The Nvidia panic, America’s Bitcoin Reserve, and Trump’s trade war hits stocks: Markets news roundup

February 8, 2025

Start Slideshow

Start Slideshow

Previous Slide

Next Slide

Previous Slide

Next Slide

The Trump administration is actively pursuing initiatives related to cryptocurrency, but there has not been any official announcement regarding the highly anticipated Bitcoin reserve. David Sacks, the White House’s cryptocurrency director and President Donald Trump’s crypto czar, held a press conference to discuss the U.S. digital asset strategy. However, he did not reveal any specific plans for stockpiling Bitcoin, instead stating that the team would evaluate the feasibility of a Bitcoin reserve.

Previous Slide

Next Slide

With rising prices, an affordable housing crisis, and the specter of looming tariffs, Americans are looking to save money just about everywhere.

And with nine in 10 American households owning at least one car, many are looking at their vehicles as a place to save.

Self, a credit-building toolkit, looked at the 50 best-selling cars between 2022 and 2024 and ran the numbers to find the most and least expensive ones to run. It didn’t consider the vehicle’s purchase or lease price and instead looked at average annual gas costs, maintenance, insurance, fees, and taxes.

Previous Slide

Next Slide

Previous Slide

Next Slide

Previous Slide

Next Slide

Previous Slide

Next Slide

President Donald Trump has begun a new trade war with Canada, Mexico, and potentially China, and this has had a significant ripple effect on the broader financial landscape, including the cryptocurrency market. Trump’s latest move involves imposing a 25% tariff on imports from Canada and Mexico, while Chinese imports will be taxed at 10%.

Previous Slide

Next Slide

Donald Trump wants a sovereign wealth fund. Here are the risks and rewards, according to a strategist

Eric Beiley of The Beiley Group at Steward Partners breaks down how a sovereign wealth fund might work for America like they do in Singapore and Norway

Previous Slide

Next Slide

Tariffs, interest rates, and market volatility: What they mean for your investments in 2025, according to a strategist

Eric Beiley, Executive Managing Director of The Beiley Group at Steward Partners, breaks down what China’s retaliatory tariffs could mean for investors

Search

RECENT PRESS RELEASES

Environmental groups urge AI industry to reduce emissions

SWI Editorial Staff2025-02-10T04:38:49-08:00February 10, 2025|

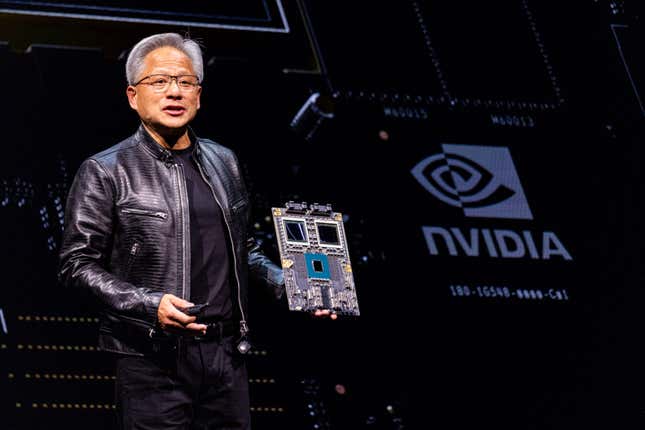

The AI investment frenzy, charted

SWI Editorial Staff2025-02-10T04:38:40-08:00February 10, 2025|

Mirova fund gets backing from institutional investors and DFIs

SWI Editorial Staff2025-02-10T04:38:36-08:00February 10, 2025|

Most-Active US Investors In January: a16z Only Investor To Warm Up To The New Year

SWI Editorial Staff2025-02-10T04:38:34-08:00February 10, 2025|

Base denies selling ETH, says the network is committed to Ethereum

SWI Editorial Staff2025-02-10T04:38:03-08:00February 10, 2025|

$883M Flows Into Ethereum in One Day: What It Means for Investors

SWI Editorial Staff2025-02-10T04:38:00-08:00February 10, 2025|

Related Post