The Dot-Com Crash of the 2000s The Cannabis Market Crash of 2023 Wash – Rinse – Repeat?

November 3, 2024

The Dot-Com Crash of the 2000s

The Cannabis Market Crash of 2023

Wash – Rinse – Repeat?

By Rainer Poertner – Jake Amate

|

Note: October results as of 10.22.24

Most analysts (including us) expected a steady expansion of legal operations and improved financial performance reflected in increasing share prices, maybe not quite at a 24% CAG.

Path to Revival

The subsequent significant advancements in technology and infrastructure fueled the revival of the tech industry’s post-dot-com crash. The rise of broadband, social media, and mobile technology opened new avenues for growth. In the same way, advancements in cannabis cultivation techniques, product innovation, better corporate discipline and management, and the development of a robust regulatory framework will be crucial for the revitalization of the cannabis industry,

The dot-com crash led to major company consolidation in the tech sector, with more vital entities acquiring weaker ones, a typical process that can be applied to any newly emerging sector’s development. We anticipate that this trend might be mirrored in the cannabis industry, where larger, well-managed, and well-financed established companies are absorbing struggling startups, hopefully resulting in a more robust and competitive landscape.

For this trend to succeed, stabilize the industry, and result in solid companies producing a solid ROI for their investors, the broad public acceptance of cannabis as a recreational product and medical treatment needs to be reflected in ongoing legislative changes. Improving tax structures and reasonable accounting allowances is vital. As more states and countries legalize cannabis for recreational and medicinal use, the market is likely to stabilize and grow.

What the Revival Will Look Like

Unlike during the frantic rise seen before the crash. Investors will likely conduct intense research and focus on established companies with a diversified product roster, sustainable business models, proven profitability, and robust supply chains. Beyond simply selling flower in their different forms, a diversified product offering, particularly in the growing sectors of edibles and wellness products, will appeal to a broader consumer base and allow for higher-margin pricing. By learning from past mistakes, dynamically reacting to quickly changing market conditions, focusing on sustainable growth, and capitalizing on market opportunities, the cannabis sector should emerge more resilient and profitable in the coming years. The public demand for unique quality products is still increasing.

Crash Resistance and Recovery

Not everyone is crashing. Some large and well-capitalized companies will survive, and a number of well-managed and specialized smaller companies producing high-quality and unique products will not only survive but thrive. While most of these companies currently have very low share prices, especially compared to their overhyped highs at the beginning of 2022, a clear stabilization trend presents a “buy low” opportunity for savvy investors. Several factors will determine which companies have the best opportunity for survival and eventual success.

1. Established Multi-State Operators (MSOs)

These companies have a diversified presence across multiple states and often possess an extensive product roster and robust supply chain, which allows them to mitigate risks associated with local regulations and source material market fluctuations. Examples of established MSOs include:

- Curaleaf Holdings (CURLF)

Curaleaf is a leading vertically integrated medical and wellness cannabis operator in the United States. With a significant market presence and a wide range of products, Curaleaf has proactively expanded its operations across various states.

- Trulieve Cannabis (TCNNF)

Trulieve is an industry-leading, vertically integrated cannabis company and multi-state operator in the U.S., with established hubs in the Northeast, Southeast, and Southwest. It is anchored by leading market positions in Arizona, Florida, and Pennsylvania. Trulieve is listed on the CSE under the symbol TRUL and trades on the OTCQX market under the symbol TCNNF.

2. Companies with Strong Financial Backing

Companies that have secured substantial funding and maintain healthy balance sheets are better positioned to weather economic downturns. These companies can invest in innovation, marketing, and expansion when necessary.

- Cresco Labs (CRLBF)

Cresco Labs is one of the largest vertically integrated multi-state cannabis operators in the United States. Cresco Labs is built to become the most important company in the cannabis industry by combining the most strategic geographic footprint with one of the leading distribution platforms in North America. Employing a consumer-packaged goods (“CPG”) approach to cannabis, Cresco Labs’ house of brands is designed to meet the needs of all consumer segments. With a solid financial position and a focus on wholesale and retail, Cresco Labs has navigated challenges effectively.

