Strategy Inc (MSTR) Stock News Today: $980M Bitcoin Buy, Nasdaq 100 Stay, MSCI Index Risk,

December 16, 2025

Strategy Inc (NASDAQ: MSTR) is back in the spotlight on December 16, 2025—and not just because the stock is bouncing. The company, formerly known as MicroStrategy, remains the market’s most watched “Bitcoin treasury” equity, meaning its share price often moves like a leveraged proxy for Bitcoin rather than a traditional software stock. [1]

As of the latest trade time on Tuesday, MSTR was at about $170.01, up roughly 4.9% on the day, after touching an intraday low near $161.37. Bitcoin, meanwhile, was trading around $87,744, up modestly from the prior close—an important detail because Bitcoin’s direction remains the single biggest swing factor for Strategy’s equity narrative.

Below is a full, up-to-date roundup of today’s key news drivers, the most-cited forecasts, and the leading analyses shaping Strategy Inc stock on 16.12.2025.

Strategy stock today: why MSTR is moving on Dec. 16, 2025

Strategy’s rebound comes after a bruising stretch of volatility. Earlier this week, Strategy’s stock closed Monday at $162.08 after a sharp drop, underscoring how quickly sentiment can turn when Bitcoin slides or when index-related headlines hit the tape. [2]

On Tuesday, however, the mood has improved—helped by:

- A fresh, nearly $1 billion Bitcoin purchase (and the disclosure of how it was funded),

- Confirmation Strategy remains in the Nasdaq 100, easing a major overhang,

- Ongoing debate about whether large index providers (notably MSCI) will tighten rules that could push Bitcoin-heavy companies out of mainstream benchmarks.

Each of those catalysts matters because Strategy’s “Bitcoin treasury” model depends heavily on market access—its ability to raise capital, stay liquid, and remain widely held through passive index-tracking funds.

The headline catalyst: Strategy’s latest $980.3 million Bitcoin purchase

Strategy disclosed in a Form 8‑K filed December 15 that it acquired 10,645 BTC during the period Dec. 8–Dec. 14, spending $980.3 million at an average price of $92,098 per Bitcoin (inclusive of fees and expenses). [3]

After that buy, Strategy reported total holdings of:

- 671,268 BTC

- $50.33 billion aggregate purchase price

- $74,972 average purchase price per BTC [4]

This matters for investors because it updates the “math problem” that ultimately drives MSTR: How much Bitcoin does the company hold, what is the average cost, and how is it financing new accumulation?

How Strategy funded the buy: fresh dilution plus preferred shares

The same 8‑K included an “ATM Update” detailing capital raised via at-the-market issuance. Strategy reported $989.0 million in total net proceeds during the Dec. 8–Dec. 14 period. [5]

The filing breaks that down by security type, including:

- MSTR (Class A common stock): net proceeds of about $888.2 million

- STRD (preferred): net proceeds of about $82.2 million

- Smaller amounts via STRF and STRK, while STRC showed no shares sold in that period [6]

Strategy explicitly stated that the Bitcoin purchases were made using proceeds from sales of STRF, STRK, STRD, and MSTR under its ATM program. [7]

Why investors care: The bull case often celebrates Bitcoin accumulation; the bear case focuses on the cost—dilution and/or expensive capital—especially when Bitcoin is not in a clear uptrend.

Nasdaq 100 update: Strategy stays in the index, removing a major overhang

A key development hanging over MSTR in early-to-mid December was whether Nasdaq would reconsider Strategy’s place in the Nasdaq 100, given ongoing debate about whether the company looks more like an operating tech firm or an investment vehicle.

What’s confirmed now

Reuters reported that Strategy “clung to its place in the Nasdaq 100” during the annual reshuffle cycle, extending its stint in the benchmark. Reuters also noted Nasdaq’s changes are expected to take effect December 22. [8]

Why the index question mattered so much

Just days earlier, Reuters highlighted analysts flagging the risk that Strategy could face removal, and cited an estimate of about $1.6 billion in passive fund outflows if Nasdaq were to drop it. [9]

For an equity like MSTR—whose shareholder base includes many index and ETF holders—passive flows can materially affect demand, especially during periods when the company is issuing shares.

The next big catalyst: MSCI’s January decision and the “digital asset treasury” debate

While the Nasdaq 100 worry is (for now) eased, the MSCI question remains live—and it could be the bigger structural issue for Strategy heading into early 2026.

