This Analyst Still Thinks Apple Stock Is a Top Pick for 2026

January 13, 2026

/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

Apple Inc logo on Apple store-by PhillDanze via iStock

Apple (AAPL) hasn’t had a great start to the year, losing nearly 5% so far. But that hasn’t stopped analysts at Evercore ISI from calling AAPL stock their top hardware pick for 2026. The bullish catalysts sound familiar — strong product cycle and healthy consumer demand — but there’s one factor that investors desperately wanted to hear about: artificial intelligence (AI).

Apple’s Siri assistant is set to receive an AI upgrade, which has excited users around the world. This won’t be a small tweak, either. The company is carrying out a deeper integration of generative AI and striving to provide a better contextual understanding through its voice assistant. By doing so, it intends to compete with modern AI models like Gemini and ChatGPT.

While that seems far away, Apple does boast the largest user base in the world. By getting anywhere close to these models, and providing seamless access through its devices, the company could flip the game on its head and generate a huge untapped revenue source. At least that’s what the bullish thesis rides on, though previous delays in trying to perfect this technology have left investors wary.

About Apple Stock

Apple designs, manufactures and sells devices like smartphones, laptops, and tablets, among others. The company is based in Cupertino, California, but its users are present in almost every country in the world.

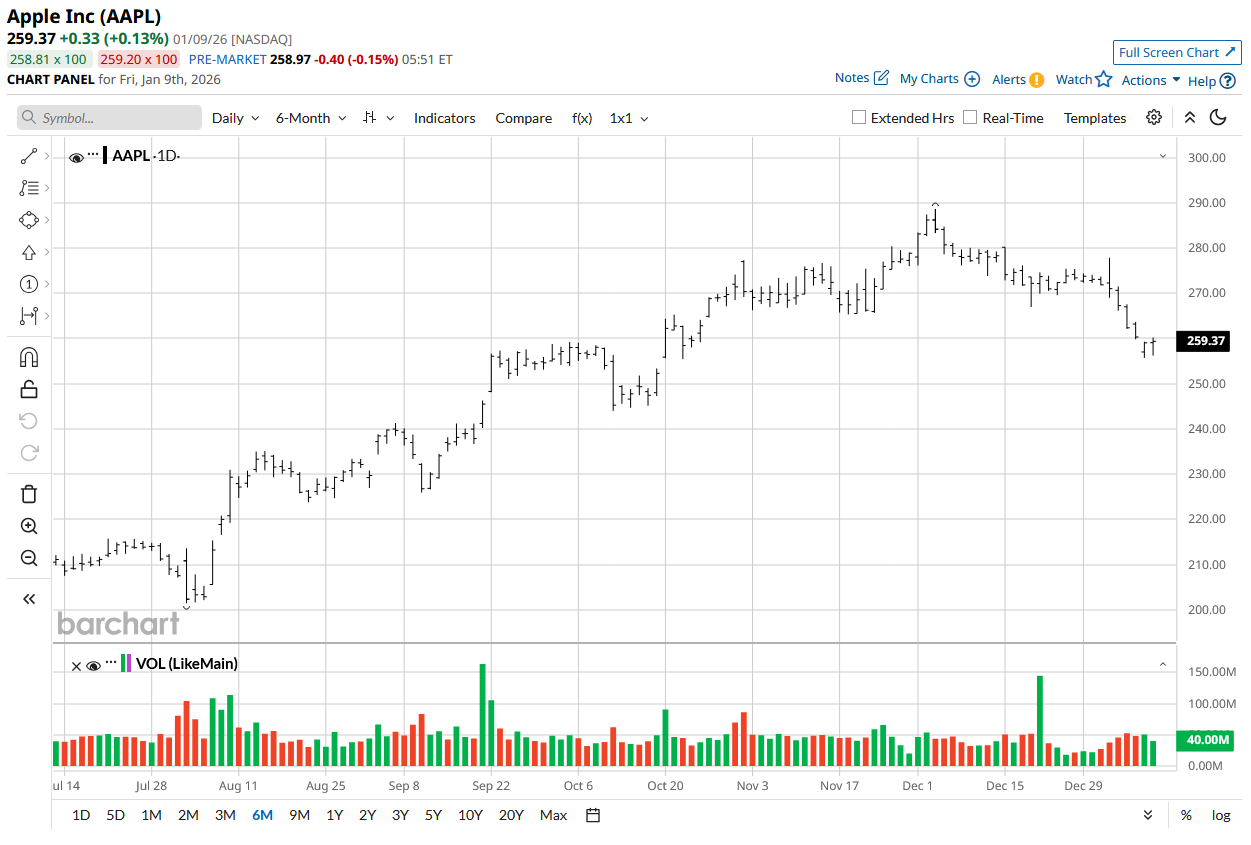

AAPL stock’s price has doubled over the past five years. Despite its size, the firm continues to deliver shareholder returns. However, AAPL underperformed in the last one year, registering only about half the gains of the S&P 500 Index ($SPX). In the last one month, AAPL stock is down nearly 7% while the S&P has gained almost 2%. This gives fresh entrants a good base to get in if they want to outperform the index in 2026, especially with the backdrop of Evercore’s bullish report.