3. Brands with Consumer Loyalty

Companies focusing on building strong brands and consumer loyalty will have an advantage as the market matures. Brands with quality products and a strong marketing strategy are better positioned for long-term success.

- Charlotte’s Web (Private)

Charlotte’s Web started as a mission, not a company. In the early days, the company’s extract was given away to help those who could benefit from it. Ten years later, the mission is as strong as ever: to improve lives naturally. Known for its high-quality CBD products, Charlotte’s Web has built a compelling reputation and a loyal customer base in the wellness sector.

4. Innovators in Product Development

Companies that invest in research and development to create unique, high-quality products that meet consumer demands will thrive. The market is increasingly leaning toward edibles, beverages, and wellness products.

- Canopy Growth Corporation (CGC)

Canopy Growth Corporation is a world-leading diversified cannabis company. Canopy operates a collection of diverse brands and curated strain variety, supported by over half a million square feet of indoor and greenhouse production capacity, partnered with some of the sector’s leading names. With a diverse product portfolio and a focus on innovation, Canopy Growth is positioned to adapt to changing consumer preferences.

- Glass House Brands (GLASF)

Glass House is one of the fastest-growing, vertically integrated cannabis companies in the U.S., with a dedicated focus on the California market and building leading, lasting brands to serve consumers across all segments. From its greenhouse cultivation operations to its manufacturing practices, from brand-building to retailing, the company’s efforts are rooted in respect for people, the environment, and the community.

- Livewire Ergogenics (LVVV)

Livewire is a pioneering force in developing and selling high-quality, handcrafted cannabis products for medical and recreational use via its “Sol Vida Wellness” product line throughout California and across the US. The company’s products are sold through distributors, retail locations, and various Online Stores, including the Company’s own online presence. Livewire is focused on innovative delivery methods to capitalize on the “new consumer behavior” and branding of on-the-go products.

5. Companies with Strong Distribution Networks

Businesses that have established robust distribution channels, both online and offline, will be better equipped to reach customers and grow their market share.

- Green Thumb Industries (GTBIF)

Green Thumb Industries Inc. (“Green Thumb”), a national cannabis consumer packaged goods company and retailer, promotes well-being through the power of cannabis while giving back to the communities it serves. Green Thumb manufactures and distributes a portfolio of branded cannabis products. Green Thumb has eighteen manufacturing facilities, eighty-five open retail locations, and operations across 15 U.S. markets. This company has effectively established a strong retail presence and distribution network across multiple states, which will help it capture market opportunities as they arise.

- Innovative Industrial (IIPR)

Innovative Industrial Properties, Inc. is a self-advised Maryland corporation focused on acquiring, owning, and managing specialized properties leased to experienced, state-licensed operators for their regulated cannabis facilities. Innovative Industrial Properties, Inc. has elected to be taxed as a real estate investment trust, commencing with the year ended December 31, 2017.

- Verena Holdings (VRNOF)

Verano Holdings Corp. is a vertically integrated multi-state cannabis operator in the United States. The company cultivates, processes, wholesales, and distributes cannabis in Arizona, Arkansas, Connecticut, Florida, Illinois, Maryland, Massachusetts, Michigan, Nevada, New Jersey, Ohio, Pennsylvania, and West Virginia. It offers cannabis products under the Encore, Avexia, MUV, Savvy, BITS, Verano, and Essence brands for medical and adult-use markets. The company is headquartered in Chicago, Illinois.

6. International Players

Companies expanding internationally may find additional growth opportunities outside the saturated U.S. market.

