The Mutual Fund Advisor: Investing in your first mutual fund? Start simple, not clever – T

November 30, 2025

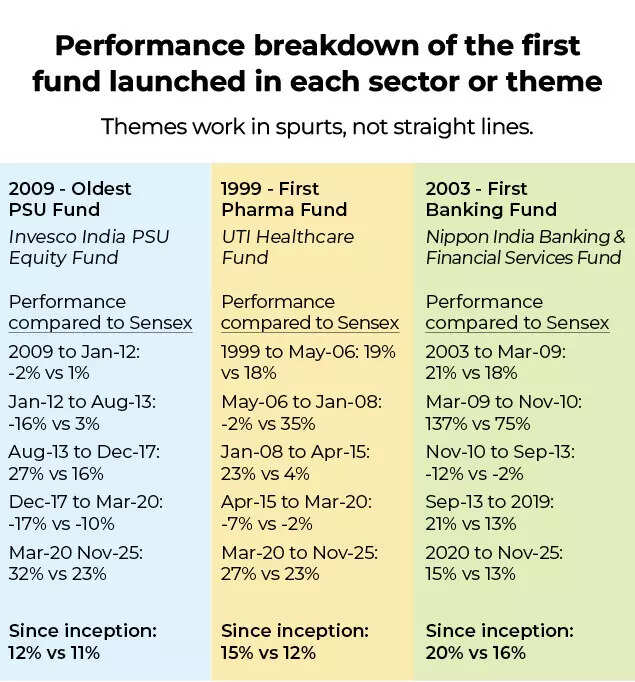

Here’s a scene I’ve seen many times.A new investor starts a SIP. Within a month, the portfolio already has seven funds: a mid-cap, a small-cap, a PSU theme, a “manufacturing” theme, an international fund, a sector fund, and one “special opportunities” fund—because each one looked great on a “top returns” list.Another new investor starts with one fund—a plain flexi-cap fund or a broad index fund—and just keeps investing.Five years later, the second investor usually has a bigger corpus and far less stress.Not because they found a magical fund. But because they began the right way.What your first mutual fund should doYour first mutual fund has a simple job:This is the “learning to drive” phase. You don’t start by driving in the hills at night in the rain. You start on a steady road.So your first fund should be boring in the best way—broad, diversified, and easy to stay invested in.Good beginner choices are:These are not flashy. That’s exactly why they work.Why “hot” funds are a bad starting pointMost beginners choose funds the way people choose restaurants—by looking at what’s “trending”.Apps and websites push:The trap is simple: yesterday’s winner is often tomorrow’s disappointment.Sector and thematic funds are not evil. They’re just sharp tools. If you’re still learning, sharp tools increase the chances of getting hurt.Why?So the fund didn’t “fail”. The investor’s timing did. And timing is the one skill beginners shouldn’t be forced to master.One simple fund often beats many clever ones (in real life)Over a full market cycle—up, down, then recovery—broad-market funds tend to be easier to hold, and that matters more than people admit.For example, consider the periods from August 2013 to December 2017 and from December 2017 to March 2020.

Performance breakdown

Now add reality: most investors didn’t stay invested in the theme through the full cycle. Many entered late and exited early.That’s why “best returns” lists can be misleading. They show what a fund did. They don’t show what investors earned.How many funds do you need in your first 2–3 years?Most beginners think diversification means “more funds”.It doesn’t.If you own five equity funds, chances are you own the same top 20–30 stocks five times. That’s not diversification. That’s repetition with extra paperwork.For the first two to three years, a good rule is:Start with 1–2 funds.That’s enough.A simple structure:If you can’t explain why you own a fund in one sentence, you probably don’t need it—yet.“But what about small caps, international exposure, sectors, themes?”Later—maybe.Think of these as “satellites”. You add them after your “core” is in place.Start with the core first because:When we design a first portfolio in Value Research Fund Advisor (VRFA), we usually start with 1–2 core funds that can quietly do the heavy lifting for decades. Once the foundation is solid, we add anything else if needed.A practical, quick check before you pick your first fundBefore you choose, ask yourself:That last question is the real test.Because your first mutual fund is not about being clever. It’s about being consistent.The whole pointIf you do just two things right at the start, you’ll be ahead of most investors:Ignore the noise. Ignore the “top returns” carousel.A decade from now, the fund you barely talked about will likely be the one that did most of the work.(Sneha Suri is Lead Fund Analyst – Value Research’s Fund Advisor)

Search

RECENT PRESS RELEASES

Related Post