SWI QuickPicks Portfolio Up 14%

July 12, 2016

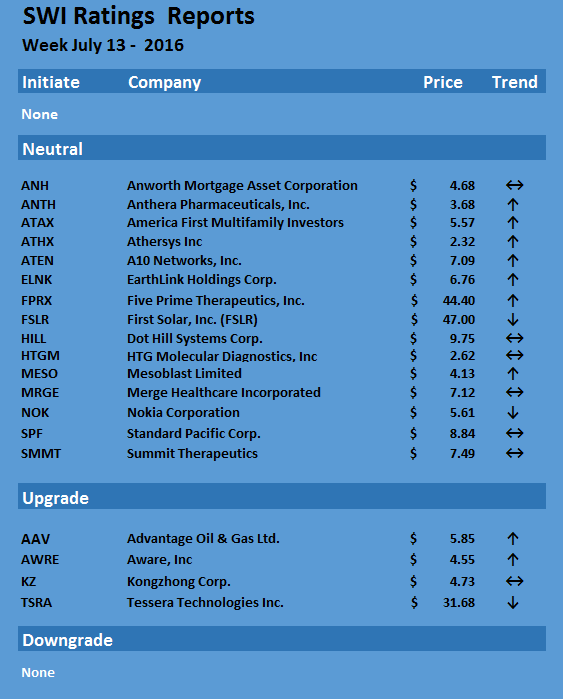

Los Angeles, Calif., July 13, 2016. The market has calmed down, the DOW closed at record highs several times last week and BREXIT is a faint memory; what were they thinking? Looks like the world is not ending without Britain being part of the EU, no panic necessary.

While our QuickPicks portfolio has maybe not generated outrageous gains, the portfolio continues to perform extremely well when compared to the S&P, or most other managed portfolios out there. Our QuickPicks portfolio has increased by 14% over the last two years, compared to the S&P with 6.6% over the same period of time. And yes, it has been two years already.

As a reminder, our QuickPicks portfolio reflects the consolidated opinions of several respected third party analysts, mixed in with our own analysis. We do not hold positions in any of these stocks. In contrast, the companies in our SWI Portfolio have been hand picked by us. We have applied a more personal and intense due diligence regiment and are holding long positions in every stock in the portfolio. Accordingly, the SWI Portfolio performs considerably better than the SWI QuickPicks, the S&P, or most managed top portfolios by leading firms, but stock selection is also based on a much higher risk/reward ratio. So far it has paid out handsomely. We will give you an update on that next week.

I would also like to use this opportunity to thank our subscribers for their loyal and ever increasing following, hopefully we have been providing you with useful opinions and insights. We will continue to thrive for excellency in everything we do. If you are pleased with our services, please recommend us to your friends. Remember, even if you like us a lot, always consult with your personal financial adviser for your investment decisions, we are happy to be double-checked.

Search

RECENT PRESS RELEASES

Related Post