Should You Invest in Ozempic Maker Novo Nordisk in 2026?

December 26, 2025

The pharmaceutical giant’s stock has tumbled over the past year and a half, but it could be poised to storm back.

Is there a more popular health trend right now than GLP-1 agonist obesity drugs such as Ozempic? Probably not. Ironically, though, investing in Ozempic, or rather in its manufacturer, Novo Nordisk (NVO 0.72%), hasn’t gone very well this year.

Shares have fallen by 40% in 2025. Competition from Eli Lilly‘s similar drug, Zepbound, and from telehealth companies selling compounded versions of Ozempic pressured Novo Nordisk’s business to the point that the company fired its CEO earlier this year.

Investing in a cold stock like Novo Nordisk can feel a bit scary, but things could be starting to heat up again for the pharmaceutical giant.

Image source: Novo Nordisk

Novo Nordisk just scored a game changer

Novo Nordisk shares jumped on Tuesday following news that the Food and Drug Administration (FDA) had formally approved its application to sell a pill form of Wegovy in the United States. Wegovy is the same drug as Ozempic — generically called semaglutide — but while the latter is approved to treat type 2 diabetes, Wegovy is the brand intended to be prescribed for weight management.

The FDA’s decision is a big deal for several reasons. First, the Wegovy pill will be the first oral GLP-1 drug on the market. In a phase 3 trial of the treatment, participants showed a mean weight loss of 16.6% over 64 weeks, and one in three lost 20% or more. Second, most patients will likely prefer taking a daily pill to injections.

Advertisement

This new version of the drug will give Novo Nordisk a crucial tool to push back against the pressure it has faced from competition. Eli Lilly is seeking FDA approval for its oral obesity drug, and could get it as soon as March, but Novo Nordisk has won the race to market. In the meantime, Wegovy could quickly gain traction, which would help Novo Nordisk even if it remains the only approved pill of its kind for a limited time.

The Wegovy pill will be available for patients in early January, and Novo Nordisk’s CEO has said the company has already built up enough supply to support an aggressive product launch. “We have more than enough pills this time,” he said.

Novo Nordisk

Today’s Change

(-0.72%) $-0.38

Current Price

$52.18

The stock’s decline has coiled the spring

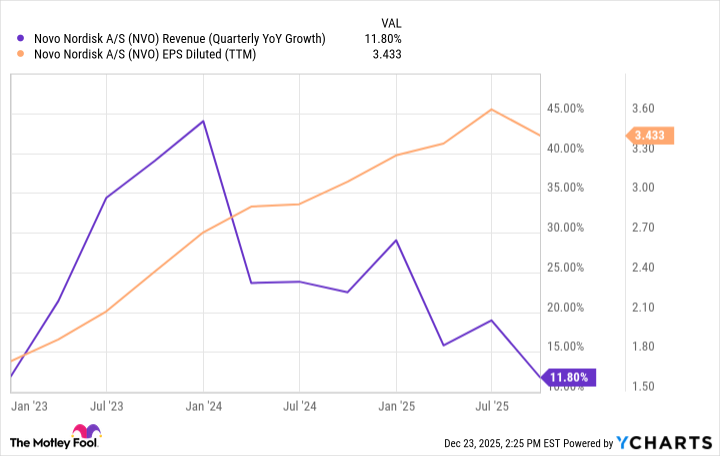

Novo Nordisk’s business has clearly felt the heat of competition. Its revenue growth has steadily slowed for over a year. However, based on the headlines and the stock performance, it would be easy to believe that the business has collapsed, and that’s simply untrue.

In fact, Novo Nordisk continues to grow, including double-digit percentage revenue growth in its most recent quarter. Its earnings per share have roughly doubled since early 2023.

NVO Revenue (Quarterly YoY Growth) data by YCharts.

After the stock’s slide, Novo Nordisk resembles a compressed spring — it’s just waiting to unleash its pent-up energy. The stock currently trades at a price-to-earnings ratio of just 13 times its expected 2025 earnings.

That’s arguably a bargain price even if its growth rate simply stabilizes at a low double-digit percentage. However, the Wegovy pill appears likely to be a significant catalyst that could reaccelerate the company’s top-line growth by mid-2026.

Is Novo Nordisk a buy?

If Novo Nordisk can boost its earnings at an annualized growth rate of 15% or higher moving forward, that would easily justify the market bumping its price-to-earnings ratio back above 20.

That means it could be a home run investment next year. A simple rebound in the stock’s valuation to 20 times earnings would equate to a share price gain of more than 50% from here, and that’s without factoring in potential double-digit earnings growth.

Additionally, at the current share price, the company’s dividend yields 3.3%, which is near its highest yield on record. If you add it all up, Novo Nordisk has the makings of a market-beating investment in 2026. That’s not a guaranteed outcome, but the tailwinds it should experience are more than enough reason to strongly consider adding the stock to your portfolio heading into the new year.

Search

RECENT PRESS RELEASES

Related Post