- Aurora Cannabis (ACB)

Aurora Cannabis Enterprises Inc. is a licensed producer of medical cannabis under Health Canada’s Access to Cannabis for Medical Purposes Regulations (ACMPR). The Company operates a 55,200-square-foot, state-of-the-art production facility in Mountain View County. With a focus on both Canadian and international markets, Aurora has the potential to capitalize on growth opportunities in regions where cannabis is becoming legalized. Aurora’s common shares trade on TSX under the symbol “ACB” and on the OTCQX under “ACBFF.”

- Cronus Group (CRON)

Cronos Group is a geographically diversified and vertically integrated cannabis company that operates two wholly-owned Licensed Producers (“LPs”) regulated within Health Canada’s Access to Cannabis for Medical Purposes Regulations (the “ACMPR”) and holds a portfolio of minority investments in other Licensed Producers.

- Tilray (TLRY)

Tilray Brands, Inc., a lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, Australia, New Zealand, Latin America, and internationally. The company operates through four segments: Beverage, Alcohol, Cannabis, Distribution, and Wellness. It also offers medical and adult-use cannabis products, purchases, and resells pharmaceutical and wellness products, and produces, markets, sells, and distributes beverage alcohol products, hemp-based food, and other wellness products.

Conclusion

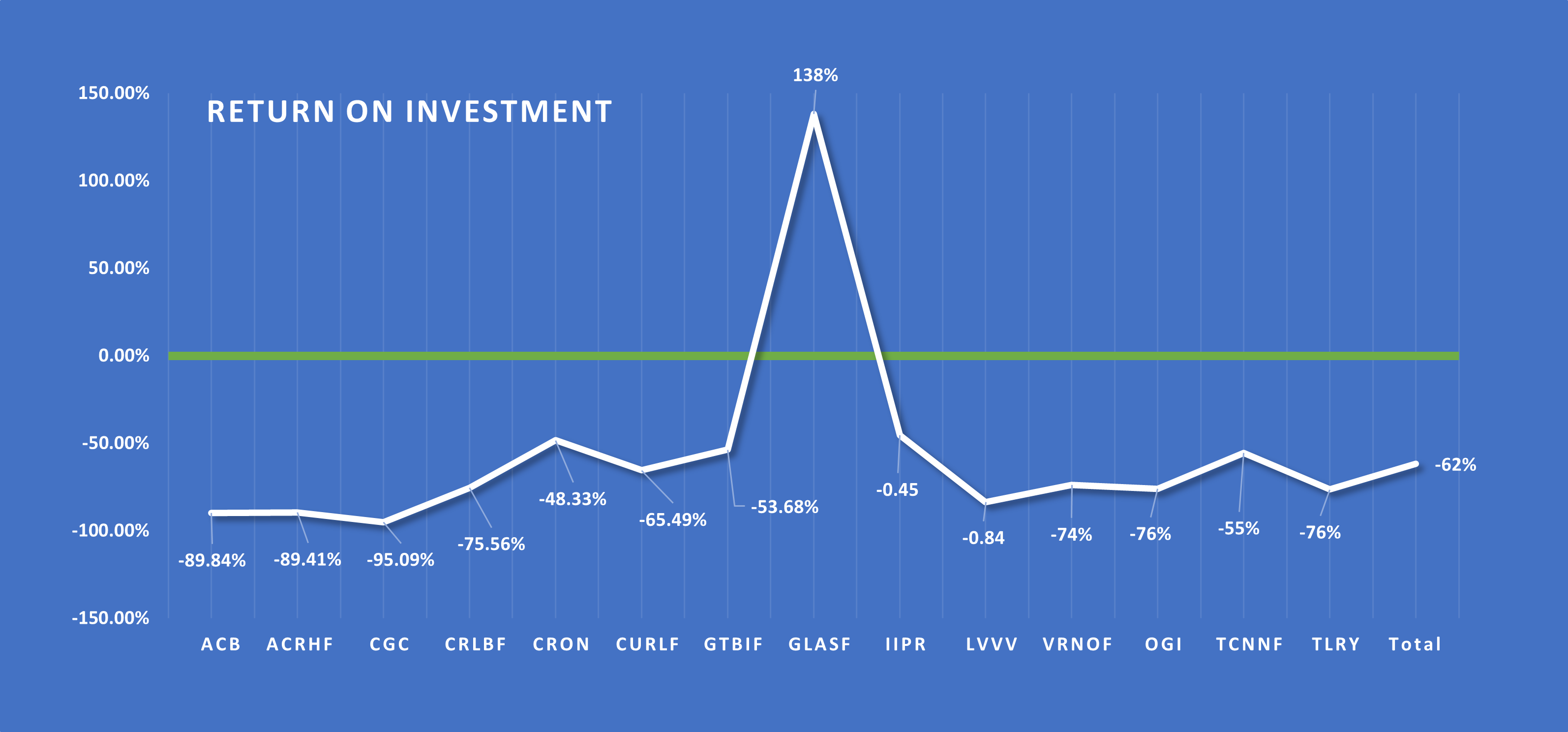

Since 2022, a record number of cannabis operations, from cultivators to retailers, have closed their doors, and stocks took the deepest dive ever in January 2023. Our monitored top players’ average return on investment has been negative 62%, with only Glass House Brands being the exception, with a positive ROI of 138%.

While this has been a painful experience for most, there seems to be a (dim) light at the end of the tunnel now. Stock prices and market caps began to stabilize (albeit at an exceptionally low level) and began a slow upward climb in September 2023. As of September 30, 2024, values in our monitored portfolio increased by 74% from June 2023, and the October trend so far (10.22.24) looks nearly all green for the first time.

