Southeast Asia Expansion and Subsidiary Losses Might Change the Case for Investing in JD L

November 2, 2025

-

In recent days, JD Logistics announced that its board will review unaudited third-quarter results on November 13, 2025, while its supply chain arm JoyLogistics has rolled out integrated bulky item delivery and installation services in Malaysia and Singapore.

-

This move marks a push into Southeast Asian markets with enhanced logistics offerings, but recent losses at subsidiary Deppon underscore ongoing sector challenges.

-

We’ll explore how Southeast Asia network expansion and subsidiary performance updates may influence JD Logistics’ investment narrative going forward.

We’ve found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Shareholders in JD Logistics are betting on the company’s expansion into high-margin, integrated supply chain solutions, including growth in Southeast Asia and a push for greater revenue diversification beyond JD.com. The latest news of board review for unaudited results and new services in Malaysia and Singapore extend JD Logistics’ international footprint, but these developments do not materially change the most important short-term catalyst, sustained growth in external third-party business. Key risks, including persistent client concentration and rising cost pressures, continue to warrant attention.

The recent launch of integrated bulky item delivery and installation by JoyLogistics in Southeast Asia is directly tied to JD Logistics’ core catalyst: building out specialized value-added services to win new external clients and reduce dependence on JD.com. This expansion strengthens its service mix and network, supporting diversification efforts, but execution risks tied to overseas ventures and capital allocation still linger for investors tracking performance drivers.

However, while top-line growth from new markets is encouraging, investors should also be aware that ongoing labor cost inflation and rising employee benefits could constrain net margins if…

Read the full narrative on JD Logistics (it’s free!)

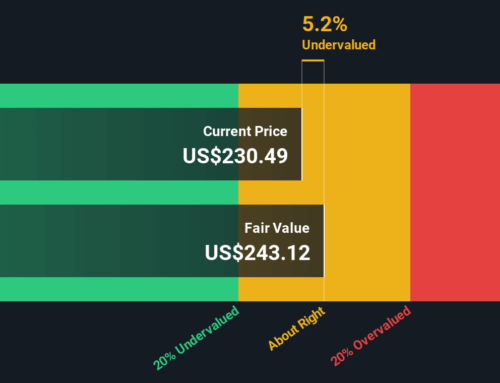

JD Logistics’ outlook anticipates CN¥262.7 billion in revenue and CN¥9.5 billion in earnings by 2028. This projection is based on an annual revenue growth rate of 10.4% and an earnings increase of CN¥3.0 billion from the current CN¥6.5 billion.

Uncover how JD Logistics’ forecasts yield a HK$17.65 fair value, a 39% upside to its current price.

Simply Wall St Community members set JD Logistics’ fair value between HK$13.31 and HK$40.51, across four distinct analyses. As you weigh these perspectives, remember that execution challenges in international expansion could significantly influence future returns and risk exposure.

Explore 4 other fair value estimates on JD Logistics – why the stock might be worth over 3x more than the current price!

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

-

A great starting point for your JD Logistics research is our analysis highlighting 5 key rewards that could impact your investment decision.

-

Our free JD Logistics research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate JD Logistics’ overall financial health at a glance.

Early movers are already taking notice. See the stocks they’re targeting before they’ve flown the coop:

-

Find companies with promising cash flow potential yet trading below their fair value.

-

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

-

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include 2618.HK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post