Think You Missed Your Chance to Invest? It’s Not Too Late to Start Smart

November 1, 2025

The biggest step you can take with investing is to get started, and here’s a way you can do that without buying the expensive S&P 500 index.

The S&P 500 is hovering near all-time highs, which may make some worry that they’ve missed their chance to invest. That’s the wrong way to think about investing. You don’t build wealth in a day, a month, or even a year. It takes decades, and the best time to start your wealth journey is now.

Schwab US Dividend Equity ETF (SCHD +0.26%) could be a smart option. Here’s why.

What does Schwab US Dividend Equity ETF do?

This is an exchange-traded fund (ETF), buying whatever’s in the Dow Jones U.S. Dividend 100 Index. If you want to make a smart decision about Schwab US Dividend Equity ETF, you need to understand the index it tracks.

Image source: Getty Images.

The Dow Jones U.S. Dividend 100 index begins its selection process by limiting its options, only looking at companies that have 10 or more annual dividend increases behind them. Real estate investment trusts are excluded from consideration because of their corporate structure. This single step drastically reduces the number of stocks being considered and focuses the index on well-run companies. Indeed, it takes a fair bit of success to reach a decade of annual dividend hikes.

The index creates a composite score for each company listed. The score includes cash flow to total debt, return on equity, dividend yield, and a company’s five-year dividend growth rate. This is an interesting collection of factors, since they basically mean the index is trying to find well-run companies that are financially strong and that have large and growing dividends. That’s basically what most dividend investors are looking to do, too.

The 100 highest-ranked companies are included in the index using a market cap weighting. This ensures that the largest companies have the biggest impact on performance. The index is updated annually, so the portfolio will always contain the best stocks, according to the index’s methodology. You get all this for a very low expense ratio of 0.06%.

Why is Schwab US Dividend Equity ETF a smart choice today?

The first reason the ETF is a smart choice is fairly simple. As noted, it basically does what a dividend investor would do to build a portfolio stock by stock. In other words, this isn’t some esoteric investment approach that you can’t wrap your head around. It just makes your life easier because you get a diversified portfolio of dividend stocks with one quick purchase.

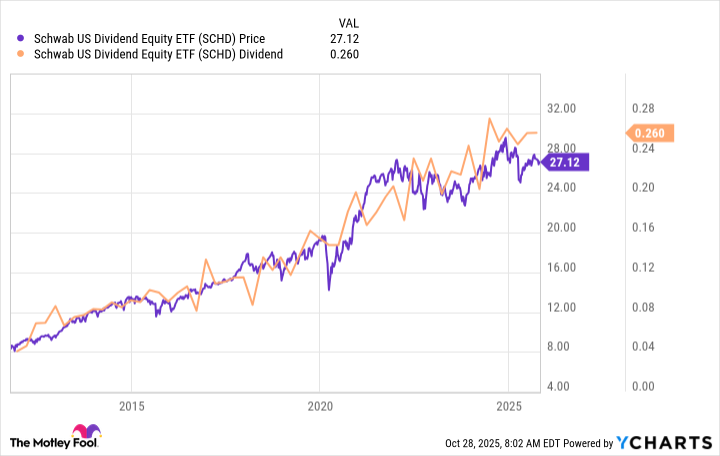

The second reason to like Schwab US Dividend Equity ETF is that it offers an attractive 3.8% dividend yield. This is well above the 1.2% of the S&P 500 index. Notably, over time, the dividend this ETF pays has trended generally higher along with the share price.

Schwab U.S. Dividend Equity ETF

Today’s Change

(0.26%) $0.07

Current Price

$26.75

That said, the third reason this ETF is a smart investment right now is that it is lagging the S&P 500 index. So far in 2025 the S&P is up around 17% while Schwab US Dividend Equity ETF has basically gone nowhere. In other words, the ETF hasn’t been experiencing the extreme exuberance (largely around a small number of tech stocks) that has been driving the broader market higher. Therefore, it might present a less worrying starting option than the S&P, as that index hovers near all-time highs.

Think long-term

What’s nice about Schwab US Dividend Equity ETF is that it isn’t a flash in the pan. It is built specifically to focus on good companies and to update its portfolio so it always owns the cream of the crop (based on its proprietary scoring system). So you can make one buying decision and just hold for the long term. Ideally, you’ll keep buying more of the ETF regularly, regardless of the market environment, so you can benefit from the wealth-building power of dollar-cost averaging.

Search

RECENT PRESS RELEASES

Related Post