This Washington-Based Company Could Be a Smart Buy for Growth Investors

November 1, 2025

One important metric is up by 25%, and it’s pointing to higher profits in coming years.

From a garage in Bellevue, Washington, in 1995, Jeff Bezos started Amazon (AMZN +9.77%). Now, 30 years later, this tech giant still calls the Evergreen State home. And you may be surprised to know that the stock could still be a smart buy today.

Amazon stock tends to be an evergreen idea for good reason: It’s a really important company, and everyone would notice if it suddenly went missing. With over $100 billion in quarterly net sales in North America, people would immediately wonder where their shipment from Amazon was if workers took the day off.

It was in the news for the wrong reasons on Oct. 20 after its cloud-computing arm Amazon Web Services (AWS) had an outage that caused internet platforms to go down around the world. That’s bad. But again, consider how important Amazon is to the entire world: When AWS stopped working properly, everyone immediately knew about it.

It was almost always a good time to be buying the stock while it was building itself into the company it is today. Investors might think that now, it’s too big to grow, and it’s consequently too late to invest. But there’s a good reason to like the stock here today.

Why Amazon stock is still a good buy

As alluded to, the company’s core businesses enjoy incessantly strong demand. And that’s good because investors can count on it. As founder and former CEO Jeff Bezos once said:

I very frequently get the question: “What’s going to change in the next 10 years”…I almost never get the question: “What’s not going to change in the next 10 years?” And I submit to you that that second question is actually the more important of the two.

Amazon

Today’s Change

(9.77%) $21.77

Current Price

$244.63

Over the next 10 years, I believe e-commerce will still be important, as will cloud computing. So I’m confident that Amazon will remain a great business.

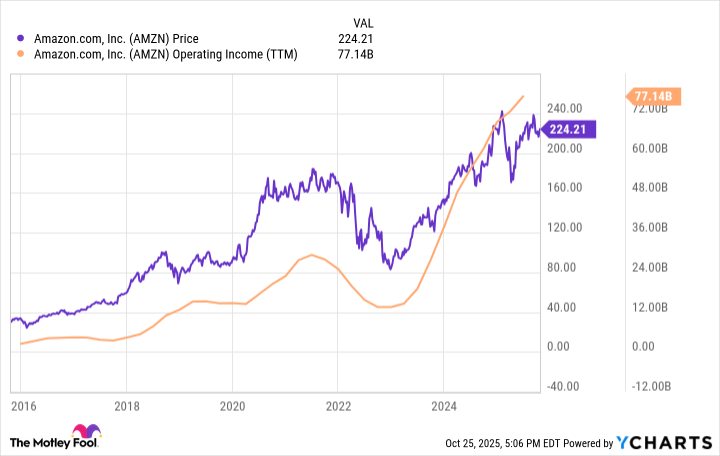

Moreover, it still looks attractive from a growth perspective. AWS generates most of the company’s operating income — 69% in the second quarter of 2025. And historically, operating income is what drives this stock higher, as the chart below shows.

Therefore, if the company can grow AWS revenue, it stands to reason that it will grow its operating income. And if it grows its operating income, the stock price will likely respond favorably. That’s why stocks go up over the long term in general, but Amazon’s chart shows the correlation more clearly than most.

AWS is enjoying a surge in demand due to generative AI applications. In the second-quarter earnings call, CEO Andy Jassy said that the segment has, “More demand than we have supplied for at the moment.” That’s a good sign.

It shows up in Amazon’s backlog as well. At the end of the second quarter, the company had performance obligations of $195 billion, which mostly relate to AWS. This is up nearly 25% from the same period of 2024 and up 10% just from the start of the year.

Clearly the trends point to ongoing strong growth in coming years for AWS. And that’s a good thing for its future profit potential.

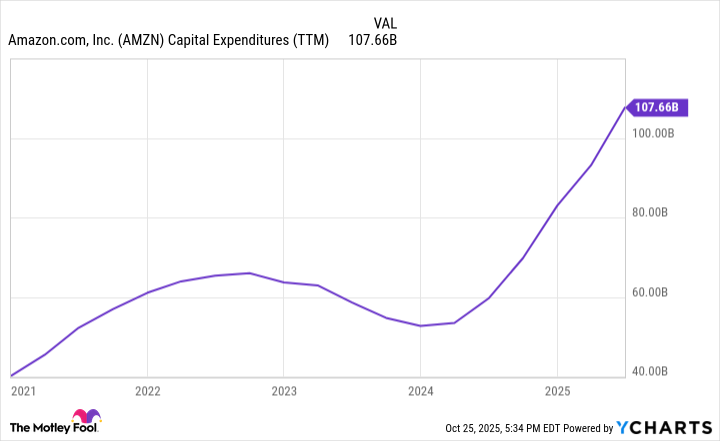

One thing to keep in mind here is that profits for some cloud-computing businesses are plunging as AI drives demand higher. The reason is that companies have to spend a lot of money to have enough computing power to run the AI workloads.

Along those same lines, Amazon’s capital expenditures (capex) are surging higher. They aren’t all related to AI, but it’s certainly a large component.

However, management had some encouraging things to say about this in the second-quarter earnings call. It had $31 billion in capex during the quarter. But that’s about what it expects to spend in the upcoming quarters as well.

In other words, it’s spending money to meet the surging demand for AI applications, but expenditures don’t appear to be accelerating out of control.

In conclusion, Amazon’s business is seeing plenty of healthy demand, and its profits are poised to continue heading higher, thanks to ongoing growth in AWS. This Washington-based company has already experienced a lot of success these 30 years. But its growth trajectory doesn’t appear to be done yet.

Search

RECENT PRESS RELEASES

Related Post