Reuters reported on December 3 that MSCI plans to decide by January 15 whether it will remove companies whose business model centers on buying cryptocurrencies, amid concerns they resemble investment funds. [10]

Reuters also reported:

- JPMorgan estimated that an exclusion—especially if followed by other index providers—could drive as much as $8.8 billion in outflows from Strategy stock. [11]

- MSCI’s consultation has included a proposed approach that could exclude companies whose digital asset holdings exceed 50% of total assets. [12]

Strategy’s response: “DATs are operating companies”

Strategy has publicly pushed back on MSCI’s idea via a dedicated page titled “Strategy’s Response to MSCI’s Proposed DAT Exclusion,” arguing the proposed threshold is arbitrary and that digital-asset treasury companies are operating companies—not funds. [13]

Why this matters to the stock: Index membership isn’t just prestige. It can mean structural demand from passive funds, and—critically for Strategy—support for its ability to raise equity and debt on attractive terms.

Volatility amplification: leveraged ETFs tied to MSTR are getting crushed (and that feeds the cycle)

If Strategy is “leveraged Bitcoin,” then leveraged MSTR ETFs are leveraged leverage—and 2025 has shown how brutal that can be on the way down.

Reuters reported on December 2 that leveraged ETFs linked to Strategy were among the biggest casualties of the year’s crypto slump:

- T‑Rex 2X Long MSTR Daily Target ETF and Defiance Daily Target 2x Long MSTR ETF had each lost nearly 85% in 2025 at the time of reporting

- A T‑Rex 2X Inverse MSTR Daily Target ETF was down 48% over the same period [14]

This ecosystem matters because it can intensify short-term moves in either direction—adding fuel to rallies, and pressure to sell during drawdowns.

Earnings guidance and the “USD Reserve”: Strategy tries to reassure dividend and debt skeptics

Another important thread in the MSTR story right now is cash-flow confidence—especially because Strategy has issued multiple preferred securities and carries meaningful obligations.

Reuters reported on December 1 that Strategy slashed its 2025 earnings forecast amid Bitcoin weakness and announced plans to create a reserve to support dividend payments, describing a $1.44 billion reserve to fund dividends on preferred stock and interest on outstanding debt. [15]

An SEC filing from December 1 provides more color, stating Strategy established a USD Reserve of $1.44 billion, funded using proceeds from sales of class A common stock under its ATM program, with an intention to maintain enough to fund at least 12 months of “Dividends,” and a goal of eventually covering 24 months or more. [16]

Investor takeaway: Strategy is signaling it understands the market’s concern—namely, that financing Bitcoin accumulation via equity and preferred issuance creates a second risk layer: capital-market dependence.

Bitcoin outlook: the macro backdrop still dictates MSTR’s “beta”

Even on a day when MSTR is up, the bigger question remains: Is Bitcoin stabilizing—or is this another bounce inside a larger drawdown?

Reuters has described recent crypto weakness as tied to risk sentiment shifts, including episodes where Bitcoin dipped below $90,000 amid broader market jitters and reduced appetite for risk. [17]

Reuters also reported that Standard Chartered cut its end‑2025 Bitcoin price forecast to $100,000 from $200,000, citing fading buying activity from digital asset treasury companies and an expectation that future increases would be driven primarily by ETF buying. [18]

Barron’s, in a separate mid-December analysis tied directly to Strategy’s stock reaction, noted Bitcoin had declined more than 30% from its October peak and had been hovering around the $90,000 area, dipping below $86,000 on Monday—context that helps explain why MSTR’s massive purchases have not automatically translated into stock gains. [19]

Wall Street forecasts for Strategy stock: big targets, huge disagreement

Strategy may be the rare large-cap-adjacent stock where analyst targets can look surreal—not necessarily because analysts are careless, but because the underlying asset (Bitcoin) is volatile and Strategy’s financing approach adds leverage.

What consensus targets look like right now

StockAnalysis.com lists a 12‑month average price target of $497.29 for MSTR, with a very wide spread between the low and high targets. [20]

Reuters, citing LSEG data earlier in December, reported that among 16 brokerages covering Strategy:

- The majority ratings skew positive (buy/strong buy vs hold),

- The median price target was $485, implying a very large upside from then-current levels. [21]

How to interpret this: Those targets aren’t “software business” calls in the classic sense. They often reflect a view on (1) Bitcoin’s direction, (2) Strategy’s ability to keep financing buys, and (3) whether the stock trades at a premium or discount to the value of its Bitcoin holdings over time.

Technical analysis on Dec. 16: momentum still looks fragile

While fundamentals and crypto headlines drive the big moves, many traders watch MSTR through technical signals—especially after sharp drops.

