The Best Stocks to Invest $50,000 in Right Now

December 28, 2025

2026 is shaping up to be a great year for these investments.

As the new year approaches, many investors are wondering where they should deploy some cash. While you may not have $50,000 sitting around, any sum of money is a great amount to get started with, especially if you have access to fractional shares in your brokerage account.

I think these three stocks make for excellent starting positions and are slated to provide market-beating returns in 2026.

Image source: Getty Images.

Taiwan Semiconductor

It’s no secret that AI companies are dumping billions of dollars into artificial intelligence (AI) data centers. This isn’t expected to slow anytime soon, and there are few better stocks to capitalize on this enormous buildout than Taiwan Semiconductor (TSM +1.33%). Taiwan Semiconductor provides most chips to various computing providers, making it a great way to invest in the trend without having to determine who the ultimate winner will be.

Taiwan Semiconductor Manufacturing

Today’s Change

(1.33%) $3.97

Current Price

$302.77

It’s also developing some innovative technology. Its 2nm (nanometer) chips are entering production right now, and consume 25% to 30% less power than the previous 3nm generation when configured to run at the same speed. Since energy availability is becoming a key concern in the AI buildout, this innovation is a welcome one.

Taiwan Semiconductor is a top way to play the AI buildout, as data center construction is expected to accelerate in 2026 and beyond.

Advertisement

Alphabet

At the start of the year, Alphabet (GOOG 0.23%) (GOOGL 0.18%) was an unpopular stock pick. There were questions surrounding the dominance of the Google Search engine, it was behind in generative AI technology, and was facing a court case that threatened to break up the company if it went the wrong way. All three of these questions were answered in 2025, and all of them were positive.

This allowed Alphabet to become one of the most successful investments of 2025, as its stock has risen more than 60% so far this year. So, if Alphabet did so well in 2025, why is it a great stock for 2026?

Alphabet

Today’s Change

(-0.18%) $-0.58

Current Price

$313.51

After all of the questions surrounding Alphabet’s stock disappeared, the market is free to value Alphabet’s stock like the dominant business it is. Advertising revenue was strong in Q3, with its base Google Search engine revenue rising 15% year over year in Q3. Its cloud computing business is also thriving, with revenue rising 34% year over year.

This allows Alphabet to focus on being a winner in the AI revolution, and its latest Gemini model is one step closer to that reality. Alphabet is going to be a successful company in 2026, and its recent track record tells me that it’s a great stock to own.

Amazon

Amazon (AMZN +0.06%) is on the opposite end of the performance spectrum. While Alphabet has soared, Amazon’s stock has lagged behind the market, rising about 6%. However, a poor 2025 is setting the stage for a big comeback in 2026. Amazon’s business is doing incredibly well, with revenue rising 13% in Q3.

Amazon

Today’s Change

(0.06%) $0.14

Current Price

$232.52

The biggest sign of Amazon’s potential is Amazon Web Services (AWS), its cloud computing division, accelerating its growth for the first time in years during Q3. AWS has much higher margins than Amazon’s core e-commerce business, and accounts for 66% of operating profit while contributing just 18% of revenue. So, if AWS’ growth is accelerating, it’s a great sign for Amazon.

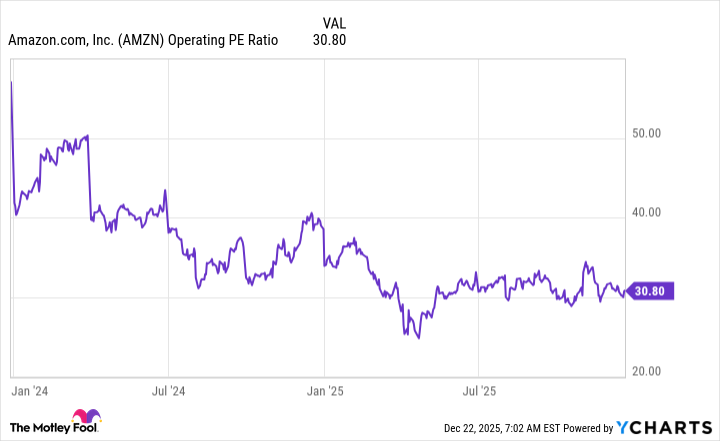

Another positive sign is Amazon’s valuation. Part of the reason Amazon’s stock didn’t perform well in 2025 is that it was growing into the high valuation it held at the start of the year. It is now trading at a reasonable level (when valued using operating profits), and I think now is a great time to invest in Amazon’s stock.

AMZN Operating PE Ratio data by YCharts

Amazon is due for a comeback in 2026, and I think it’s one of the best investments you can make now.

Search

RECENT PRESS RELEASES

Related Post