The Stock Market Is Doing Something Witnessed Only 3 Times in 153 Years — and History Is

October 12, 2025

The S&P 500 has reached multiple record highs this year.

The S&P 500 has been roaring higher, registering gains of 24% and 23%, respectively, over 2023 and 2024, and right now heading for a new double-digit annual increase. The famous benchmark even reached record levels in recent days, reinforcing the strength of the current bull market rally.

What’s been leading the way? Growth stocks, particularly companies involved in the artificial intelligence (AI) boom. Investors are excited about the potential of this game-changing technology and the value it may deliver to companies that got in on it early. The AI market is forecast to reach into the trillions early next decade, and that could result in major growth for companies involved — and their shareholders.

On top of this, the Federal Reserve lowered interest rates last month and signaled more cuts ahead. Declining interest rates are supportive for companies — they benefit from lower borrowing costs — and for consumers’ wallets, meaning they can spend more on products and services. That’s positive news for growth stocks and the stock market in general.

All of this sounds fantastic, but something the stock market did recently — something rare — could suggest trouble ahead.

Image source: Getty Images.

Concerns about Trump’s tariff plan

First, it’s important to note that this year hasn’t been entirely joyful for investors. Earlier in the year, stocks sank amid concerns about President Donald Trump’s import tariff plans. But as the president showed some flexibility on the implementation of certain tariffs and many companies demonstrated their abilities to manage the headwinds, investors grew more confident.

Meanwhile, as mentioned above, AI growth and monetary policy supported this optimism — and to make the picture even brighter, corporate earnings came in strong. In fact, 79% of S&P 500 companies beat analysts’ estimates on revenue and more than 80% surpassed earnings forecasts in the second quarter, according to BlackRock. This greatly exceeds the historical average of about 60%.

All of this also has helped stocks to roar higher, pushing the S&P 500 to multiple new record highs — and prompting the stock market to do something witnessed only three times in 153 years. As we consider this, it’s important to understand valuation measures. Investors often use the price-to-earnings ratio, a look at the current stock price in relation to earnings, or the forward P/E ratio, which considers earnings estimates for the year ahead instead of past earnings. Both are acceptable measures when evaluating a stock.

The S&P 500 Shiller CAPE ratio

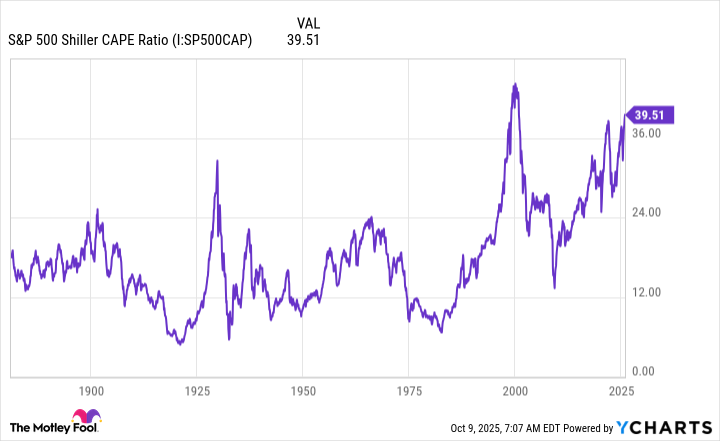

But another measure, when looking at the S&P 500 as a whole, could be even stronger as it accounts for shifts in the economy and corporate profits over a 10-year period. I’m talking about the S&P 500 Shiller CAPE ratio, which considers price in relation to earnings per share over a decade.

In recent months, the S&P 500 Shiller CAPE ratio reached beyond the level of 36, something it’s done only two other times in 153 years. And this month, the measure surpassed 39, a move it hasn’t made since the dot-com bubble back in 1999 — at the time, it reached a high of more than 44.

S&P 500 Shiller CAPE Ratio data by YCharts

What does all of this mean? The stock market, as a whole, has become expensive. And history shows that when the market has reached such levels, declines have followed.

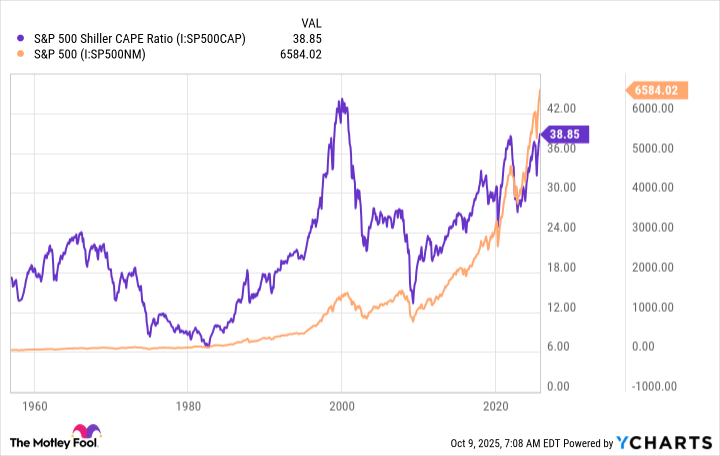

S&P 500 Shiller CAPE Ratio data by YCharts

For example, from December 1999 through December 2002, the S&P 500 lost more than 37%. And from December 2021 — following the other peak in this valuation metric — through December 2022, the benchmark fell 16%.

A dark cloud — but a silver lining

So, history is very clear about what could happen next, but this potential dark cloud has a very shiny silver lining. And that’s the fact that, in investing, time is on your side. Though high valuations generally have led to periods of declines, the index always has gone on to recover and gain. Bull markets and bear markets are normal investing phases, and even the darkest of days haven’t kept the index down permanently.

All of this means that if you invest in quality companies with solid financial positions and future prospects, you don’t have to worry about market downturns or crashes. You should even take this opportunity to get in on some great companies trading for bargain prices — and as you stay calm during those turbulent times, you could set yourself up to score a win over the long term.

Search

RECENT PRESS RELEASES

Related Post