Trump Killed Solar In Hawaiʻi. The Legislature Must Act Now

November 6, 2025

The sun still shines brilliantly today here on Hawaiʻi island, but a dark cloud now looms over our state’s clean energy future. On July 4, President Trump signed his big budget bill into law, abruptly terminating the 30% federal solar tax credit — nine years ahead of schedule, along with many other green energy tax credits.

For Hawaiʻi, already burdened with the nation’s highest electricity rates, this could not have come at a worse time. The impact will be devastating. Without immediate action from our state Legislature, Hawaiʻi’s solar industry faces a bloodbath next year, families will remain trapped paying HECO’s sky-high rates, and our ambitious clean energy goals will slip further out of reach.

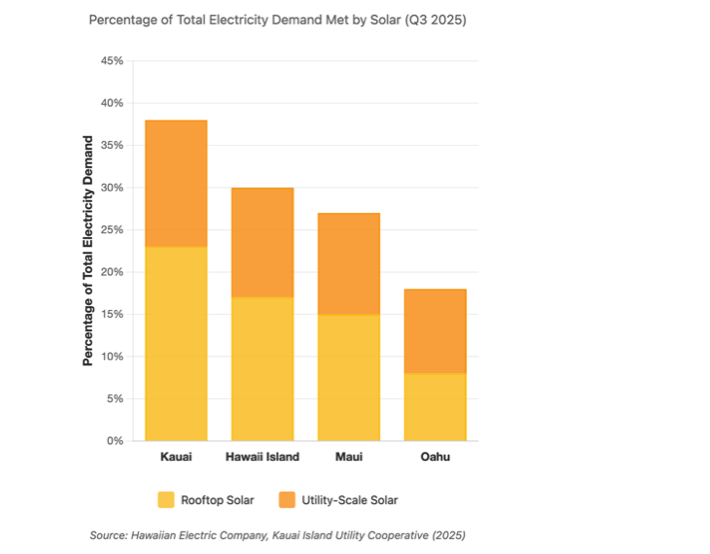

The chart shows how much solar each island currently has installed, combining utility-scale solar and rooftop solar — providing almost 1/3 of the state’s total electricity demand.

Ideas showcases stories, opinion and analysis about Hawaiʻi, from the state’s sharpest thinkers, to stretch our collective thinking about a problem or an issue. Email news@civilbeat.org to submit an idea or an essay.

Let me be clear about what this means for ordinary Hawaiʻi residents. Right now, Hawaiian Electric Co. customers on Oʻahu pay approximately 43 cents per kilowatt hour — more than 2.5 times the national average of 16 cents. Here on Hawaiʻi island, rates are even worse in some areas. These are not just statistics; they represent real financial pain for working families already struggling with Hawaiʻi’s crushing cost of living.

Solar has been the escape hatch. Combined with Hawaiʻi’s 35% state tax credit (capped at $5,000), the federal credit made solar affordable for middle-class families. A typical $15,000 system would cost just $5,700 after both credits — a reasonable investment that would free families from HECO’s monopoly pricing for decades.

Starting Jan. 1, 2026, that same system will cost $10,000 — an 75% increase in out-of-pocket costs. For many families, that difference means the difference between going solar and remaining captive to utility rates that continue their relentless climb.

The human cost extends far beyond individual households. Hawaiʻi’s solar industry employs thousands of skilled workers — installers, electricians, project managers, sales professionals — most of them local residents with families to support. These are good jobs, often paying well above minimum wage, in a state desperately short of quality employment opportunities.

The industry is already bracing for impact. Solar installers across the state report application numbers surging as homeowners race to beat the Dec. 31 deadline. But industry leaders I’ve spoken with are unanimous in their outlook for 2026 and beyond: expect massive layoffs, business closures, and an exodus of talent from the state.

Rocky Mould, executive director of the Hawaii Solar Energy Association, put it bluntly when the legislation was being debated: without the federal credit, the impact would hit the industry like a “sledgehammer.”

He was right. Smaller solar companies that lack diverse revenue streams may not survive at all. Even larger firms are already planning for significant workforce reductions.

This is economic devastation by policy choice. And it’s entirely preventable.

Hawaiʻi has set the nation’s most ambitious renewable energy goal: 100% clean electricity by 2045. Rooftop solar, combined with battery storage, is absolutely essential to reaching that target. Every home that goes solar reduces stress on the grid, eliminates fossil fuel consumption, and moves us closer to true energy independence.

The economics of this transition have always been challenging given our isolation and dependence on imported oil. The federal tax credit wasn’t a subsidy to rich homeowners — it was a strategic investment in breaking our dangerous addiction to imported fossil fuels. Hawaiʻi currently imports virtually all of our petroleum, sending billions of dollars out of state annually while enriching hostile regimes and contributing to climate change.

Without aggressive support for distributed solar, we will remain dangerously dependent on fossil fuels for far longer than necessary. Every year of delay means more carbon emissions, more money flowing to oil exporters, and greater vulnerability to supply disruptions. The recent surge in applications before the federal credit expires proves that financial incentives work — they change behavior and drive adoption at scale.

Here’s what our state Legislature must do when it convenes in January:

First, absolutely protect and preserve Hawaiʻi’s 35% state solar tax credit. There have been disturbing rumblings about reducing or eliminating this credit, including House Bill 1369 introduced earlier this year that would have repealed it outright. Such proposals must be rejected completely. With the federal credit gone, the state credit becomes even more critical. The Legislature should actually consider increasing it to partially offset the federal loss.

Every year of delay means more carbon emissions.

Second, reinstate and expand a direct rebate program for low and middle-income households, funded by the barrel tax. The environmental response, energy, and food security tax currently generates roughly $27 million annually. A portion of these funds — perhaps $10 million per year — should be allocated to provide direct rebates of $3,000-$5,000 for households earning below 140% of area median income.

Unlike tax credits, which only help those with tax liability, direct rebates would make solar accessible to renters and lower-income families who need relief from high energy costs most desperately.

Third, further streamline permitting and interconnection processes. If financial incentives become less generous, we must make up ground by reducing bureaucratic friction and delays that add unnecessary costs to every installation.

The barrel tax funding mechanism is particularly appropriate. We’re literally taxing the problem — fossil fuel imports — to fund the solution: clean energy adoption. It’s elegant policy that creates a virtuous cycle while we still rely on petroleum. As solar adoption grows and gasoline use declines, the barrel tax revenues will naturally diminish, but by then we’ll have built substantial renewable capacity.

Some legislators may balk at “subsidizing” solar installations during tight budget times. This framing is backwards. Supporting residential solar is an investment in energy infrastructure with a guaranteed return.

Every kilowatt of solar capacity we install today is a kilowatt we won’t need to generate from expensive imported oil tomorrow. It’s infrastructure development that happens at no cost to taxpayers — in fact, homeowners pay the capital costs and taxpayers simply share in the savings through reduced energy imports.

Moreover, the economic multiplier effects are substantial. Solar installation creates local jobs, keeps energy dollars circulating in Hawaiʻi’s economy rather than flowing to Texas or Saudi Arabia, and reduces the long-term electricity costs that burden both households and businesses. These benefits far exceed the foregone tax revenue from credits.

The choice is ours. The federal government has abandoned Hawaiʻi families and our clean energy future. Our state Legislature must not make the same mistake.

The sun rises every morning over our beautiful islands. The question is whether we’ll have the political will to harness its power for all of our people, or whether we’ll remain trapped in an expensive fossil fuel past that benefits only utility shareholders and oil companies.

Search

RECENT PRESS RELEASES

Related Post