Trump’s first 100 days: Clean energy supply chains upended across Southeast Asia | NEWS

April 28, 2025

U.S. President Donald Trump signs an executive order pledging to boost the U.S. clean coal industry. (Photo: Trump’s social media platform)

As U.S. President Donald Trump marked his first 100 days back in office on April 30, he had already signed more than 100 executive orders—aggressively dismantling his predecessor’s policies and unleashing a tariff shockwave that rattled global trade markets. His dismissive stance on climate change has also fueled a brewing backlash against ESG initiatives.

In our special series, “Trump’s First 100 Days,” RECCESSARY explores the far-reaching impact of Trump’s tariff agenda, climate policies, and corporate strategies, offering an in-depth look at how the renewable energy sector is bracing for disruption.

Clean energy takes a hit as tariffs drive up fossil fuel costs

Trump’s “reciprocal tariffs” have jolted global markets, putting the clean energy sector under growing strain. As supply chains struggle to adapt overnight, industries like battery production, electric vehicles (EVs), and solar energy are expected to be hit hardest—particularly in ASEAN countries now navigating a critical phase of energy transition.

According to Time magazine, many components essential to U.S. clean energy industries—such as critical minerals and semiconductors for EVs—depend heavily on imports. The newly imposed tariffs are poised to drive up costs across the sector.

The U.S. Energy Information Administration (EIA) projects an 18.2 GW increase in utility-scale storage demand by 2025, setting new records. Yet with most lithium batteries sourced from China, tariffs are expected to further inflate costs for American firms.

Bentley Allan, Associate Professor at Johns Hopkins University and Co-Director of the Net Zero Industrial Policy Lab, warns that developing a fully domestic battery or solar supply chain will take years of building expertise. Higher tariffs, he cautioned, may backfire by stoking fear across the market.

Adding to the pressure, Trump has slapped 25% tariffs on imported steel and aluminum—key materials used in fossil fuel industries—raising energy costs across states like Michigan, Minnesota, and New York, which rely heavily on Canadian energy imports.

Michael Mehling, Deputy Director of MIT’s Center for Energy and Environmental Policy Research, pointed out that tariffs not only boost import costs but also create broader inflationary spillovers throughout the economy.

