Solana Outperforms Bitcoin, Ethereum After Firedancer Validator Goes Live On Its Mainnet

December 12, 2025

In the last 24 hours, there were $255.07 million worth of liquidations in the crypto market, according to CoinGlass data.

- Solana’s price rose over 5% in the last 24 hours after the Firedancer validator went live on mainnet following nearly three years of development.

- Ethereum led liquidations, with Bitcoin close behind, while Solana saw relatively moderate forced liquidations versus major peers.

- Oliver D Maximus, a market watcher, said on X that Dogecoin might bounce back in the short term, but also warned that there was less room for the token’s growth.

Solana (SOL) led gains among major tokens in early morning trade on Friday, outperforming Bitcoin (BTC) and Ethereum (ETH) after the Firedancer validator went live on mainnet.

Solana’s price rose 5.5% in the last 24 hours and was trading at around $138.23. CoinGlass liquidation data showed that forced liquidations were mostly under control, with about $14.40 million in leveraged bets on Solana wiped out in the last 24 hours.

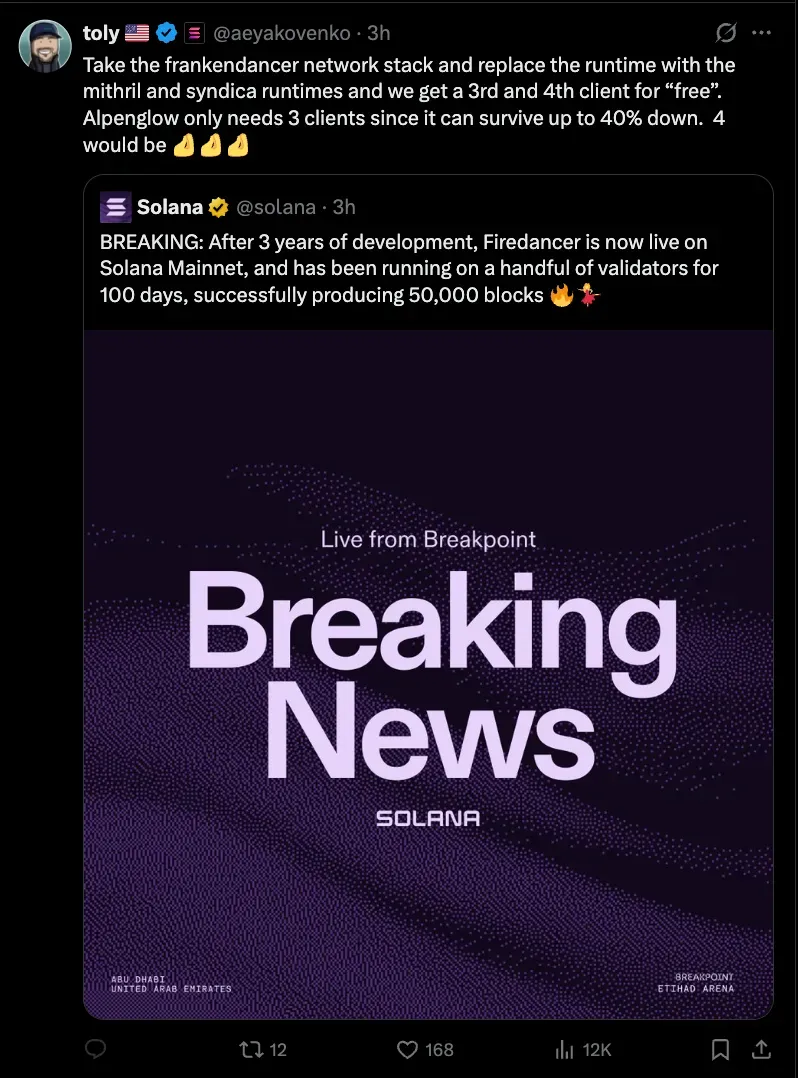

The uptick comes after Solana co-founder Anatoly Yakovenko announced the end of the network’s Firedancer validator beta phase earlier on Friday. After being under development for nearly three years, it’s now live on mainnet.

Firedancer is said to be different from Solana’s standard Agave client because it adds client diversity and will be able to handle past outages better by improving throughput, efficiency, and network resilience. On Stocktwits, retail sentiment around SOL continued to be in the ‘bullish’ territory with ‘low’ levels of chatter over the past day.

