The Climate Premium: How Environmental Risks Are Reshaping CRE Economics

March 20, 2025

The US property and casualty (P&C) insurance market is

undergoing a seismic shift, driven by escalating climate risks and

rising claims. But in many high-risk states, regulatory constraints

prevent insurers from fully adjusting premiums to match the growing

exposure. As a result, rather than simply charging higher rates,

many insurers are pulling back — scaling down coverage,

tightening underwriting standards, or exiting certain markets

altogether.

This shifting landscape is increasingly affecting the commercial

real estate (CRE) sector. Developers, lenders, and investors are

facing a new reality in which insurance coverage is more expensive,

harder to secure, or even unavailable in some high-risk areas.

At Goodwin’s 2025 Real Estate Capital Markets (RECM) Conference,

Pari Sastry, assistant professor of finance at Columbia Business

School, outlined how these forces are reshaping the economics of

real estate insurance, forcing stakeholders to rethink risk

management, financing, and long-term investment strategies.

This article highlights key insights from Professor Sastry’s

talk. Watch her full presentation for more detail, including

analysis of how climate change is affecting residential markets:

“The Growing Impact of Climate Change on Real

Estate Coverage.”

Surging Development in High-Risk Areas

Insured P&C losses have exceeded $100 billion globally for

the past five consecutive years, according to Swiss Re, with the US

accounting for about two-thirds of the global total of $135 billion

in losses in 2024. Several factors are contributing to rising

claims, including climate change, inflation, rising construction

costs, and an increasingly litigious environment. However, the

primary contributor is surging development in high-risk areas that

are prone to natural disasters such as fires, floods, and

hurricanes.

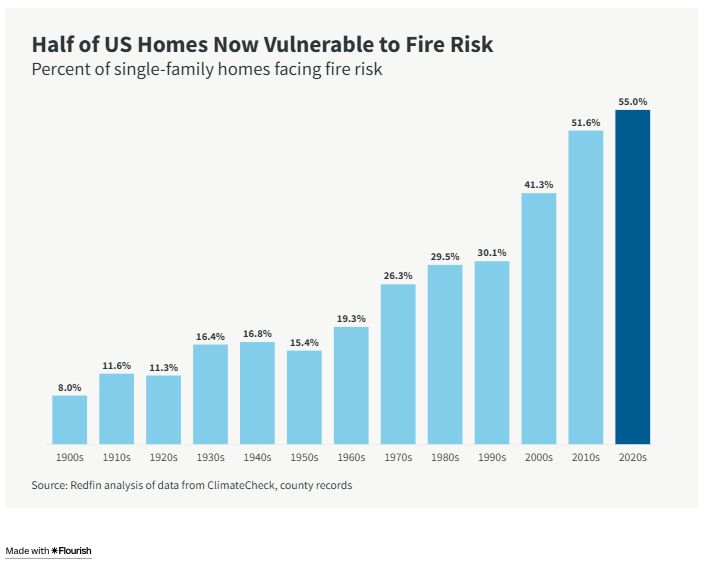

For instance, residential housing development has steadily

increased in areas that are vulnerable to such risks. According to

Redfin, 55% of US housing stock is now located in zones with high

fire risk — almost twice as much as in the 1980s. This

dramatic increase in development, coupled with rising population

growth in these high-risk areas, has substantially heightened the

potential for catastrophic losses, driving up insurance

premiums.

Regulations Often Exacerbate the Challenge

In many states, insurers are limited in their ability to adjust

premiums in response to the increasing risks posed by climate

change. In states such as California, Florida, and Texas, for

example, insurers need approval from regulators to raise premiums,

often capping premiums. This regulatory constraint creates a

disconnect between the actual risks and the premiums charged to

property owners, including those in the CRE sector.

This not only makes it difficult for insurers to price policies

in ways that enable them to turn a profit but also puts many of

them at significant risk of insolvency. As a result, many insurers

are exiting or scaling back their operations in certain markets. An

increasing number, including large national insurers, have stopped

offering new policies in high-risk areas, and others are

significantly reducing their coverage options in those areas.

This creates a precarious environment for CRE investors who may

find themselves unable to secure adequate insurance coverage.

What Can Developers, Investors, and Governments Do?

CRE developers and investors may be able to secure lower

premiums by integrating resiliency measures into new developments,

including investing in construction methods or materials that

reduce the risk of damage, such as wind-resistant roofs or flood

barriers. But it remains unclear how much a given investment will

affect premiums in practice.

Some large CRE firms have begun to explore alternative insurance

models, such as self-insuring or utilizing catastrophe bonds (cat

bonds) to diversify risk. Companies such as Blackstone and Apollo

have developed in-house insurance strategies to hedge against

rising premiums and climate-related risks. This strategy allows

them to better control their risk exposure and maintain coverage in

an increasingly uncertain market.

Some states are exploring reforms to allow insurers more

flexibility in adjusting premiums, loosening regulations to allow

insurers to raise premiums so they more accurately reflect the

risks posed by climate change and natural disasters. Such

adjustments would likely lead to higher premiums in high-risk areas

but could slow insurer exits from these markets.

Governments may begin to put more emphasis on resilience,

particularly in high-risk areas. This could include investing in

infrastructure improvements such as flood control measures or

wildfire prevention programs to mitigate the impacts of climate

change. Zoning regulations that limit new development in

particularly dangerous areas and stricter building codes could also

be part of the solution, helping to reduce future risk and the

associated insurance costs.

* * *

Climate risks are reshaping the insurance market and how real

estate stakeholders approach risk management. While some relief may

come from innovative insurance strategies such as self-insurance

and capital market – based solutions, the industry must

remain agile in responding to the dynamic and increasingly complex

environment.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.

Search

RECENT PRESS RELEASES

Related Post