South Korea’s 11th power plan makes partial progress towards decarbonization

March 30, 2025

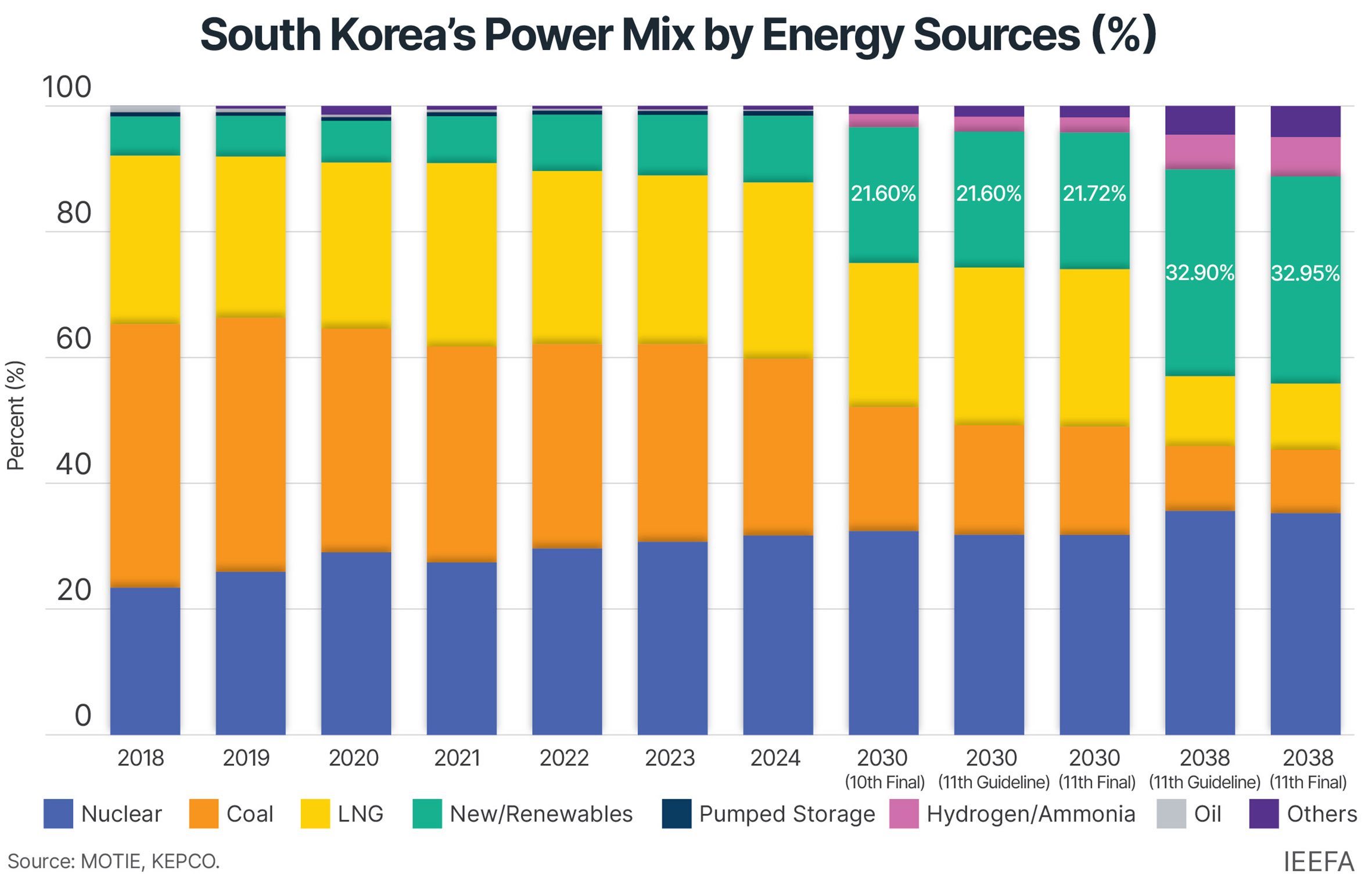

In February 2025, South Korea finalized its 11th Basic Plan for Long-Term Electricity Supply and Demand (BPLE). The plan makes some progress toward the country’s decarbonization goals, reflecting calls to reduce fossil fuel dependency in the power generation mix while increasing the use of carbon-neutral energy.