Investing.com’s technical dashboard for Strategy Inc (MSTR) on Dec. 16 showed a “Strong Sell” technical summary on the daily timeframe, including a 14‑day RSI around 40.36 and moving averages that were largely signaling “sell.” [22]

This kind of readout doesn’t predict news, but it helps explain why rallies can face overhead selling pressure after a fast drawdown.

Today’s analysis: is Strategy stock undervalued after the slide?

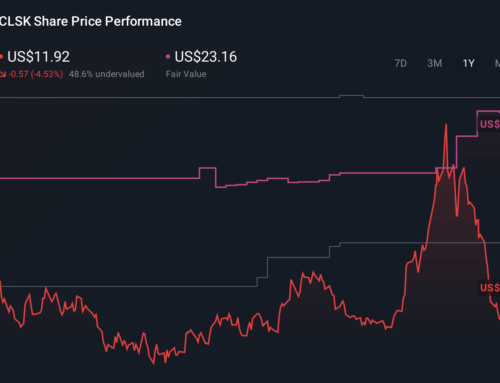

One of the most prominent same-day valuation discussions comes from Simply Wall St, which framed the debate as whether Strategy’s recent pullback represents undervaluation or an efficient repricing of risk.

In a December 16 piece, Simply Wall St highlighted the stock’s steep multi-month decline and noted the question investors face: discount opportunity vs. justified skepticism, given the company’s Bitcoin-centric model and volatility. [23]

Separately, a Dec. 16 “premarket movers” note from 24/7 Wall St tied Strategy’s early strength to Bitcoin’s bounce and referenced bullish price-target commentary from at least one sell-side shop—illustrating how quickly the narrative can flip when crypto turns green. [24]

The bigger picture: Strategy’s influence is spawning more “crypto treasury” imitators

Strategy’s playbook is no longer a one-off—new entrants continue to pitch variations of the model.

Reuters reported on December 16 that activist investor Eric Jackson is set to lead a crypto treasury firm via a reverse merger, positioning it as a peer to Strategy but with differences such as multi-asset exposure and active hedging. [25]

This matters because, the more crowded the “Bitcoin treasury company” trade becomes, the more investors may scrutinize what makes Strategy distinctive—scale, liquidity, index membership, and execution—versus what looks like commoditized exposure.

What to watch next for Strategy Inc (MSTR) investors

Here are the most important upcoming swing factors that could drive the next leg in Strategy stock:

- Bitcoin’s next move

With BTC around the high-$80,000s today, any break above/below key levels tends to show up quickly in MSTR. - MSCI’s decision timeline (by Jan. 15, 2026)

Whether MSCI changes its index rules for digital-asset-heavy companies could influence passive fund ownership and capital access narratives. [26] - Post-reshuffle Nasdaq 100 mechanics (effective Dec. 22)

Strategy’s continued inclusion removes one overhang, but investors will watch how flows and positioning evolve after changes go live. [27] - Ongoing ATM issuance and weekly Bitcoin purchase cadence

Strategy’s own filings have become a recurring market event—investors track how much is raised, what is sold (common vs preferred), and how quickly it’s deployed into BTC. [28] - Volatility products and leverage in the ecosystem

Leveraged ETFs tied to MSTR have already shown how violent drawdowns can be; they can also add fuel during rebounds. [29]

Bottom line

On December 16, 2025, Strategy Inc stock is rising—but the story is bigger than a one-day bounce.

Strategy just executed another near‑$1B Bitcoin purchase, financed largely through fresh issuance. It also cleared a major hurdle by remaining in the Nasdaq 100, while a more consequential test still looms: MSCI’s potential index-rule shift that could reshape passive ownership and the long-term capital-raising narrative.

For readers tracking “Strategy stock” as a Bitcoin proxy, the most honest framing is this: MSTR is trading at the intersection of crypto prices, capital markets, and index policy—and any one of those can move faster than traditional fundamentals.

References

1. www.reuters.com, 2. www.nasdaq.com, 3. www.sec.gov, 4. www.sec.gov, 5. www.sec.gov, 6. www.sec.gov, 7. www.sec.gov, 8. www.reuters.com, 9. www.reuters.com, 10. www.reuters.com, 11. www.reuters.com, 12. www.reuters.com, 13. www.strategy.com, 14. www.reuters.com, 15. www.reuters.com, 16. www.sec.gov, 17. www.reuters.com, 18. www.reuters.com, 19. www.barrons.com, 20. stockanalysis.com, 21. www.reuters.com, 22. www.investing.com, 23. simplywall.st, 24. 247wallst.com, 25. www.reuters.com, 26. www.reuters.com, 27. www.reuters.com, 28. www.sec.gov, 29. www.reuters.com

Search

RECENT PRESS RELEASES

Related Post