These Stock Market Indicators Are Sounding the Alarm. Here’s What Investors Should Do Righ

February 8, 2026

There’s no better time to start preparing your portfolio for volatility.

Stock prices may be surging, but many investors are having mixed feelings about the market.

While nearly 40% of investors still feel optimistic about the next six months, according to the most recent weekly survey from the American Association of Individual Investors, roughly 30% worry that stock prices will fall in the coming months.

Nobody can predict the future, especially the short term. But there are a couple of warning signs investors may want to pay attention to right now — along with some steps to prepare for a potential downturn.

Image source: Getty Images.

Will the stock market crash in 2026?

There’s no way to predict what the market will do this year, but it can sometimes be helpful to use historical context to get a sense of what’s happened in similar circumstances. And there are two stock market metrics that have not-so-good news for investors.

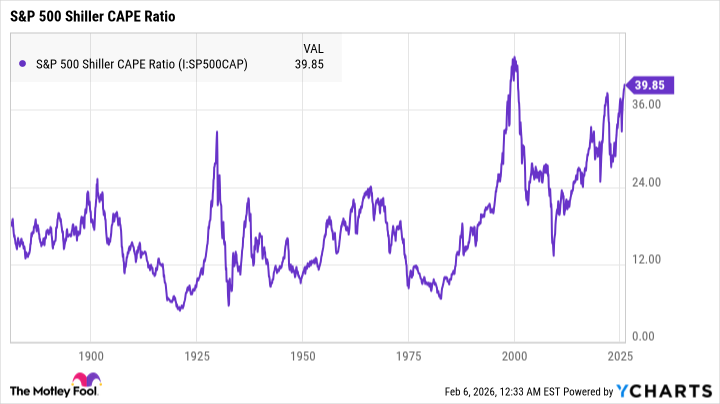

First, the S&P 500 Shiller CAPE (cyclically adjusted price-to-earnings) ratio. This metric is based on the average inflation-adjusted earnings over the last 10 years, and it’s commonly used to determine whether the S&P 500 is over- or undervalued. The higher the figure, the more overvalued the index may be.

Historically, the average Shiller CAPE ratio sits at around 17. As of February 2026, though, this metric is nearing 40. This is the second-highest value in history, next to the peak prior to the dot-com bubble in the early 2000s.

S&P 500 Shiller CAPE Ratio data by YCharts. CAPE Ratio = cyclically adjusted price-to-earnings ratio.

The second metric to watch is the Buffett indicator, which measures the ratio of U.S. gross domestic product (GDP) to the total market value of U.S. stocks. It was popularized by Warren Buffett, who explained in a 2001 interview with Fortune magazine how he used the metric to correctly predict the dot-com bubble burst.

“For me, the message of that chart is this: If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you,” he said. “If the ratio approaches 200% — as it did in 1999 and a part of 2000 — you are playing with fire.”

As of this writing, the Buffett indicator sits at 221%. The last time the metric neared 200% was in November 2021, just before stocks entered a bear market that would last nearly a year.

What should investors do right now?

No stock market metric is perfect, as past performance doesn’t predict future returns. Even if there are strong historical patterns suggesting a downturn could be looming, that doesn’t necessarily mean a crash, recession, or bear market is imminent.

Perhaps the best thing investors can do right now is ensure their portfolios are prepared for volatility, just in case. That involves double-checking that you’re only investing in stocks with strong fundamentals, such as:

- Healthy finances: A company needs to be on a solid financial footing to survive an economic downturn. Shaky companies can still thrive when the market is surging, so stock price alone isn’t necessarily a sign of financial health. Now is a good time to comb through financial statements to review metrics such as profitability, debt, revenue growth, and other factors that can indicate whether a company is likely to survive tough economic times.

- Competitive advantage: When the dot-com bubble burst in the early 2000s and much of the tech sector collapsed, the companies that survived were those that had a leg up over their peers. Organizations that didn’t offer anything unique or had nonviable business models crashed and burned, and the same could happen again if we face another significant downturn.

- A strong leadership team: Sometimes, a company’s survival depends on the decisions by leadership during pivotal moments. Even a strong business may struggle if the executive team consistently makes poor choices, making this a key factor for long-term success.

The stronger your portfolio, the more likely it is that it will survive even the worst bear market or recession. By double-checking all your investments now, you’ll be prepared no matter what may lie ahead.

Search

RECENT PRESS RELEASES

Related Post