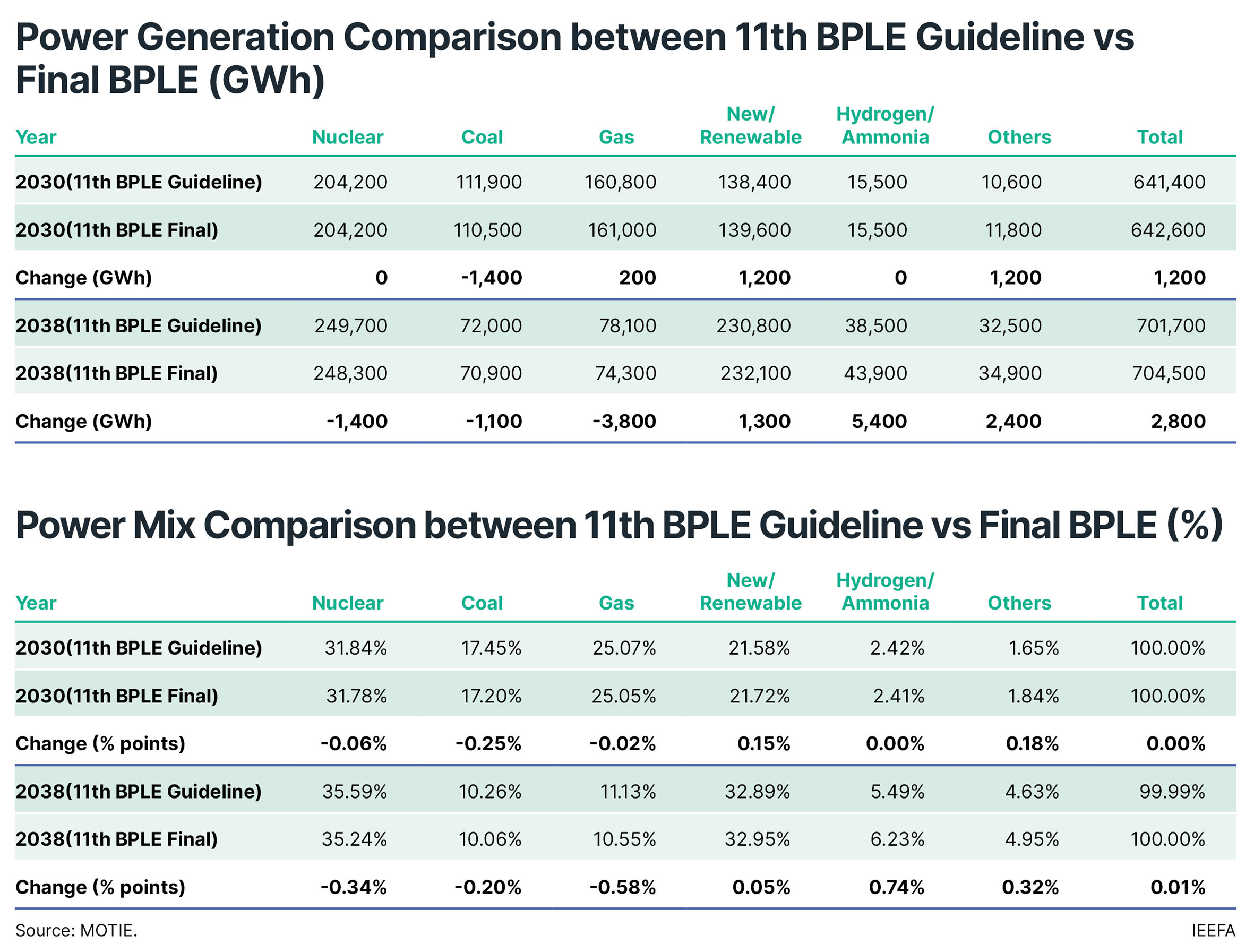

Compared to the 11th BPLE guideline released in mid-2024, the final plan has increased power generation from new and renewable energy by 1,200 gigawatt hours (GWh) in 2030 and 1,300GWh in 2038. Conversely, nuclear power generation was reduced by 1,400GWh in 2038, while coal power production decreased by 1,100GWh, and natural gas generation fell by 3,800GWh.

