has over 250 million active customers, and according to the company, the platform is set to drive $10 billion in incremental annualized sales. AI is also fueling the demand for AWS, whose Q3 revenues grew at the highest pace in 11 quarters.

- Live Video and Prime Ads: While Amazon’s digital ad business is under threat due to third-party AI agents like Comet, Prime’s digital ad business could continue to do well. The company has started cracking down on Prime password sharing and should ramp up ads in 2026. Live sports could be another enabler of ads on Prime, and during the Q3 call, Jassy said that it “got a lot of interest from advertisers in upfront negotiations,” which he emphasized “exceeded our own expectations for upfront commitments with significant growth across the board.”

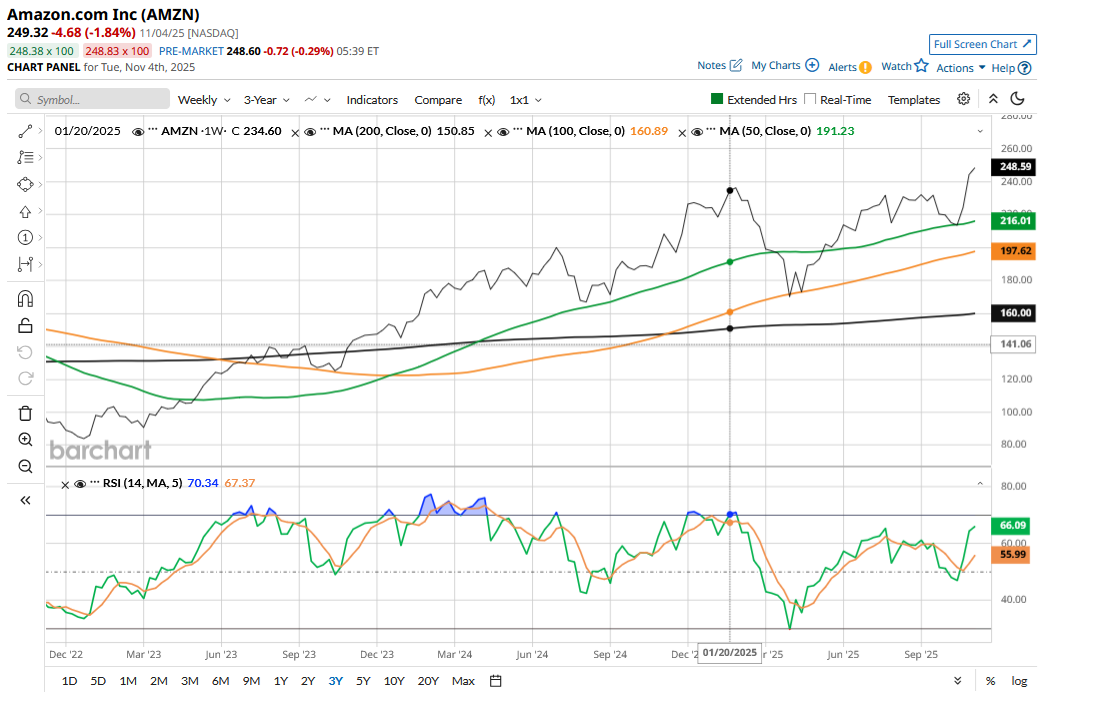

AMZN Stock Forecast

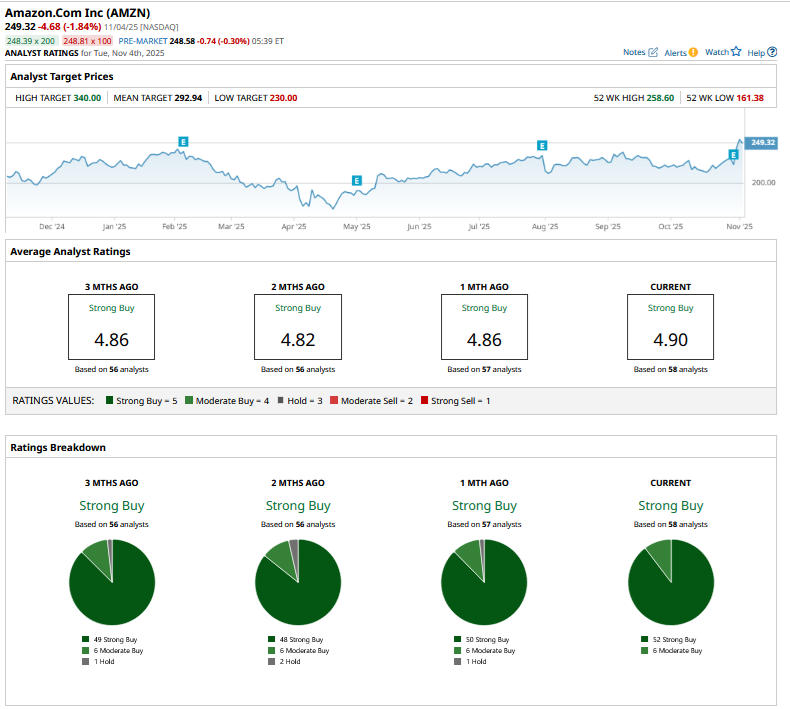

In my previous article, I had noted that Amazon was in for a post-earnings bump given the tepid valuations and the YTD underperformance. The stock saw strong gains, which were the highest among the Magnificent 7 peers that have reported their September quarter earnings. Several Wall Street analysts raised AMZN’s target price following the company’s Q3 report, and its new Street-high target price of $335 is over 34% higher than the Nov. 4 closing price.

I remain bullish on Amazon, and while it has played catch-up with tech peers, the best is yet to come for the Seattle-based company as it doubles down on AI. From a valuation perspective, a forward price-earnings (P/E) multiple of 35x is not really exorbitant considering the kind of growth the company brings to the table.

On the date of publication, Mohit Oberoi had a position in: AMZN , GOOG , MSFT . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Search

RECENT PRESS RELEASES

Related Post