The Smartest High-Yield Dividend ETF to Buy With $100 Right Now

October 26, 2025

Sit back, take it easy, and let this dividend ETF do the work you’d be doing if you bought individual stocks yourself.

It takes a lot of work to build a stock portfolio. The work doesn’t end once you’ve bought a collection of stocks, either, because you have to maintain the portfolio. So, what if you could pay someone a tiny fee to do all of that work for you?

That’s what’s on offer from Schwab US Dividend Equity ETF (SCHD +0.02%). Here’s why this is the smartest exchange-traded fund (ETF) to buy right now whether you have $100 or $100,000.

What do you do when you buy dividend stocks?

If you are a long-term investor who loves dividend stocks, you probably do something similar to what I do. My list of factors to look for includes a well-run business, financial strength, a strong dividend history, attractive yield, and solid dividend growth prospects. No single item is singularly important, per se, because selecting a stock is more art than science. It’s a balancing act.

Image source: Getty Images.

My portfolio is somewhat eclectic, though I do tend to end up with concentrations in specific income-focused sectors. But adding a stock into the mix is just step one, though notably it is a very big step. After that, I monitor quarterly earnings and news flow around the company to make sure things are going reasonably well.

I don’t need perfection, but I also don’t want the business to implode without my knowing it. Managing a diversified portfolio is a lot of effort. It would be even more problematic if I were trying to do this work and hold down a non-finance related job. Not to mention keeping a loving relationship with my significant other (and the child we brought into this world) afloat. Investing in individual stocks is just hard and time-consuming, there’s no way around that fact.

That doesn’t mean you shouldn’t do it. It just means you need to consider the larger picture. What good is a big portfolio if your personal life suffers because of that portfolio? Money is important, but it shouldn’t be the only thing that is important.

A better way to invest in dividends?

I recently bought a starter position in Schwab US Dividend Equity ETF. It’s just a starter position, but I expect it will grow materially in importance over time. The reason I bought it is that, following extensive discussions, I know my family isn’t going to invest like I invest. They either have no interest in the market or lack the time and energy to do what I do. I need to set them up with an investment that can take care of the hard dividend investing work without costing too much money. Exchange-traded fund Schwab US Dividend Equity is a “nearly perfect” option.

Schwab U.S. Dividend Equity ETF

Today’s Change

(0.02%) $0.01

Current Price

$27.04

Getting the cost out of the way upfront (I’m proudly cheap…I mean frugal), the expense ratio is a tiny 0.06%. That’s practically free on Wall Street. Next up is the dividend yield, which is currently around 3.8%. I’d prefer 4%, which is the rule-of-thumb retirement withdrawal rate, but given how much work I save owning this ETF, I’m not going to complain about the yield being 0.2 percentage points shy of 4%.

But the real reason to buy Schwab US Dividend Equity ETF is its approach. It tracks the Dow Jones U.S. Dividend 100 Index. The index starts by only considering companies that have a decade or more of annual dividend increases under their belts (real estate investment trusts are excluded from consideration).

Then a composite score is created for each company, looking at cash flow to total debt, return on equity, dividend yield, and a company’s five-year dividend growth rate. The 100 highest ranked companies get into the index with a market cap weighting. The index is updated annually.

That’s basically what I do, and what most dividend investors do, when they are looking for a stock. Essentially, Schwab US Dividend Equity owns good businesses that are growing, that offer attractive yields, and that have yields backed by a growing dividend.

The only place where the ETF diverges from my approach is that the portfolio is restructured every year. I prefer to buy and hold for the long term, in a Warren Buffett-esque attempt to benefit from the long-term growth of the businesses I own.

Not perfect, but it is the best compromise I’ve found

So I can’t say that Schwab US Dividend Equity ETF is a 100% replacement for my dividend investment approach. But I like what it does and I think it would be a good compromise for my family when they end up taking over our family’s investing (hopefully no time soon, since it means I’ll be incapable of doing it anymore).

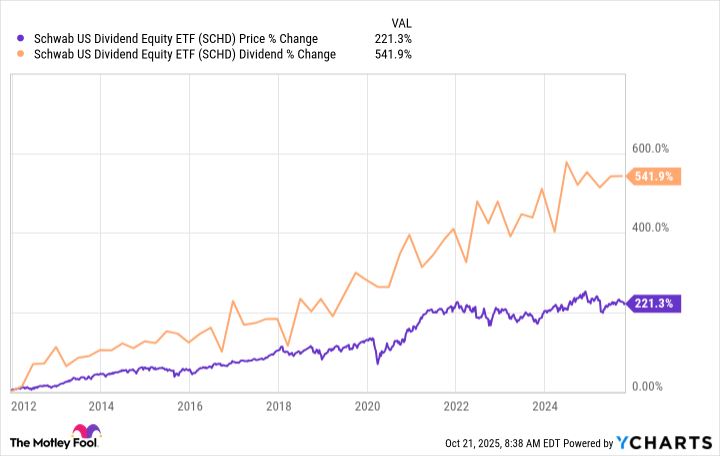

If history is any guide, the ETF will provide them with income today, income growth for tomorrow, and modest capital appreciation over time. And all while owning a diversified collection of well-run businesses.

I think that combination makes this a smart investment for my family and me, and it could be a smart one for you, too. A $100 investment gets your foot in the door with around three shares, but you’ll probably want to buy more over time…or at least that’s my plan.

Search

RECENT PRESS RELEASES

Related Post