The Best Vanguard ETF to Invest $1,000 in Right Now

November 18, 2025

Vanguard High Dividend Yield ETF is diversified and focused on dividends, which may help investors avoid some of the pain of a tech crash.

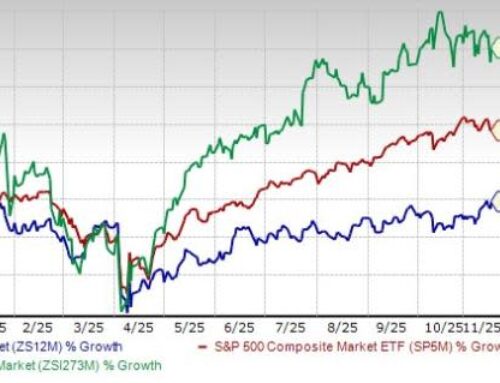

The S&P 500 (^GSPC 0.92%) is hovering near all-time highs. The index’s advance has been driven by a small number of very large technology stocks. If you are a long-term investor, history suggests that buying an exchange-traded fund (ETF) that follows the S&P 500 index is probably a good choice, even at today’s lofty levels.

But if you have a hard time putting money to work in that index today, you may be best off considering Vanguard High Dividend ETF (VYM 1.04%). Here’s why.

What does Vanguard S&P 500 ETF do?

If you are looking to buy an S&P 500 index fund, Vanguard S&P 500 ETF (VOO 0.95%) is a solid, low-cost option. However, it is important to understand what the exchange-traded fund is actually doing. The obvious answer is that it tracks the S&P 500 index, but that isn’t enough information. You have to take it to the next level: What is the index doing?

Image source: Getty Images.

The S&P 500 index is a committee-created list of approximately 500 U.S. companies that, as a group, are representative of the U.S. economy. The stocks tend to be large and economically important. The companies are weighted by market cap, so the largest companies have the biggest impact on the index’s performance. That’s logical since that’s roughly how the economy works. The primary benefit of the ETF is its ultra-low expense ratio of 0.03%, which is one of the most cost-effective ways to invest in the S&P 500 index.

There’s just one problem: The index’s design tends to result in a small number of large companies having an oversized impact on the S&P 500’s performance. Currently, the index is heavily weighted in technology stocks, which comprise nearly 35% of the index. Three tech-related stocks, Nvidia (NVDA 1.91%), Microsoft (MSFT 0.53%), and Apple (AAPL 1.82%), make up nearly 22% of the index.

Furthermore, the heavy exposure to the strongly performing tech sector has pushed the overall valuation of the S&P 500 index to concerning levels. To put some numbers on that, the average price-to-earnings ratio for the index is nearly 29 times, and the average price-to-book value ratio is 5.2 times.

Vanguard S&P 500 ETF

Today’s Change

(-0.95%) $-5.89

Current Price

$611.94

If you can’t get on board with the tech exposure and valuation of the S&P 500 index, you should probably skip the Vanguard S&P 500 ETF and consider investing $1,000 into the Vanguard High Dividend Yield ETF instead (that sum will get you around seven shares of the ETF).

What does Vanguard High Dividend Yield ETF do?

Vanguard High Dividend Yield ETF is also an index-tracking ETF. It mimics the FTSE High Dividend Yield Index. The index considers primarily dividend yield when selecting U.S. stocks. The index isn’t particularly complex; it basically just lines up all U.S. stocks by yield from highest to lowest.

After that, the highest-yielding half of the list is included in the index and the ETF using a market cap weighting. The 0.06% expense ratio is fairly low, and the portfolio is fairly large at 566 stocks, so there’s material diversification in the mix.

The two primary benefits here will be the yield and the significantly different composition of the portfolio compared to the S&P 500 index. On the yield front, Vanguard S&P 500 ETF offers a roughly 1.2% dividend yield, while Vanguard High Dividend Yield ETF’s yield is more than twice that at 2.5%. To be fair, 2.5% isn’t exactly huge, but given the size of the portfolio, it isn’t shocking that the yield isn’t higher.

Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF

Today’s Change

(-1.04%) $-1.47

Current Price

$139.54

As for the makeup of the portfolio, Vanguard High Dividend Yield ETF’s largest exposure is financials, at around 22% of the portfolio. Technology is tied for second, with industrial stocks at 13%. Those two sectors are followed by healthcare and consumer discretionary, at 12% and 10%, respectively.

The summary of this breakdown is that Vanguard High Dividend Yield ETF has more exposure to conservative areas, which has led to an average P/E ratio of 20.5 times and an average P/B ratio of 2.9 times.

Trade down to a higher yield

Technology remains a significant factor for the Vanguard High Dividend Yield ETF, but not nearly as substantial as it is in the S&P 500 index. Moreover, given the shift toward higher-yielding stocks, there is a clear value bias to Vanguard High Dividend Yield ETF. If you are worried about the lofty level of the S&P 500 index and its focus on richly priced technology stocks, Vanguard High Dividend Yield ETF could be the best choice for you right now.

Search

RECENT PRESS RELEASES

Related Post