Some federal solar credits are ending. Virginia installers rush to meet demand.

October 26, 2025

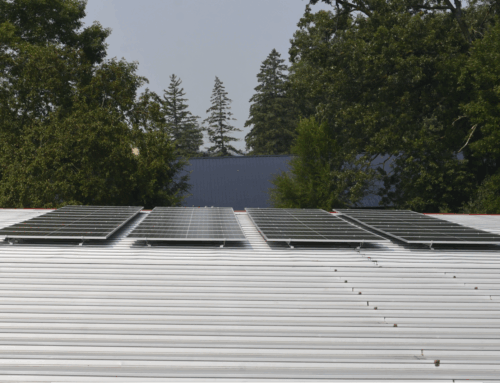

The Wesley Union A.M.E. Zion Church in Norfolk had solar panels installed in 2020, an upgrade that’s saved the church an estimated 25-30% on energy bills.

The savings, which equate to about $75 a month, are put toward other church initiatives such as a fund to help prevent evictions, according to Pastor Brandon Praileau. The solar project was done at no cost to the church, covered through a combination of assistance from a local solar investment fund and federal tax credits for commercial projects.

But the tax credits used for the project are set to expire soon, and solar energy advocates in Virginia are working to complete projects ahead of the deadline to still receive credits that cut the cost of installations by nearly a third.

Affecting residential and commercial projects, changes to federal tax codes approved this summer drastically cut timelines for the credits down by several years.

For Virginians, a 5-kilowatt solar system on a residential home costs $13,855 on average, according to the energy marketplace EnergySage. After federal tax credits, the cost drops to $9,699. While higher income households may still have the means to install solar without the 30% tax credit, Praileau said lower income households get left behind.

“It further goes to show that renewable energy, and these incentives that incentivize renewable energy like the solar tax credit, would allow folks to be able to buy into programs to save money on their energy costs,” said Praileau, who is also the Virginia director of Solar United Neighbors, a nonprofit that represents solar owners. “All of those things are impacting a bunch of Virginians because it takes away their energy freedom.”

Virginia ranks 9th in the U.S. for total solar capacity installed, and about 7,100 megawatts are generated from those installations. According to the Solar Energy Industries Association, this is enough to power more than 810,000 homes.

How are the credits changing?

In July, the federal One Big, Beautiful Bill Act introduced significant changes to the clean energy tax landscape. Specifically, the Residential Clean Energy Credit, or the 25D credit, will expire at the end of the year. This credit covers 30% of the costs of new clean energy projects installed on a residential property, including solar. To qualify, homeowners must have solar panel installations completed and ready to be connected to the electric grid by Dec. 31.

There’s no cap, or maximum dollar amount, for projects that are categorized under this tax credit, as long as the project is completed by the end of the year.

Before the bill, the credit would have been available until 2032. Then, the credit percentage rate would have gone down to 26% for property placed in service in 2033 and 22% for property placed in service in 2034.

For commercial projects, the bill shifted deadlines. Now, projects that begin construction by July 4, 2026, must be placed in service within four calendar years. If project managers do not meet the July 4 deadline, then they must be in service by Dec. 31, 2027. Essentially, there’s a rush to meet the July 4 deadline to secure four years of construction, said Robin Dutta, executive director of the Chesapeake Solar and Storage Association.

These projects include installations on businesses, houses of worship and public buildings.

How is this affecting business?

Nolie Diakoulas, sales director of Convert Solar, said interest in residential solar has “exploded” since July, when the deadlines for credits changed. Convert Solar is a full-service solar energy system provider based in Virginia Beach, and the company serves residential and commercial clients.

“We experienced double and triple the usual volume of customers, continuing right up to our 2025 installation cutoff date of Oct. 1,” Diakoulas said. “Currently, Convert Solar has approximately 700 projects scheduled for installation by the end of the year. While the latter half of the year is typically our busiest, this year’s volume is double what we usually see.”

Diakoulas said the interest in commercial projects has not seen the same surge, in part because of how complicated the projects can be.

Dutta, who works with solar-related businesses across the mid-Atlantic, said commercial projects are usually much larger than residential, meaning they often have more extensive permitting before construction can begin. And if those projects do not begin by July 4, the timeline becomes even more crunched, Dutta said.

“The question we have is, how many systems may have to miss the July 4 deadline won’t be able to be built by the end of 2027?” Dutta said. “It definitely increases business uncertainty. We’ve seen (solar installation) companies already conduct layoffs.

“Some are going out of business already, just because these are tight timelines. This is a more constricted, constrained and expensive business environment.”

What resources remain available?

Even with the residential credit going away at the end of the year, Diakoulas said the residential industry’s shift toward a third-party ownership model means projects on homes can leverage 48E credits, a commercial solar credit.

With third-party ownership, there are two forms: leasing agreements and power purchase agreements, or PPAs. In the lease model, a customer signs a contract with a developer and pays for the use of the installation over a specific period of time, rather than paying for the power generated. In the PPA model, the system offsets the customer’s electric utility bill, and the developer sells the power generated to the customer at a fixed rate, usually lower than the local utility.

“(Third-party ownership) is an excellent option for homeowners because this model guarantees savings from day one (unlike a loan), covers all warranties and maintenance for 25 years and guarantees the solar system’s production,” Diakoulas said.

Though the tax credits are ending, advocates are working to keep solar accessible.

Praileau said Solar United Neighbors encourages a renewable energy system that benefits all incomes. That includes sharing information about how to start the process of transitioning to solar energy and promoting resources like the Virginia Solar Renewable Energy Credits. Through this program, for every megawatt-hour of electricity solar panels produce, a homeowner can then sell to utilities to help them meet renewable energy goals.

Last weekend, the local chapter of the nonprofit advocacy group Third Act hosted community and school leaders from across the region at Norfolk Academy to learn more about installing solar at school buildings. Susan Lee Feathers, a co-facilitator of Third Act Tidewater, said the school has had significant savings through its solar project, and teachers have used the installation to facilitate science lessons about energy. Feathers said schools often don’t have to pay for installation, thanks to power purchase agreements. Another strategy is having a donor pay for the installation, and the donor is reimbursed through energy savings.

“We want to make stronger, healthier schools,” Feathers said. “(Solar is) a clean source of energy, it’s renewable and it’s a community asset. Once it goes in, if there is a power outage, you’re going to have a back up. This is a step in the right direction.”

Eliza Noe, eliza.noe@virginiamedia.com

RevContent Feed

Search

RECENT PRESS RELEASES

Related Post