Sustainable investing outlook: Strong returns amid net flow pressures

July 7, 2025

The politicization of environmental, social, and governance (ESG) investing in some regions, along with anti-renewable measures, has continued to influence both the discourse around ESG and the flow of funds into such investments in recent quarters. Despite persistent rhetoric to the contrary, the Institute for Energy Economics and Financial Analysis (IEEFA) found in 2024 that ESG investing demonstrated stronger performance, fund flows, asset owner sentiment, and regulatory momentum across much of the world. This briefing note revisits the subject and finds that, despite a more challenging backdrop, the broad conclusion remains largely valid.

Sustainable investment fund flows

Global sustainable funds continued to draw strong investor interest in 2024, attracting USD31 billion in net inflows. However, in the first quarter of 2025, sentiment turned more cautious amid broader market volatility, resulting in modest net outflows of USD8.6 billion. This decline mirrors trends observed across the broader global fund market, where net inflows fell substantially to USD530 billion in the same period (4Q 2024: USD847 billion), reflecting investors’ shift to more risk-averse positioning in an uncertain macroeconomic environment.

With global sustainable fund assets totaling USD3.2 trillion at the end of March 2025, net redemptions amounted to a meagre 0.3% of the asset base. As has been the case since early 2023, the U.S. continued to see outflows, with a 10th consecutive quarter of net redemptions. The quarter-over-quarter assets under management (AUM) decline for the U.S. was -4%, significantly more than the marginal decline seen of -0.4% in European flows. This trend reflects the increasingly hostile political climate (particularly from the U.S.), with state-level anti-ESG policies and corporate rollbacks of ESG commitments intensifying.

Meanwhile, the European Union (EU) experienced modest outflows amid heightened scrutiny and regulatory complexity. In recent months, debate has resurfaced around whether defence stocks should be included in socially responsible investing (SRI) and ESG portfolios. The EU is expected to address this issue in its upcoming review of the Sustainable Finance Disclosure Regulation(SFDR), providing clarity on the role of defence in sustainable investment strategies. At the same time, regulators are placing greater emphasis on the naming of funds and ensuring alignment between stated investment objectives and sustainable objectives.

Surveys by BNP Paribas Securities Services and Morgan Stanley also indicate that both institutional and retail investors remain firmly committed to sustainable investing, with a growing focus on themes that aim to deliver both financial returns and measurable impact. Almost half of the institutional investors surveyed in the BNP survey felt unaffected in their sustainability commitments by recent political changes. A majority expected sustainability to be more important over the next five years, and only 16% expected it to be less vital. Likewise, the Morgan Stanley survey showed an overwhelming majority of younger people remaining interested in sustainable investments.

Based on the above, and despite some headwinds, it is premature to draw conclusions from a single quarter’s outflows. Investors appear to be exercising caution, awaiting greater clarity before committing capital.

