Strong Earnings and ESOP Moves Might Change the Case for Investing in Worthington Enterpri

October 5, 2025

- Worthington Enterprises reported first-quarter results showing US$303.71 million in sales and US$35.15 million in net income, both higher than the previous year, and also announced the filing of a US$60.26 million ESOP-related shelf registration while closing out a previous US$7.76 million offering.

- The company’s continued buybacks, steady quarterly dividends, and increased sales suggest a focus on shareholder value and ongoing operational momentum.

- We will consider how the strong earnings growth highlighted in the recent quarterly report may reshape Worthington Enterprises’ investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Advertisement

Worthington Enterprises Investment Narrative Recap

To be a shareholder in Worthington Enterprises, you need to believe in the company’s ability to generate steady income, maintain strong cash flows, and continue returning value through dividends and share buybacks. Recent announcements, higher quarterly earnings, an ESOP-related shelf registration, and continued buybacks, do not materially change the short-term catalyst of underlying margin expansion, though they do little to address the biggest current risk, which is exposure to steel price volatility and trade uncertainties.

The most relevant recent announcement is the company’s repurchase of 100,000 shares for US$6.3 million, bringing total repurchases to 41.4% of the buyback plan. While supportive of shareholder value creation, this action aligns with the existing focus on capital efficiency, rather than shifting focus from the operational challenges that stem from external market and trade headwinds. This makes the effect of the buyback more incremental for near-term results, as revenue drivers still depend heavily on stable input costs and consumer sentiment.

But even with buybacks and dividends supporting stability, investors should be aware of the company’s exposure to steel price swings and…

Read the full narrative on Worthington Enterprises (it’s free!)

Worthington Enterprises’ outlook forecasts $1.4 billion in revenue and $213.4 million in earnings by 2028. This is based on a projected annual revenue growth rate of 7.6% and a $117.3 million earnings increase from the current earnings of $96.1 million.

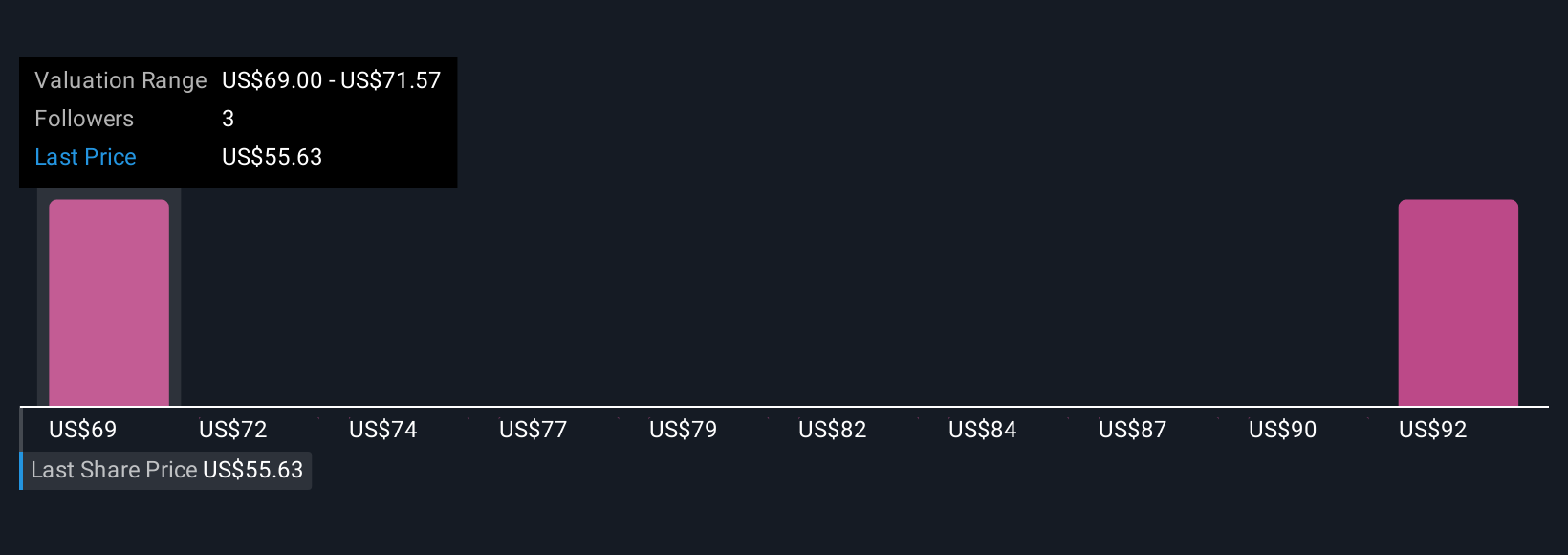

Uncover how Worthington Enterprises’ forecasts yield a $69.00 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Worthington Enterprises range from US$69 to US$94.71 based on two unique perspectives. With steel price volatility still a key concern, you can see how opinions on the company’s prospects may diverge and why it’s useful to compare analyses from different sources.

Explore 2 other fair value estimates on Worthington Enterprises – why the stock might be worth as much as 70% more than the current price!

Build Your Own Worthington Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Worthington Enterprises research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Worthington Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Worthington Enterprises’ overall financial health at a glance.

No Opportunity In Worthington Enterprises?

Early movers are already taking notice. See the stocks they’re targeting before they’ve flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Worthington Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post