In 2022, The global cannabis market size was valued at USD 14.5 billion, and the projections for growth varied wildly even among respected analysts, ranging from growing to an incredible $90 billion to $428 billion by 2031, at a CAGR between 24% to 34.03% during the forecast period. North America typically holds a market share of 80% of the global market. No matter what projection you trust, the cannabis market size in the U.S. is projected to grow significantly over the next few years despite the ongoing turmoil driven by the increasing demand for high-quality products and the legalization of medical and recreational cannabis in most states.

The cannabis industry continues to face challenges, especially in the still-evolving regulatory landscape and the ongoing price pressure caused by the lower prices of the still-thriving illicit sales. Nevertheless, well-managed companies that adhere to the typical yardsticks for generating and measuring success, whether private or public, are well-positioned for survival and growth and will generate strong ROI for their investors over time, but not overnight. Companies that want to succeed need to have:

· Solid operational frameworks

· Experienced management

· Focus on financial discipline and profits.

· Operational transparency

· Legal compliance

· Innovative and high-quality products

· Diversified portfolios

· Innovative marketing

· Loyal customer base

As the market stabilizes, these companies will likely emerge as leaders in the cannabis industry’s new and improved landscape. Investors should continue to monitor these key factors and the performance of individual companies as the industry matures and recovers.

About StockWatchIndex

StockWatchIndex (SWI) is an exceptionally focused financial information and consulting service that generates market awareness for public companies through its website http://www.stockwatindex.com, associated SWI newsletter, and an extensive social network outreach program. SWI aims to “Rise Above the Noise” and the clutter of the typical mass-market information services, providing investors with relevant and up-to-date information focused on specific industry sectors and companies. There are no outrageous claims of success rates, just solid research and analysis, frequently updated market and stock trend information, analyst opinions, and notable stock picks, presenting information that assists investors in making sound investment decisions.

We encourage you to pass on our research and releases to any of your Friends.

Subscribe to this “Rise Above the Noise” SWI Newsletter

If you want to follow other companies that we cover with in-depth articles and research reports,

go to www.stockwatchindex.com or our research site at www.swiresearch.com.

Search

RECENT PRESS RELEASES

Related Post