TotalEnergies (ENXTPA:TTE): Evaluating Valuation Following 15-Year Google Renewable Energy

November 15, 2025

TotalEnergies (ENXTPA:TTE) just inked a 15-year deal to supply Google with renewable energy from its Montpelier solar farm in Ohio. The agreement will provide power for the tech giant’s fast-growing data center operations.

See our latest analysis for TotalEnergies.

Momentum has picked up for TotalEnergies in recent weeks, with a 7% share price return over the past month and steady gains since striking major renewable supply deals with tech and data center customers. While the past year’s total shareholder return sits at 3.9%, long-term holders have seen the company deliver over 120% in returns over five years. This reflects an ability to balance both legacy operations and newer growth initiatives.

If TotalEnergies’ expanding reach into renewables has you thinking bigger, now’s a great moment to discover fast growing stocks with high insider ownership

With shares not far below analyst price targets and a robust track record of value creation, the key question now is whether TotalEnergies presents a buying opportunity or if the market is already accounting for future growth in its current price.

Advertisement

Most Popular Narrative: 7.8% Undervalued

With TotalEnergies closing at €56.23 versus a narrative fair value of €60.96, analysts see more upside potential based on future cash flow resilience. The setup depends on how expansion in renewables and disciplined capital allocation might unlock new value.

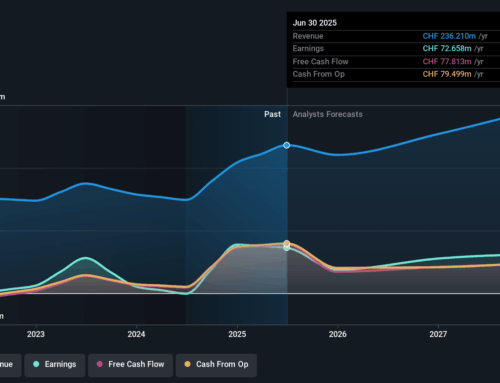

TotalEnergies is aggressively scaling its renewables and Integrated Power division, with significant increases in renewable power generation and value-accretive farm-downs. This strategy increases exposure to regulated, stable cash flows as electricity demand rises with electrification, suggesting there may be room for long-term improvement in net margins and recurring revenues.

Curious about the building blocks behind that higher price target? The fair value relies on rising recurring revenues and future margin expansion, all incorporated into the latest forecast. Does the logic hold up under scrutiny? Only the full narrative reveals the numbers behind the optimism people are talking about.

Result: Fair Value of $60.96 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent oil market oversupply or intensified global decarbonization policies could quickly put pressure on TotalEnergies’ revenues and margins, which could challenge current optimism.

Find out about the key risks to this TotalEnergies narrative.

Build Your Own TotalEnergies Narrative

If you want to challenge the consensus or trust your own research, it takes just a few minutes to assemble your own story, so why not Do it your way

A great starting point for your TotalEnergies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Standout Stock Ideas?

Don’t let a single opportunity pass you by. The market is packed with innovative companies. Here’s your chance to zero in on tomorrow’s winners before the crowd catches on.

- Tap into strong income streams. Check out these 16 dividend stocks with yields > 3% offering healthy yields and robust financials for consistent returns.

- Spot the future leaders in advanced medicine with these 32 healthcare AI stocks making breakthroughs in healthcare technology and artificial intelligence.

- Unlock undervalued gems by assessing these 885 undervalued stocks based on cash flows poised to benefit from resilient cash flows and potential market mispricings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if TotalEnergies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post