South Korea’s renewables growth depends on grid, power purchase agreements (PPAs), and ren

June 4, 2025

The success of qualitative renewable growth depends on removing bottlenecks in transmission and distribution, power purchase agreements, and renewable portfolio standards

Despite new policies and increased efforts to expand South Korea’s renewable energy capacity, actual renewable energy growth in the national grid has been lackluster. A new report by the Institute for Energy Economics and Financial Analysis (IEEFA) attributes this to three major bottlenecks: an inadequate grid, inefficient PPAs, and ineffective RPS systems.

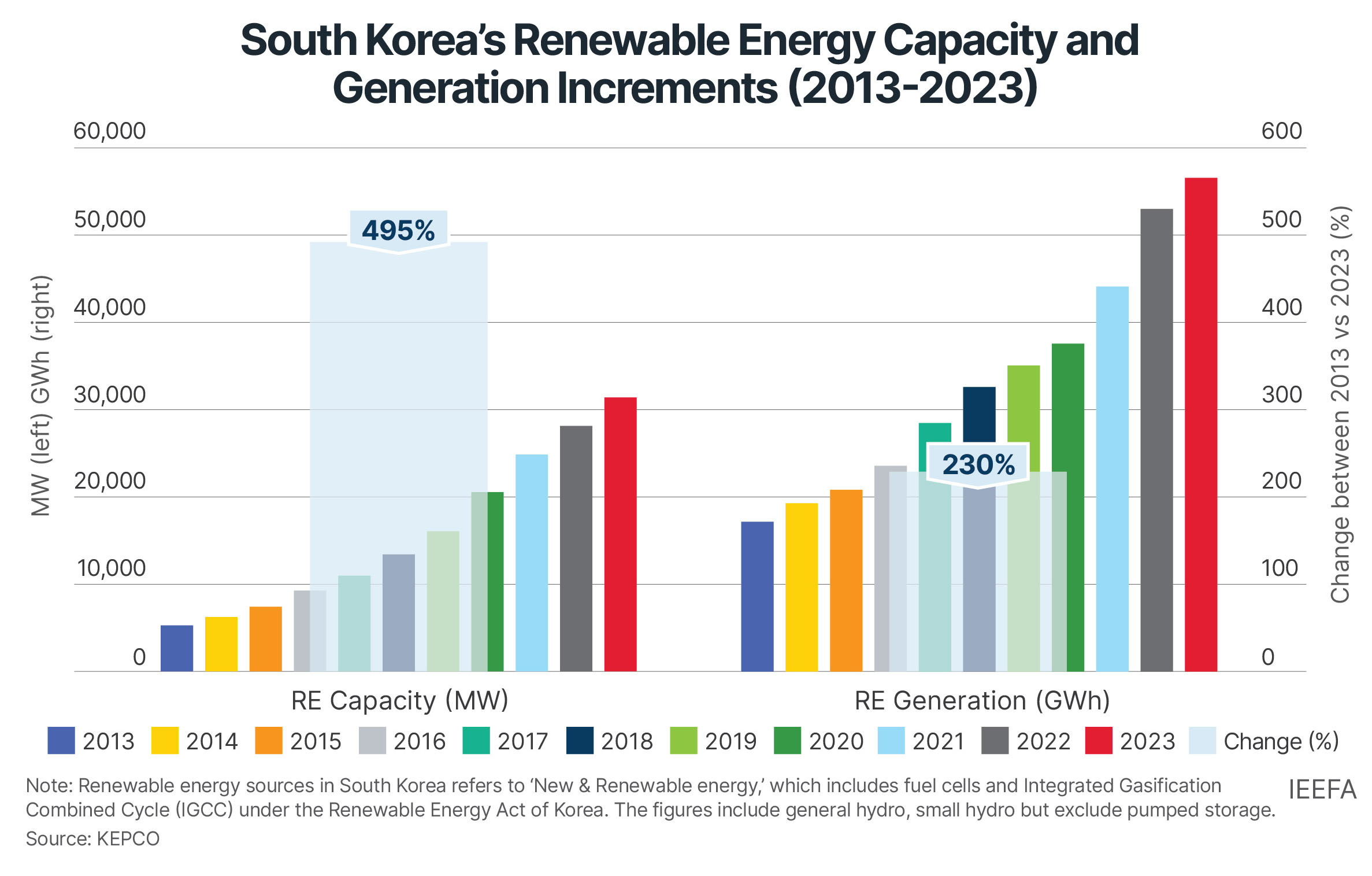

Data from the Korea Electric Power Corporation (KEPCO) shows that renewable energy capacity in South Korea has increased sixfold from 2013 to 2023, while actual generation delivered to consumers rose by around half, expanding just threefold.

“South Korea has yet to achieve meaningful renewable energy growth in its national grid,” says report author Michelle (Chaewon) Kim, IEEFA’s Energy Finance Specialist, South Korea. “One criticismis the lack of renewable energy integration in the national grid due to the delayed expansion and modernization of transmission and distribution infrastructures.”

