The “Safest” Trillion-Dollar Artificial Intelligence (AI) Stock to Invest $50,000 In Right

January 10, 2026

There are currently nine technology stocks that boast valuations of at least $1 trillion.

At this writing, there are 11 public companies with market capitalizations north of $1 trillion. Perhaps unsurprisingly, nine of these companies operate in the technology industry — which has been going through a renaissance over the last few years, driven by rising demand for artificial intelligence (AI) applications.

Digging a little deeper, three members of the trillion-dollar club are semiconductor stocks: Nvidia, Broadcom, and Taiwan Semiconductor Manufacturing (TSM +1.77%). By now, it’s obvious that chips are a core pillar supporting the greater AI foundation. But among these trillion-dollar chip leaders, which one is the “safest”?

In my eyes, Taiwan Semiconductor takes the cake. Let’s delve into what makes TSMC such a unique opportunity and explore why now is an ideal time to consider a position in the semiconductor giant, if you haven’t already.

Image source: Taiwan Semiconductor Manufacturing.

Why is Taiwan Semi so important?

By now, you’re likely aware that sophisticated chips, known as graphics processing units (GPUs), are the key piece of hardware on which AI models, such as ChatGPT, are trained. What you might not fully understand, however, is that GPU leaders like Nvidia, Advanced Micro Devices, and custom chip specialists such as Broadcom focus more on designing hardware rather than actually making it in-house.

Instead, these companies outsource their manufacturing needs to external foundries. This is where Taiwan Semi makes its impact. Whenever a hyperscaler announces a multibillion-dollar chip deal, odds are Taiwan Semi is the foundry bringing this hardware to life.

Advertisement

TSMC is currently the largest chip manufacturer in the world in terms of revenue — controlling nearly 70% market share. What’s even more impressive is that Taiwan Semi has worked to diversify its supply chain, opening up additional facilities in Germany, Japan, and now Arizona.

Given that worldwide data center buildouts are a priority for big tech, TSMC is positioned not only to continue benefiting from secular tailwinds fueling AI but also to remain in a prime position to expand its already massive lead over the competitive landscape.

Taiwan Semiconductor Manufacturing

Today’s Change

(1.77%) $5.62

Current Price

$323.63

What is Wall Street’s opinion of TSMC?

Among the 17 sell-side analysts that cover Taiwan Semi, 15 have a buy or equivalent rating on the stock. While that provides a surface-level opinion of optimism around TSMC, smart investors should want to know what’s driving this bullish outlook.

According to research from Deloitte, capital expenditures (capex) for AI data centers could reach $450 billion globally in 2026. In just two years’ time, this addressable market could rise to an estimated $1 trillion.

Perhaps more importantly, Deloitte suggests that at least half of this AI infrastructure spend will be allocated toward next-generation chips. These dynamics suggest that TSMC’s revenue trajectory may continue to steepen throughout the remainder of the decade. Against this backdrop, I think the company should continue to easily command enormous pricing power over competing foundries — leading to further margin expansion and compounding profits.

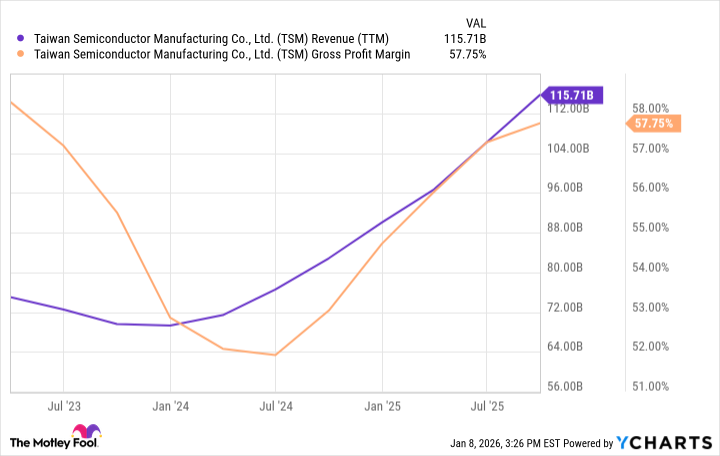

TSM Revenue (TTM) data by YCharts

Is Taiwan Semi a good long-term investment?

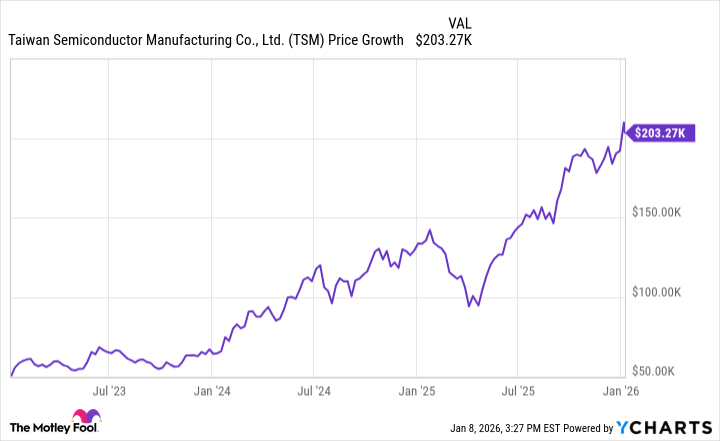

If you had invested $50,000 into Taiwan Semi stock at the start of the AI revolution, you’d now have more than four times your initial capital. I’ll concede that this is an abnormal level of price appreciation in just three years’ time.

There is a solid argument to be made that TSMC’s growth is only just beginning. Over the next several years, the AI infrastructure era will feature additional GPU architectures, including Nvidia’s upcoming Vera Rubin chips and AMD’s MI400 accelerator series.

In addition, Broadcom is increasingly becoming favored by Apple, Alphabet, Tesla, and more in the custom application-specific integrated circuits (ASICs) market.

Taiwan Semi is the perfect pick-and-shovel opportunity at the intersection of AI chips and next-generation infrastructure buildouts. Given its unique position to benefit from the broader macro demand trends for AI chips, I see TSMC as a relatively insulated and much safer opportunity than any single chip designer or AI developer. For these reasons, I see the stock as a no-brainer buy and potential multibagger over the coming years.

Search

RECENT PRESS RELEASES

Related Post