Stocks plunge 2% on Fed, growth concerns

August 20, 2015

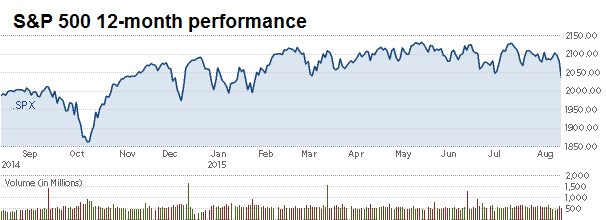

U.S. stocks closed near session lows on Thursday, off more than 2 percent, as investors weighed continued uncertainty about the timing of a rate hike and concerns about global growth headed by slowing in China.

The S&P 500 and Dow Jones industrial average both had their worst day since Feb. 3, 2014. (Tweet This )

“I think the markets are overly pessimistic,” said Anthony Valeri, investment strategist at LPL Financial. “I think this sentiment is panicking over news from China, the Fed (and) oil at six-year lows.”

Weakening in emerging market currencies on the heels of China’s yuan devaluation last week added to worries of broad economic slowdown.

“I think the oil and the geopolitical problems are the real problems for the market because we’re looking at lower global economic growth, and lower global growth is going to weigh on the U.S. as well,” said Peter Cardillo, chief market economist at Rockwell Global Capital.

The S&P 500 fell into the red for 2015 and closed down 1.1 percent for the year. Consumer discretionary led all 10 sectors lower with a decline of 2.8 percent for its worst daily performance since June 1, 2012. Energy is the greatest laggard for the year so far, down more than 18 percent.

Stocks extended recent losses, with the major averages all below their 200-day moving averages.

The Dow Jones industrial average closed down 358 points, accelerating losses in the close, with Merck and Disney leading all blue chips lower. The index closed below 17,000 for the first time since Oct. 29, 2014, and is off more than 4.5 percent for the year so far.

Bernstein downgraded Disney to “market perform” from “outperform,” saying valuations for media stocks need to be adjusted because of an increased risk premium regarding affiliate fees.

The Nasdaq Composite closed below its 200-day moving average for the first time since Oct. 17, 2014. The index lost 2.8 percent to below 4,900, with Apple (AAPL) off 2 percent and the iShares Nasdaq Biotechnology ETF (IBB) (IBB) falling 4 percent. The Nasdaq is up about 3 percent year-to-date.

Small caps are also on the radar. The Russell 2000 traded below its 200-day moving average and has closed below it since Tuesday.

Overseas, stocks ended lower and pressured U.S. equities. European stocks closed down about 2 percent as concerns about China, the Federal Reserve weighed.

The Shanghai Composite plunged 3.4 percent as investors failed to gain confidence in government support measures.

Read More ‘Death cross’ danger looms for China stocks

“Oil’s sliding down, China’s currency is getting hurt. Kazakhstan’s and Vietnam’s currencies (are) all being devalued. The instability in the global marketplace is a great concern here,” said Adam Sarhan, CEO of Sarhan Capital. “What’s getting investors to go out there?”

Hit by sharp declines in crude prices, the oil-producing nation of Kazakhstan introduced a freely floating exchange rate for the tenge, which subsequently lost more than a quarter of its value .

The State Bank of Vietnam (SBV) devalued the dong (VND) by 1 percent against the dollar on Wednesday-its third adjustment so far this year-and simultaneously widened the trading band to 3 percent from 2 percent previously, the second increase in six days.

Read More Fear and loathing on trading desks

“The market has really taken a pessimistic stance vis-a-vis the Fed,” said Dave Schiegoleit, a senior portfolio manager with The Private Client Reserve of U.S. Bank in Los Angeles.

“I think we’re hearing comments from people taking a dovish stance that the Fed could cramp the fragile growth we’re seeing,” he said, noting that he expects a rate hike in September. On the hawkish side, “if the Fed holds off then that means the Fed is seeing something the market isn’t.”

Robert Pavlik, chief market strategist at Boston Private Wealth, expects one rate hike this year.