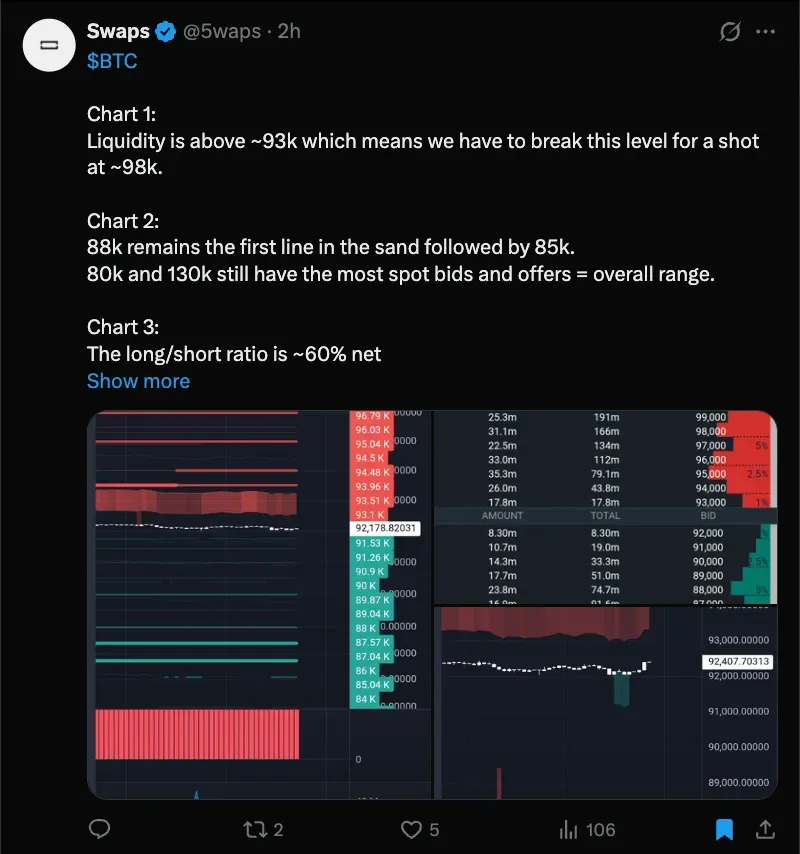

Bitcoin (BTC) followed Solana, rising 2.6% over the past day. BTC was trading at around $92,573, with $103.49 million in liquidations over the last day. Analyst Swaps said on X that Bitcoin was still stuck in a range. For it to go higher, it would need to break above $93,000. However, the support range for the crypto could be in the $85,000 to $88,000 range. On Stocktwits, retail sentiment around the apex cryptocurrency remained in ‘neutral’ territory, with ‘low’ levels of chatter over the last 24 hours.

Ethereum (ETH) was trading at about $3,253 and had about $61.69 million in liquidations in the last 24 hours. Most of the liquidations were on the long side, consistent with profit-taking. On Stocktwits, retail sentiment around Ethereum improved from ‘neutral’ to the ‘bullish’ zone over the last 24 hours, with chatter at ‘normal’ levels.

Binance coin (BNB) was trading around $887.94, which is a 2.4% increase over the last 24 hours. On Stocktwits, retail sentiment around BNB continued to be in ‘neutral’ territory with chatter at ‘normal’ levels over the past day.

Even though derivatives data showed more long-side liquidations over the past 24 hours, totaling about $719,200, Dogecoin (DOGE) rose about 2.4% on the day and was trading near $0.1412. Oliver D Maximus, a market watcher, said on X that the $0.16 area could be a short-term inflection point. However, he also warned that the overall upside was still limited at higher levels. On Stocktwits, retail sentiment around DOGE trended in the ‘bearish’ zone, with ‘low’ levels of chatter in the past 24 hours.

Cardano (ADA) was trading modestly higher over the past 24 hours, steadying after a sharp intraday drop. Liquidations were largely concentrated on long positions, indicating leveraged bullish bets were flushed even as price action stabilized. Retail sentiment around ADA continued to be in the ‘bullish’ territory with ‘normal’ levels of chatter over the past day on Stocktwits.

Ripple (XRP) was valued at about $2.04, up 1.1% more than it was 24 hours ago. XRP-related liquidations came to about $3.3 million, with long liquidations outnumbering short bets. Retail sentiment around XRP on Stocktwits remained in ‘bearish’ territory, with ‘low’ levels of chatter over the past day.

Overall, the total amount of liquidations in the crypto market stood at $255.07 million in the last 24 hours.

Read also: JP Morgan Uses Public Blockchain For The First Time to Issue Debt

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Search

RECENT PRESS RELEASES

Related Post