Electricity demand is expected to rise with the development of large-scale semiconductor clusters in Yongin and Artificial Intelligence (AI) data centers in Seoul and Gyeonggi provinces. However, power grid construction and modernization delays raise concerns about an unstable power supply and a potential weakening of industrial competitiveness.

The report highlights fundamental problems with the Power Purchase Agreement (PPA) and Renewable Portfolio Standard (RPS) systems. These include high PPA prices due to rigid regulations and KEPCO’s grid monopoly, limited supply of renewable energy, and reliance on indirect compliance through Renewable Energy Certificates (RECs). These challenges have contributed to the lack of tangible growth in renewable energy.

Future-proofing grid infrastructure

Launched in February 2025, the Power Grid Act aims to enhance compensation measures for power grid construction due to local community opposition. However, Kim emphasizes that proactive grid investment to streamline and modernize transmission and distribution systems should be linked with the law.

“Grid expansion and modernization are required for renewable energy integration in the national grid and for regional electricity generation to be supplied to emerging AI data centers and mega-scale semiconductor clusters,” notes Kim.

Given KEPCO’s persistent financial challenges and its monopoly in transmission and distribution, market reforms are necessary to improve its economic stability and efficiency through enhanced competition.

“In addition, encouraging public-private partnerships to generate funding, rationalizing the electricity tariff system to allocate grid investment funds, and introducing government subsidies and tax incentives to promote grid investments are also essential,” adds Kim.

Addressing ineffective PPAs

According to the report, ineffective PPAs are hindering South Korea’s renewable energy growth, which has led to the country lagging at least 15 years behind other nations.

Continued underinvestment in the power grid could threaten the reliable, high-quality power supply essential in industrial complexes, particularly those in AI, semiconductor, and biotechnology areas. Additionally, it would hinder progress toward carbon neutrality – a goal prioritized by initiatives like RE100, which has over 160 member companies operating in South Korea, including 36 headquartered in the country.

“While more than 31% of RE100 member companies worldwide procured renewable electricity through PPAs in 2022, only around 20.2% of export-oriented companies in South Korea did so – either through direct PPAs (10.1%) or third-party PPAs (10.1%),” says Kim, “Delays in grid construction and modernization may threaten industrial competitiveness and carbon neutrality goals for international companies.”

A proposed solution is to consolidate and streamline the current bifurcated PPA systems. Direct PPAs and third-party PPAs could be unified to reduce unnecessary rigidity and complexity.

“Current PPA rules add unnecessary costs and undermine renewable energy development efficiency between sellers and buyers. Moreover, PPA prices are exacerbated by limited renewable energy supply, which is reflected in the increasing costs of RECs,” explains Kim.

Unlike South Korea, PPA participants in the United States, Australia, and many European countries, including renewable energy generators, providers, and consumers, can freely procure any shortfall from the market.

South Korea could facilitate a buyer’s PPA market, activating the self-sustaining, ‘virtuous cycle’ by increasing corporate demand while expanding renewable energy investments, achieving economies of scale, increasing renewable energy supply, and lowering prices.

Paving the way for the success of RPS

Launched in 2012, the RPS mandates that power generators exceeding 500 megawatts (MW) capacity should maintain a specific renewable energy proportion in their generation mix. As of January 2024, 29 Generation Companies (GENCOs) and Independent Power Producers (IPPs) fall under this mandate. However, power generators can fulfill their obligations by purchasing RECs, tradable instruments in the Korea Power Exchange (KPX) that certify renewable energy generation.

Many GENCOs’ and KEPCO’s power generators have primarily relied on purchasing RECs to meet their RPS obligations rather than directly increasing renewable power generation.

In May 2024, the Ministry of Trade, Industry, and Energy (MOTIE) launched a master plan to increase renewable energy adoption and supply chain expansion, improving the effectiveness of the RPS system. The aim is to reduce reliance on RECs and simplify the complicated PPA requirements.

The plan pursues a transition to a government-led system in which renewable power generators and the government cooperate to meet mandatory renewable energy supply targets through direct government bidding. The revised RPS is expected to provide clearer market signals, strengthen domestic renewable energy supply chains, and lower energy costs.

South Korea needs to focus not only on expanding capacity but also on the qualitative growth of its renewable energy sector. This shift would also be pivotal for global competitiveness in emerging industrial sectors. Successful reform would require a holistic approach that combines grid expansion and modernization with market-friendly PPA terms and an efficient RPS system to promote tangible renewable energy generation and adoption.

Read the report: Bottlenecks to renewable energy integration in South Korea

Read this press release in Korean

Author contact: Michelle (Chaewon) Kim ([email protected])

Media contact: Josielyn Manuel ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable, and profitable energy economy. (www.ieefa.org)

Search

RECENT PRESS RELEASES

Related Post