“It’s making people unwind their risk-on trades,” he said.

Longer-end yields declined and gold jumped to a more than one-month high as investors piled into safe-haven assets. Gold futures surged $25.30 to $1,153.20 an ounce.

Read More Classic market overshoot is developing: El-Erian

“I think change hits the market. Markets don’t like rapid movement,” said James Meyer, chief investment officer at Tower Bridge Advisors. “I think you have investors, traders… who have made wrong bets and have to unwind. Part of it is momentum and momentum is down.”

He noted some volatility in oil prices as futures contracts expire. The WTI crude contract rolls from September to October after the settle.

Crude oil settled 34 cents higher at $41.14 a barrel after falling below $41 a barrel early Thursday to hit a fresh six-and-a-half-year low. Brent crude fell more than 1 percent to below $47 a barrel.

“We continue to be in lockstep with energy and it’s going to be difficult to get out of that,” said Art Hogan, chief market strategist at Wunderlich Securities.

Analysts also noted the lack of bullish catalysts as behind the selloff. Cumulative trade volume for the day was near the highs for this summer.

Read More World drowns in oil as producers slug it out

Uncertainty about the timing of a rate hike remained, as the Fed minutes indicated conditions for liftoff are “approaching” but not present .

The U.S. 2-year Treasury note yield (U.S.:US2Y) held near 0.66 percent, while the 10-year yield(U.S.:US10Y) traded lower near 2.07 percent.

The U.S. dollar traded lower against major world currencies, with the euro climbing above $1.12.

Stocks held lower after mixed economic releases continued to indicate modest growth.

Initial claims data came in at 277,000, but remained consistent with an improving labor market trend that could support a rate hike this year.

Existing home sales rose to an eight-year high, while leading indicators declined 0.2 percent in July.

The Philadelphia Fed index for August came in at 8.3. Earlier in the week, the Empire State survey plunged to a 2009 low.

Read More Fed watch: The great debate rages on

U.S. stocks closed lower on Wednesday after the earlier-than-expected release of the minutes and under pressure from global growth concerns and a plunge in oil prices.

In earnings news, Sears (SHLD) lost an adjusted 67 cents per share for its latest quarter, smaller than the loss of $2.50 estimated by the lone analyst providing an estimate. Profit margins improved at both the Sears and Kmart chains, but same-store sales declined. The stock closed down 1.6 percent.

Shares of Nortek (NTK) spiked 17 percent on a Dow Jones report that United Technologies (UTX)is in talks to acquire the maker of ventilation systems.

Twitter (TWTR) plunged nearly 6 percent to close at its IPO price of $26 a share, after dipping below in intraday trade.

Read More Early movers: SHLD, DIS, VRX, LL, FOSL, LMT, LB & more

Hewlett Packard (HPQ), Gap (GPS), Intuit (INTU), Marvell Tech (MRVL), Ross Stores (ROST), Salesforce.com (CRM) and Fresh Market (TFM) are all due after the bell.

The Dow Jones Industrial Average (Dow Jones Global Indexes: .DJI) closed down 358.04 points, or 2.06 percent, at 16,990.69, with Disney (DIS) leading all constituents lower.

The Dow transports fell 2.5 percent, with JetBlue (JBLU) plunging 4 percent to lead all constituents lower.

The S&P 500 (^GSPC) closed down 43.87 points, or 2.11 percent, at 2,035.74, with consumer discretionary leading all 10 sectors lower.

The Nasdaq (^IXIC) closed down 141.56 points, or 2.82 percent, at 4,877.49.

The CBOE Volatility Index (VIX) (^VIX), widely considered the best gauge of fear in the market, traded above 18.

About five stocks declined for every advancer on the New York Stock Exchange, with an exchange volume of 920 million and a composite volume of nearly 3.9 billion in the close.

On tap this week:

Friday

Earnings: Deere, Foot Locker, Ann

More From CNBC.com:

More From CNBC

Search

RECENT PRESS RELEASES

Related Post