The improved final 11th BPLE is expected to pave the way for South Korea’s green energy transition in association with the recently passed Energy Trifecta Bill, which includes the National Grid Expansion, Special Offshore Wind Power, and High-Level Waste Management bills.

However, compared with the earlier guideline, the overall power mix reflects minor changes due to the expected increase in total generation resulting from the rising demand outlook in 2030 and 2038. The proportion of new and renewable energy in the power mix has increased by 0.15% point to 21.72% in 2030, rising to 32.95% in 2038. Meanwhile, the share of natural gas fell by 0.58% point to 10.55% in 2038, with nuclear energy’s share at 35.24% and coal at 10.06%. Significantly, unproven hydrogen and ammonia-based power generation have risen sharply to 6.23% in the final 11th BPLE.

Renewables to quadruple by 2038 but will not triple by 2030

The final 11th BPLE seeks to achieve the country’s decarbonization goals by quadrupling renewable energy capacity to 121.9 gigawatts (GW) by 2038, compared to the 30GW target proposed in 2023. However, it fails to triple capacity by 2030, as pledged at the 2023 United Nations Climate Change Conference (COP28).

The plan outlines an increase in nuclear power generation capacity from 24.7GW in 2023 to 28.9GW in 2030 and 35.2GW in 2038. Meanwhile, liquefied natural gas (LNG) is calculated to rise from 43.2GW to 58.8GW and 69.2GW in 2030 and 2038, respectively. Additionally, the 11th BPLE prioritizes greenhouse gas-emitting, LNG-fired power, which is an expensive near-term solution. In the long term, the plan focuses on nuclear power from Small Modular Reactors (SMRs), an unproven and costly approach. This is part of the government’s strategy to meet additional power demand expected from the Artificial Intelligence (AI) and semiconductor sectors.

This strategy differs from other countries that have rapidly adopted renewable energy to power their AI and semiconductor sectors while accounting for broadening carbon neutral and decarbonization regulations.

International decarbonization requirements, such as the RE100 initiative, Europe’s Carbon Border Adjustment Mechanism (CBAM), and various Scope 1, 2, and 3 reporting regulations, are increasing. The Institute for Energy Economics and Financial Analysis (IEEFA) previously highlighted that using LNG-fired electricity and heat to fuel semiconductor clusters and AI data centers could expose South Korea to substantial industry-trade and finance-capital risks amid strengthening decarbonization trends.

Tripling renewable energy capacity by 2030 could meet high-growth industry demand

The International Energy Agency (IEA) has predicted that AI data centers will sharply increase the demand for renewable power, corresponding with the commitments of technology companies to source clean operational energy. The net increment of renewable power generation for AI will likely triple to 262 terawatt-hours (TWh) by 2026 compared to 2023, and the share of AI demand in renewable power generation is expected to double to 17.9%.

Semiconductors make up more than 20% of South Korea’s total exports. The U.S. is the fifth largest export destination for South Korean semiconductors and is home to 428 RE100 member companies. There would be significant consequences if major U.S. fabless companies were to switch chip suppliers from South Korean firms to others in search of lower embedded carbon for their products.