Tariffs hit Southeast Asia’s clean energy exports, supply chains face shake-up

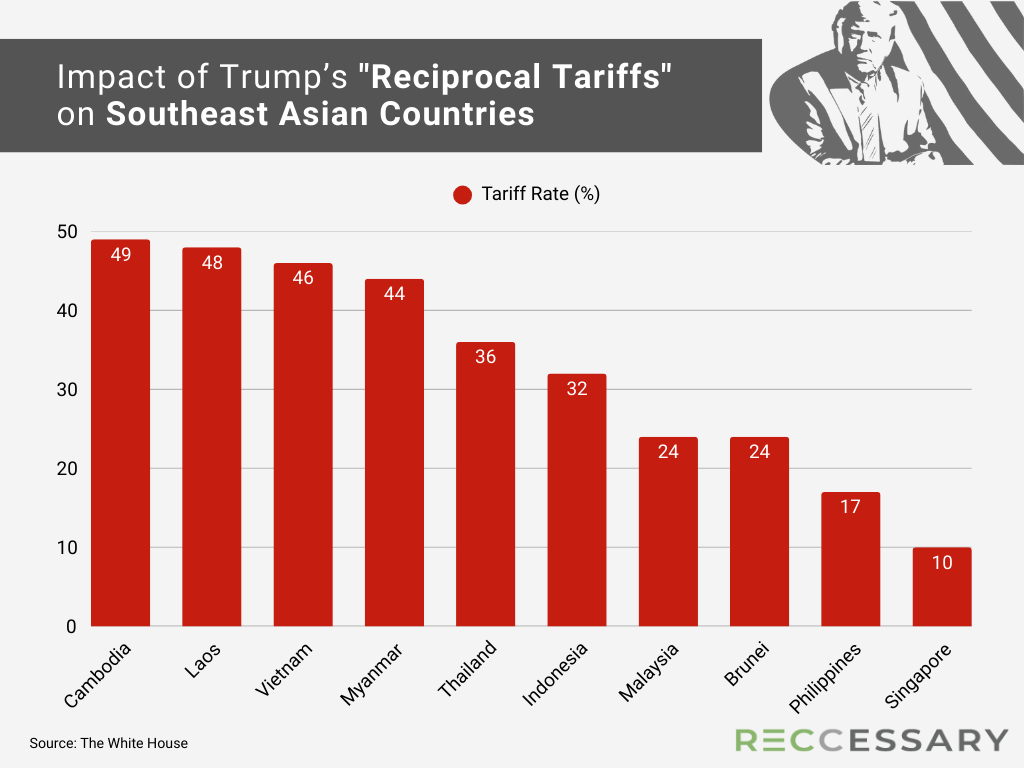

Trump’s tariff blitz, framed as a push to shrink the U.S. trade deficit and revive domestic manufacturing, has particularly targeted ASEAN countries, with tariff rates ranging from 10% to 49%. Although a temporary reprieve exempted non-China countries, the threat looms large after the 90-day grace period.

Read more: U.S. to imposes record-high tariffs on solar imports from Southeast Asia

Data from BloombergNEF (BNEF) reveals that the U.S. is a major destination for clean energy exports from Asia, with Thailand and Cambodia each sending over 9% of their exports to the U.S., alongside South Korea. Malaysia and Vietnam also rank among the top exporters, underscoring ASEAN’s heavy reliance on the American market.

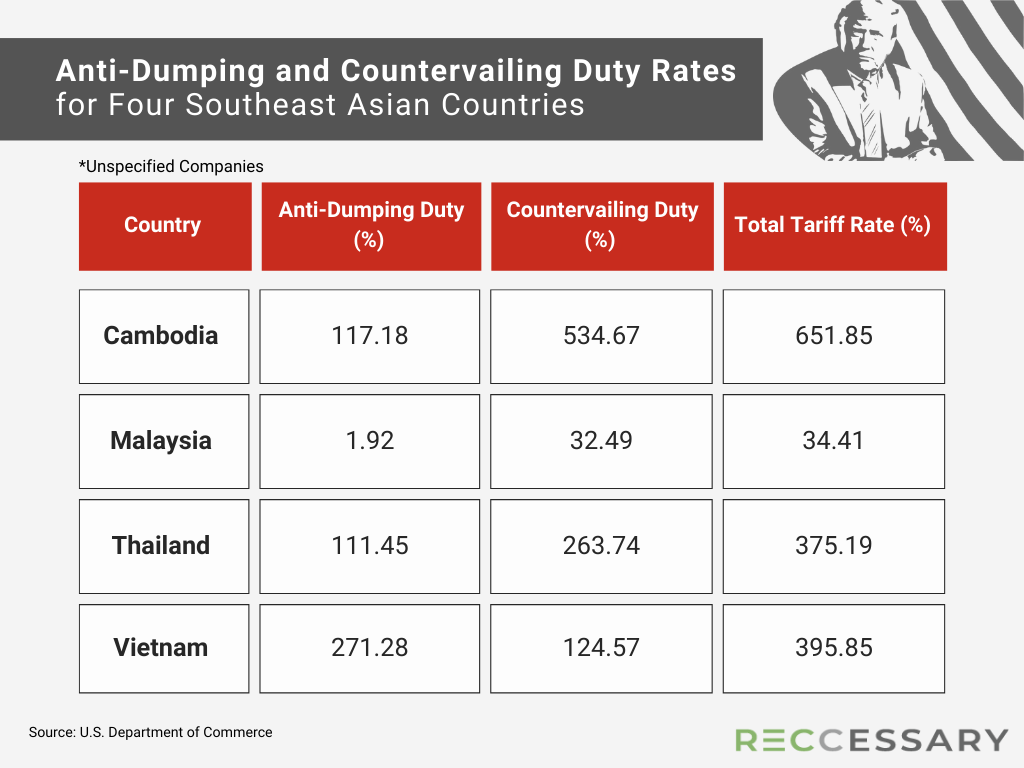

Solar manufacturers, already under scrutiny for “origin laundering,” face the most severe impact. On April 21, the U.S. Department of Commerce finalized steep anti-dumping and countervailing duties on solar cells from Cambodia, Malaysia, Vietnam, and Thailand, with rates reaching up to 3,521.14%—a level described as “unprecedented” by Tim Brightbill, legal counsel for the American firms that petitioned for the investigation.

