This Overlooked Artificial Intelligence (AI) Stock Could Be a Long-Term Compounder

January 23, 2026

This high-quality business, unfortunately, trades at a lofty valuation.

Valued at over $500 billion, some may think it’s a stretch to call ASML (ASML 0.43%) an overlooked artificial intelligence (AI) stock. But it’s not a household name. By contrast, investors readily think of companies such as Nvidia, with AI hardware, and Alphabet, with AI software. And yet, without ASML, almost nothing in AI would be possible.

ASML makes lithography machines — machines that use extreme ultraviolet light to etch designs onto silicon wafers. This is the process for making most things in the semiconductor industry, and ASML is virtually the only shop in town.

Image source: Getty Images.

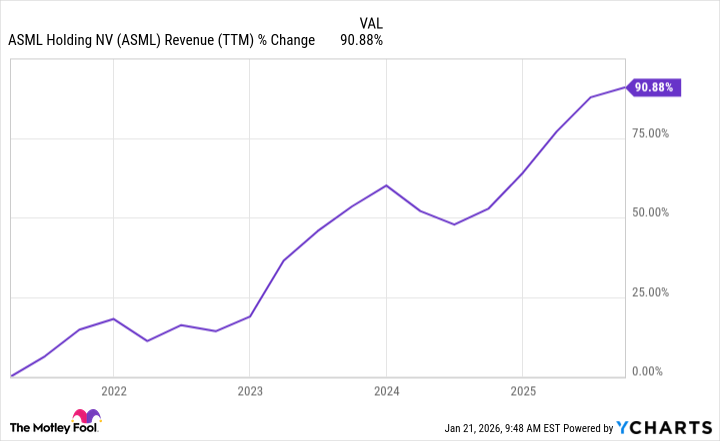

The boom in artificial intelligence has driven incredible revenue growth for ASML in recent years. Granted, growth can be bumpy at times because each machine it sells costs hundreds of millions of dollars, meaning that selling a couple more or a couple less can have a huge impact on financial results. But the general trend has been up.

Data by YCharts.

Having a stranglehold on the market has its advantages. ASML enjoys stellar financial metrics, including an operating margin of nearly 35%. In short, the business is incredibly profitable. This gives it incredibly favorable numbers for metrics such as return on equity (53%) and return on invested capital (43%).

Moreover, ASML’s management has used its favorable business results to build a very strong balance sheet. The company is based in the Netherlands, so its numbers are reported in euros. As of its fiscal third quarter of 2025, it had 5.1 billion euros in cash and cash equivalents, compared with just 2.7 billion euros in long-term debt.

Today’s Change

(-0.43%) $-5.96

Current Price

$1389.04

Investors are often encouraged to buy high-quality businesses. For those wondering, ASML fits that description. It has a defensible position in a high-growth industry, which has driven revenue growth, strong profit margins, and a great balance sheet. In other words, ASML is a high-quality business.

But is ASML stock a buy?

The only hangup with ASML stock today is its valuation. It trades at over 50 times earnings, which is a pricey level unless it can achieve remarkable long-term earnings growth.

To be sure, ASML is a long-term compounder. Therefore, I believe it will achieve at least some earnings growth. The aforementioned return on invested capital shows that when management spends money to grow the business, it pays off. And right now, management is investing to nearly double its revenue by 2030.

ASML’s profits should be up by a greater amount if things go according to plan. The company has a gross margin of 52%, but management hopes to push this up to 60% by 2030. And management will reward shareholders through stock buybacks and dividends.

In conclusion, ASML is a high-quality, long-term compounder. I believe it will make investors money over the next five years, but a pricey valuation may limit some of its potential upside.

Search

RECENT PRESS RELEASES

Related Post