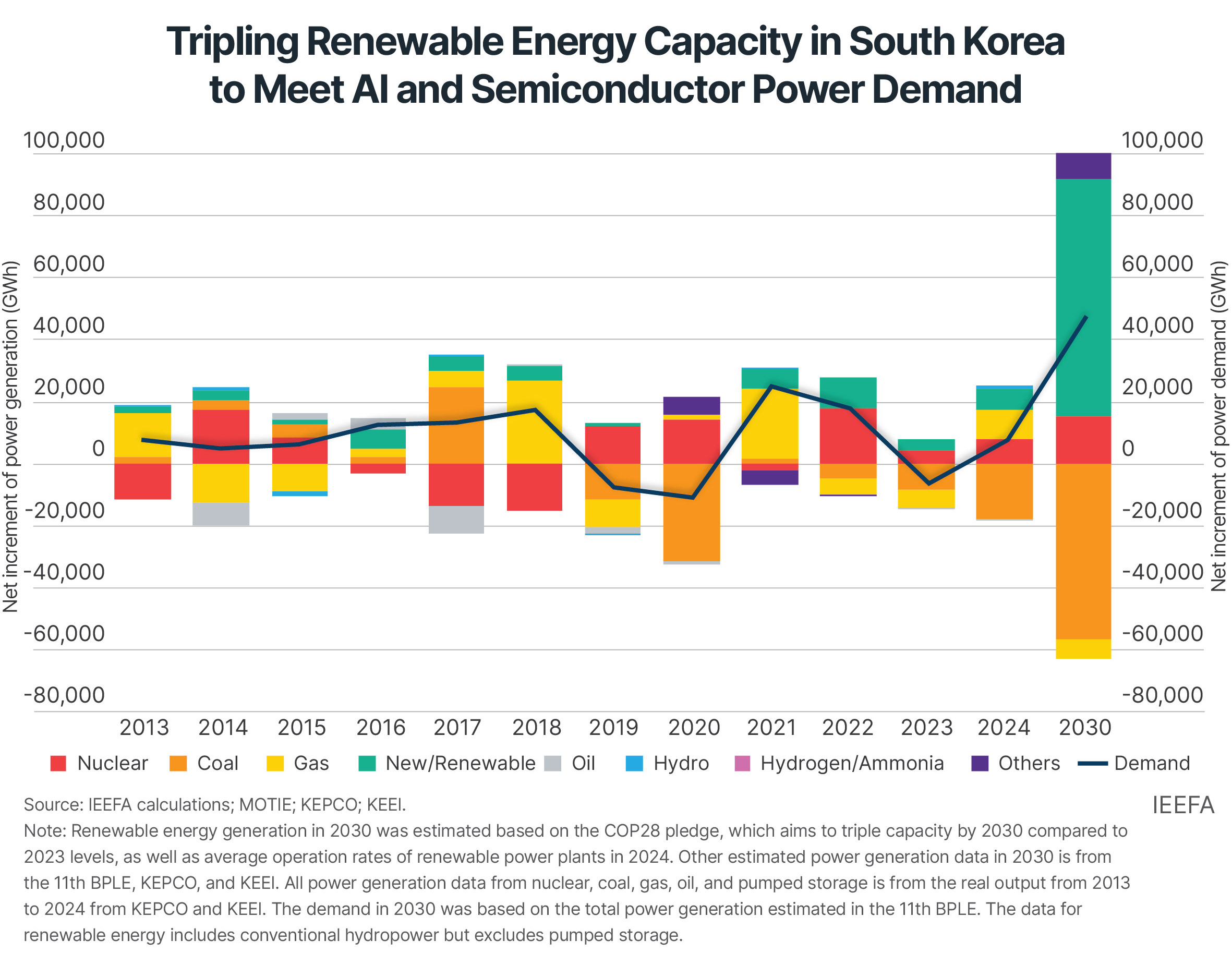

Consequently, tripling renewable energy capacity by 2030 could fully meet the projected electricity demand from the AI and semiconductor sectors, assuming existing power plant buildout plans proposed in the 11th BPLE remain on track.

Based on IEEFA’s analysis, the net increment of renewable power generation compared to 2024 could reach 76,445GWh by 2030. This projected level of renewable energy generation would be more than sufficient to meet the anticipated net increase in power demand, estimated to be around 47,032GWh during the same period.

Renewable energy is the frontline for national competitiveness

In 2024, the share of renewable energy in South Korea’s power mix surpassed the 10% threshold for the first time. However, the country is still far behind the global average of around 30% renewable energy generation. According to the final 11th BPLE, South Korea is projected to reach the 32.9% renewable energy target around 2038, signaling that the country’s clean energy transition is lagging at least 15 years behind.

Renewable energy is emerging as the frontline for national competitiveness. Using fossil fuel-based energy to meet the demands of the emerging AI and semiconductor sectors will jeopardize industrial competitiveness and undermine geopolitical influence, national security, access to financing, and public well-being. It is essential for South Korea to recognize the cost of missing out on the energy transition and to address industry risks by ensuring an accelerated renewable energy adoption.

Search

RECENT PRESS RELEASES

Related Post