Solana vs Ethereum — Price Prediction After SEC Agenda Update Shakes Market

September 28, 2025

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

The SEC’s Spring 2025 agenda has caused ripples in the cryptocurrency market, casting uncertainty over major tokens. As regulatory developments unfold, investors are closely monitoring the impact on Ethereum and Solana, as the market anticipates potential policy changes. Trading activity has become cautious, with participants reassessing risk exposure amid broader market turbulence. Analysts are tracking the movement of sentiment as regulatory clarity or uncertainty could impact short-term volatility and longer-term investment strategies.

In this context, MAGACOIN FINANCE is starting to make a name for itself. The Ethereum-based token is garnering traction as analysts forecast that it could benefit from increased transparency regarding SEC rules while market trust evolves.

SEC Regulatory Agenda and Digital Assets

The SEC Spring 2025 agenda puts digital assets at the center of its policy program. It aims to provide clearer guidelines for the issuance, custody, and trading of cryptocurrencies while ensuring investor protection.

Deregulatory measures include streamlining fundraising channels, lessening operational burdens, and re-evaluating the Consolidated Audit Trail system to balance cost against security oversight considerations. Analysts believe that these measures could provide confidence and institutional participation, creating opportunities for projects that comply with them. Investors consider that greater regulatory clarity could help ease uncertainty, boosting adoption and liquidity across digital assets.

Ethereum Price Outlook

Ethereum has been under pressure short term after recent highs. The initial small ascending channel from the prior weeks broke down, signaling a change of momentum. RSI has declined towards 40, indicating a weakening bullish strength without reaching extreme oversold levels. Traders are paying close attention to key support levels around $4,200 and $4,000.