Supply chain reconfiguration: India and the Middle East rise

Canadian solar module maker Heliene, which operates a factory in Minnesota, is already feeling the pain. CEO Martin Pochtaruk stated that tariffs could add $3–4 million in monthly costs for solar cells imported from Laos if Trump’s plan moves forward.

In response, Heliene is eyeing India as an alternative sourcing hub, given its lower tariffs compared to Southeast Asia. India’s government recently launched a $1 billion subsidy plan to bolster its still-nascent solar manufacturing sector.

Beyond India, Taiwan’s InfoLink Consulting notes that Indonesia’s solar products also show strong competitive potential. BNEF analyst Felix Kosasih suggests the tariffs could even prompt a full supply chain exodus from Southeast Asia toward lower-cost regions like the Middle East.

Read more: Trump’s tariffs threaten Southeast Asia’s role in global clean energy supply chain

The tariff impact extends beyond solar. The U.S. imports EV battery products from Thailand and Malaysia, meaning supply chain shifts could ripple across multiple industries, forcing manufacturers to adapt to new markets and accept tighter margins.

Fang Eu-Lin, Head of Sustainability and Climate Change at PwC Singapore, emphasized that while ASEAN exporters face immediate shocks, recovery efforts will take time as firms recalibrate.

Southeast Asia eyes closer ties with China amid energy transition

Despite the turbulence, ASEAN’s energy transition is inevitable. Veteran climate journalist Kamyar Razavi argues that with China’s solar panel capacity now twice the rest of the world combined, ASEAN countries have an opportunity to leverage China’s scale to accelerate their low-carbon shift.

OCBC ESG analyst Ong Shu Yi echoed this sentiment, noting that U.S. trade restrictions could divert Chinese exports to fast-growing renewable energy markets like Malaysia and Thailand—deepening China-ASEAN industrial ties.

With mounting tariff pressure, some businesses are pivoting towards ASEAN markets to capitalize on cost and proximity advantages, further accelerating regional energy transition. Johan Sulaeman, professor at the National University of Singapore Business School, stressed the urgent need for ASEAN coordination to manage surplus capacity and solidify regional integration.

However, major hurdles remain. Sulaeman warned that local-content policies designed to protect domestic industries could hinder intra-ASEAN clean energy trade. Moreover, the ASEAN Power Grid (APG) remains fragmented, with cross-border electricity trade largely bilateral rather than fully regional.

Razavi also highlighted political barriers, citing Indonesia’s coal lobby as an example. Despite China’s dominance in global solar production, Indonesia’s energy strategy remains tethered to coal and critical mineral development like nickel, showing that political factors still heavily influence emerging market energy paths.

Uncertain times, but long-term climate goals remain

Trump’s erratic policy swings—announcing tariffs one day, suspending them the next—underscore the unpredictability of his administration. Yet the global trajectory toward sustainability and decarbonization remains unchanged. Short-term shocks, paradoxically, may create new investment opportunities.

For ASEAN’s small- and medium-sized enterprises (SMEs) now embarking on their energy transition journeys, today’s disruptions offer a chance to rethink strategies and position themselves for success in a post-Trump era.

Sources: Time, Nikkei Asia, Bloomberg, Business Times, SEMAFOR

※ RECCESSARY’s “Trump’s First 100 Days” special series brings you three in-depth articles, released daily, tracking Trump’s impact on the renewable energy sector.

Search

RECENT PRESS RELEASES

Related Post

.jpg)