TD Cowen Trims Strategy Price Target as Bitcoin Yield Outlook Softens

January 14, 2026

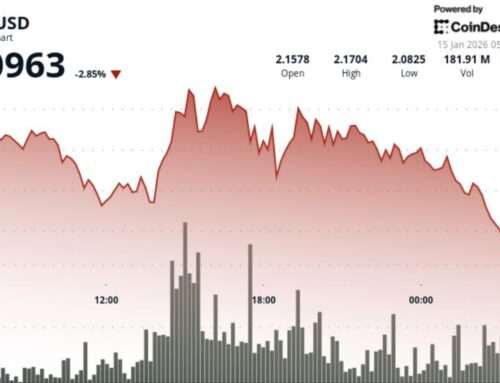

In brief

- TD Cowen cut its Strategy price target to $440 but kept a buy rating.

- Strategy recently raised a further roughly $1.25 billion and used nearly all of it to buy more Bitcoin.

- Analysts link the strategy to broader shifts in Bitcoin’s institutional market structure.

TD Cowen trimmed its price target on Michael Saylor’s Strategy (Nasdaq: MSTR) to $440 from $500, even as the firm presses ahead with its aggressive Bitcoin purchases.

The research and investment banking division of TD Securities maintained a buy rating but flagged near-term pressure on its key performance metric amid price compression.

“Strategy has not only survived this latest period of price compression; it has leaned into it,” analysts Lance Vitanza and Jonnathan Navarrete wrote in a note released Wednesday.

The research firm said the adjustment reflects the near-term impact of Strategy’s accelerated Bitcoin purchases on its internal modeling. Its analysts noted that Strategy continued to add Bitcoin through a period of compressed prices, a pattern consistent with its stated approach.

Still, Strategy “remains attractive for those looking to create bitcoin exposure,” the analysts wrote, adding that while it had “flirted over the past few weeks with a zero bitcoin premium,” it could not have been faulted for slowing its treasury operations.

Instead, analysts say the company “moved aggressively to take advantage of what they expect would be “a temporary depression in the price of bitcoin.”

During the week ending January 11, Strategy raised about $1.25 billion through a mix of common stock and variable-rate preferred stock called Stretch, per the note. The firm also noted that nearly all proceeds were used to purchase approximately 13,600 additional Bitcoin during the same period.

The trim comes as Strategy chairman Michael Saylor has pushed back against framing the company’s performance solely by net asset value (NAV) multiples.

“No, I think that’s just a myopic narrative,” he said in an interview released Tuesday, when asked about how investors should interpret Strategy’s multiple to net asset value. “Companies exist to create value,” he said, arguing that valuation should be tied to what a company actually does operationally.

Strategy’s behavior as described by TD Cowen reflects broader shifts in Bitcoin’s market structure, as observers point to its growth and what remains to be built out.

That shift has seen Bitcoin moving in lockstep with the growth of “regulated spot ETFs, deeper institutional derivatives markets, and more systematic hedging,” Vincent Liu, chief investment officer at Kronos Research, told Decrypt.

It also marks how Bitcoin has shifted participation “away from purely speculative trading,” Liu added.

“Market depth and liquidity have improved, reflected in tighter spreads, higher turnover on regulated venues, and capital increasingly intermediated through traditional financial channels,” he said, adding that such an environment supports Strategy’s approach.

“Deeper institutional participation through derivatives and balance sheet allocations can provide more stable liquidity, dampening short-term volatility,” Liu said. “However, concentrated flows, macro correlations, and episodic liquidity shocks continue to pose systemic risk. While ongoing participation may reduce some price swings, volatility is unlikely to compress fully.”

Those changes come as analysts say Bitcoin’s ecosystem still needs to mature to function reliably as financial infrastructure.

“More ‘missing pieces’ within its ecosystem must be established” to ensure Bitcoin “functions as infrastructure,” Ryan Yoon, senior research analyst at Tiger Research, told Decrypt.

This is evident in the rise of BTCFi, or decentralized finance on top of Bitcoin, Yoon noted, citing earlier analysis on Strategy’s model. “These shifts show that Bitcoin is being integrated into a broader functional framework,” he said.

Still, institutional participation could expand “once regulation is fully aligned with the traditional financial system,” Yoon said.

“While this presents a clear opportunity, it is important to remember that no asset only goes up. For volatility to compress, Bitcoin will need further acceptance from governments as a viable alternative to gold,” he said.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Search

RECENT PRESS RELEASES

Standard Chartered lifts Ethereum call to $7,500, arguing institutional demand could leave

SWI Editorial Staff2026-01-15T00:47:51-08:00January 15, 2026|

By the Numbers: EGLE’s 2025 recruitment and internships

SWI Editorial Staff2026-01-14T23:48:54-08:00January 14, 2026|

Data center impact on environment, health among top concerns near Ypsilanti

SWI Editorial Staff2026-01-14T22:48:51-08:00January 14, 2026|

New Virgin Atlantic A330 Sale-Leasebacks Might Change The Case For Investing In AerCap Hol

SWI Editorial Staff2026-01-14T22:48:15-08:00January 14, 2026|

Prediction: Filings in February Will Show Warren Buffett Made 1 Investment for the Third a

SWI Editorial Staff2026-01-14T22:47:37-08:00January 14, 2026|

Meta Hires Former Trump Adviser, Senator’s Wife: President Says Zuckerberg Made ‘A Great C

SWI Editorial Staff2026-01-14T22:46:50-08:00January 14, 2026|

Related Post