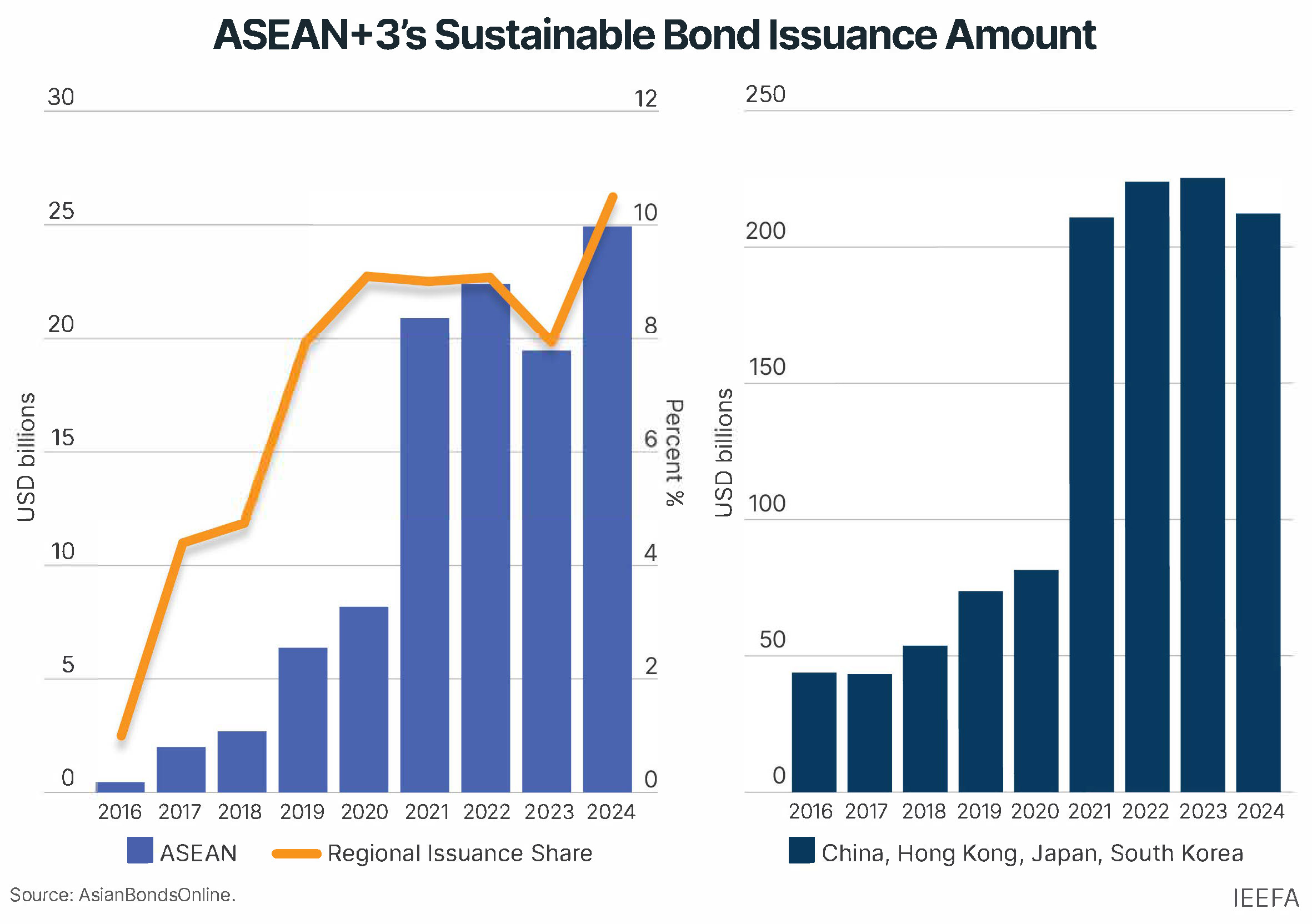

Inflows in Asia remain healthy, albeit from a low base

Europe remains the cornerstone of the sustainable funds market, accounting for 84% of global sustainable fund assets as of end-March 2025. In Asia, sustainable fund inflows continued in the first quarter of 2025, driven primarily by South Korea, Taiwan, and Thailand.

Taiwan’s exchange-traded funds (ETF) market has expanded rapidly in recent years, reaching272 ETFs with TWD6.4 trillion (approximately USD220 billion) in assets under managementat the end of 2024, making it the third-largest in Asia. This growth has been driven by a retail investing boom and rising demand for low-cost, highly liquid investment instruments. Reflecting this trend, Taiwan-domiciled sustainable funds have seen continuous net inflows since the fourth quarter of 2023.

Meanwhile, Thai government-led incentives for sustainability funds have spurred investor interest and inflows. Various schemes allow investors who subscribe to ESG mutual funds and the recently launched ESG Extra Funds to tax deductions of up to 30%. These funds are required to invest at least 80% of their net asset value in Thai assets with sustainability characteristics.

China, where sustainable funds had recorded consecutive outflows since 2Q 2022, finally saw a reversal in trend with a marginal inflow in 1Q 2025. This shift comes on the heels of a very strong year for China’s broader ETF market, which recorded RMB1.1 trillion (around USD153.5 billion) in net capital inflows in 2024, marking a historic high and a 104% increase from 2023. While the recent inflow remains modest, it signals early signs of improving sentiment toward sustainable investing in China. This cautious optimism is supported by ongoing regulatory backing for green finance, a growing pipeline of ESG-themed products, and continued efforts to enhance market transparency and standardization.

Read the full Briefing Note.

Search

RECENT PRESS RELEASES

Related Post