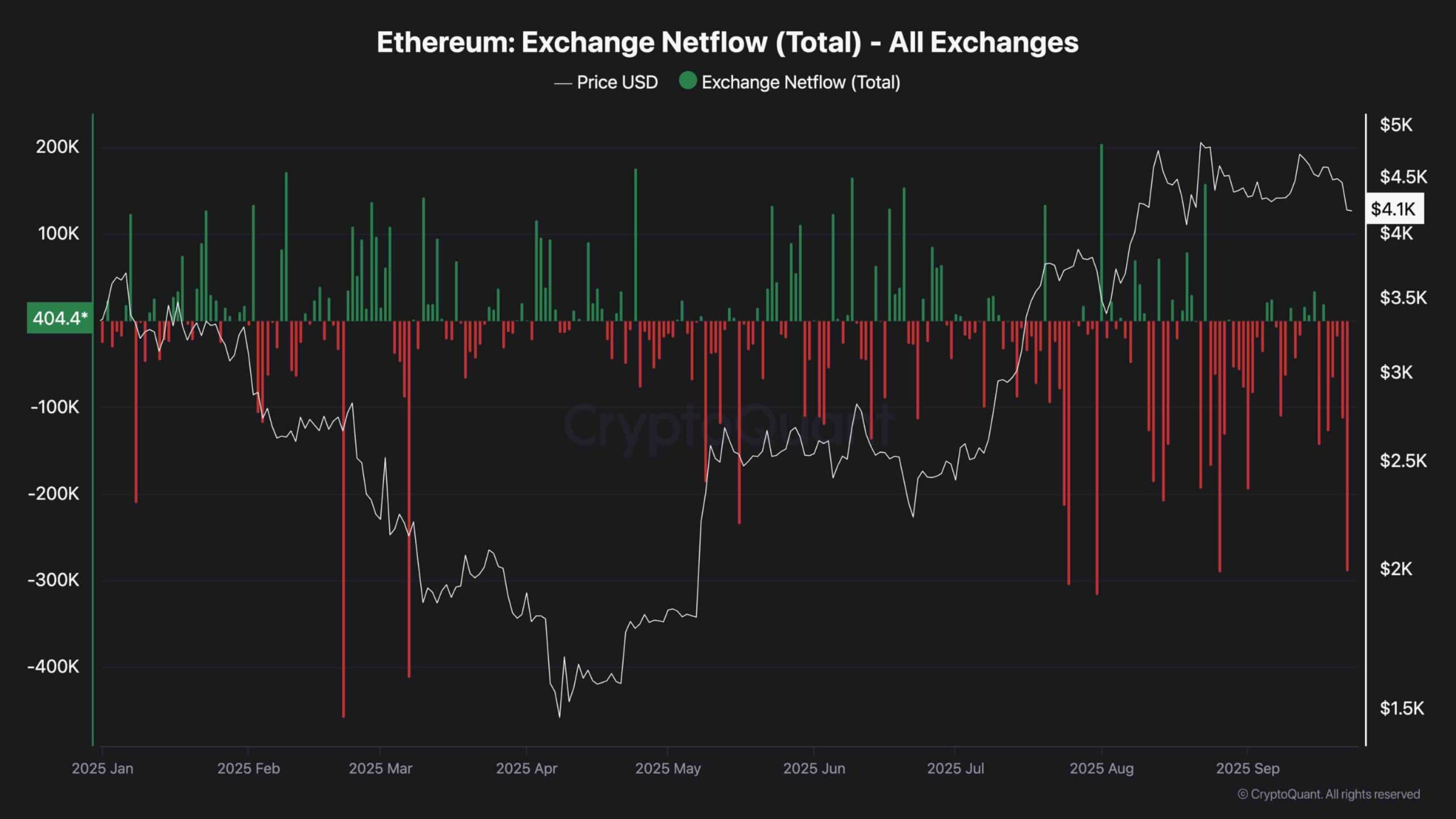

Exchange netflows show consistent ETH outflows, indicating coins moved to self-custody or staking. Nonetheless, this decreases selling pressure and offers medium- to long-term bullish support. Despite short-term technical weakness, Ethereum’s broader fundamentals remain strong, supported by institutional interest and ongoing network improvements.

Analysts have pointed out that if support holds, ETH could make a higher low and retest previous resistances. Conversely, failure to hold these zones may intensify selling pressure, raising the chances of deeper retracements. Momentum indicators indicate consolidation ahead of a bullish recovery.

Solana Price Outlook

Solana has fallen by 10% recently but bounced back to yield a higher low. Despite the downward shift, the higher highs and higher lows since April have held. Long-term horizontal resistance is near $250, which has proven difficult for the price to break since 2021. It reached an all-time high of $295 earlier this year.

Based on technical wave theory, SOL appears to be in the fifth of five waves up that it is moving in. A bullish move above $250 could break through overhead resistance and initiate a parabolic rally. Further upside targets include Fibonacci retracement levels between 0.064 and 0.071 ETH.

Analysts believe Solana can outperform Ethereum throughout the remainder of 2025 with continued momentum. Volume patterns show strong accumulation around recent lows, which supports upside potential. Traders are closely observing resistance and liquidity zones to determine the direction of Solana’s upcoming rally.

Solana vs Ethereum: A 2025 Blockchain Showdown

In 2025, Solana and Ethereum remain the top smart contract environments, but their courses are unique. Solana is known for speed, processing thousands of transactions per second with low latency. With its unique combination of Proof of History and Proof of Stake, this network is primed for high-frequency applications like gaming and DeFi in real-time, providing a competitive advantage that drives swift adoption.

On the other hand, Ethereum depends entirely on its Layer-2 ecosystem for scalability, with significantly fewer transactions per second on the base layer. However, its network enjoys unmatched developer activity, mature DeFi protocols, and a strong institutional following. The future upgrades, like danksharding-enabled Dencun, promise to deliver enhanced throughput and decreased fees, streamlining the competitive position of Ethereum.

From a market standpoint, Solana has demonstrated more acute short-term increases, making it a viable option for traders aiming for rapid profits. Ethereum has proven more stable, and the greater liquidity and regulatory clarity are drawing long-term investors. Analysts have noted that Solana could move to the lead for upside potential, particularly if it finally breaks past persistent resistance levels. Overall, Ethereum is poised for long-term growth as various factors such as network maturity, security, and adoption by institutions boost its strong fundamentals.

Amid the Solana vs Ethereum debate, MAGACOIN FINANCE is quickly stealing attention at a time when the SEC’s latest agenda update has unsettled the broader market. Built as a Layer 2 project on Ethereum, it benefits directly from Ethereum’s growth while carving its own path. What makes it stand out is its design; early supporters are placed at the center, with a structure that rewards them from the start.

A significant share of tokens is set aside for community growth and exchange liquidity. This approach is aimed at creating stable trading conditions once the token lists, giving investors confidence that volatility will be managed from day one. To add even more momentum, MAGA

COIN FINANCE has introduced a limited-time 50% bonus for buyers using the promo code PATRIOTS100X. The bonus has already sparked strong demand, with investors treating it as a chance to maximize exposure before wider listings.

As Solana and Ethereum wrestle with market turbulence following the SEC update, MAGACOIN FINANCE is emerging as the project many are watching for fresh growth potential.

Conclusion

The SEC’s agenda has introduced both short-term volatility and long-term opportunity for Ethereum and Solana. Regulatory clarity may boost investor confidence and support compliant projects. Ethereum faces short-term consolidation, with Layer-2 solutions and upcoming upgrades supporting medium- to long-term growth. Solana’s speed and low fees position it for potential breakout momentum in the coming months.

Amid this landscape, MAGACOIN FINANCE emerges as a notable Ethereum-based token. Analysts believe it is well-positioned to benefit from evolving rules and market confidence, making it a project to watch alongside these established blockchains in 2025.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

Search

RECENT PRESS RELEASES

Related Post