Apple’s lack of flashy AI success has kept its valuation close to its historic levels. AAPL is trading at a forward price-to-earnings multiple of 31.9 times, which is expensive but only slightly higher than its five-year historic average. The forward price-to-sales and price-to-cash flow ratios are also trading at a similar reasonable premium. This could all change once the improved AI assistant comes out and investors start calling Apple an AI company. That sentiment could drive AAPL stock much higher.

Apple will announce its fiscal first-quarter earnings on Jan. 29, and investors will get more clarity on the Siri update, which is expected to launch in the spring.

Apple Beats EPS Estimates

Apple announced its Q4 2025 earnings on Oct 30. The company reported EPS of $1.85 for the quarter, which came in 7% higher than the estimated $1.73 per share. The company’s whopping $102.5 billion in revenue was driven largely by Products segment revenue, which clocked in at $73.7 billion. The Services segment brought in $28.8 billion. Despite negativity surrounding the lack of innovation in the iPhone, sales of the device were up 6% year-over-year (YOY).

CEO Tim Cook gladly added to the debate around iPhone 17, pinning its success on the quality of the product. Cook called it the strongest iPhone lineup ever built by the company, and the sales point to as much.

When asked about supply-chain issues, management said there was no issue in product ramp-up. The issues related to several iPhone 17 models were based purely on the high demand for the devices. As always, managment also received questions about AI. The company did point out that most of its operating expenses growth was due to investments in AI. However, skeptics continue to ask why the company isn’t yet leading in the artificial intelligence field.

What Are Analysts Saying About Apple Stock?

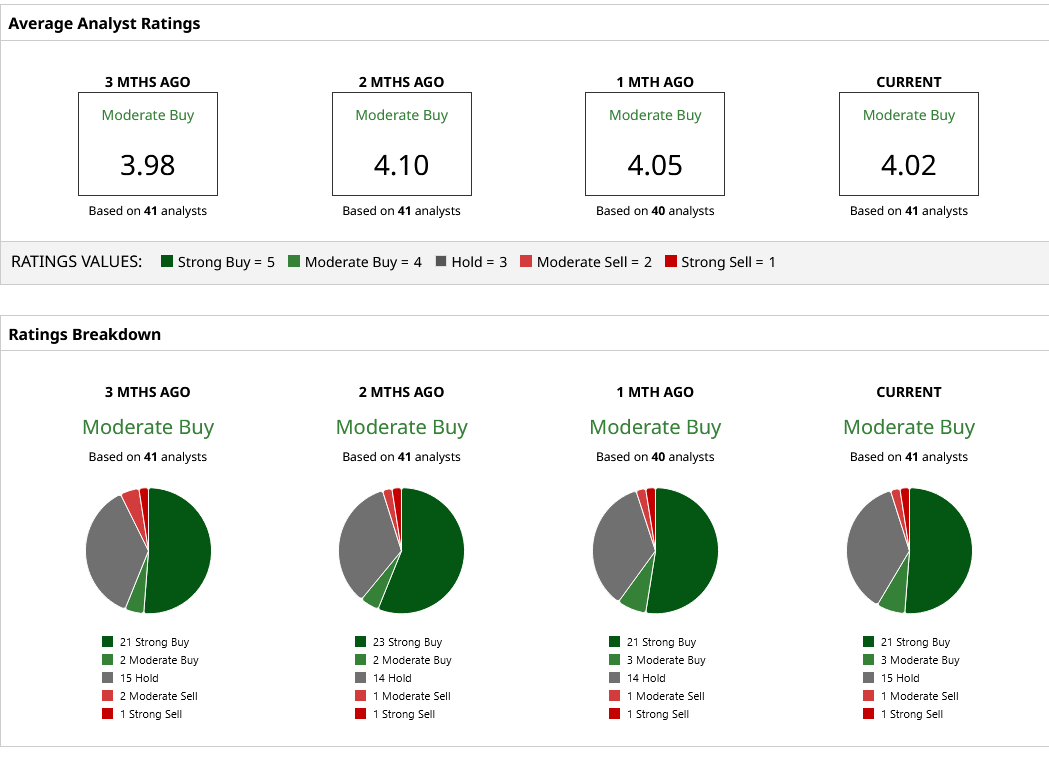

41 analysts cover AAPL stock on Wall Street, with half of them rating shares as a “Strong Buy.” AAPL also has its fair share of “Hold” ratings from 16 analysts. This isn’t surprising, as the iPhone maker often comes under criticism for its lack of innovation and disappointing upgrades. However, if Evercore’s report is anything to go by, 2026 could prove these analysts wrong and provide Apple’s next big rally.

Overall, AAPL stock has a consensus “Moderate Buy” rating and an average analyst price target of $289.61, implying about 11% potential upside from current levels.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Search

RECENT PRESS RELEASES

Related Post