Truth, Lies, and Hype: Sorting Through the Messaging Around Real Estate Investing

December 17, 2025

Did you know that our White Coat Investors Facebook Group has more than 99,000 members? Or that The White Coat Investor group on Reddit is active, fun, and informative? So many doctors and other high earners need a place where they can get social, ask and answer questions from their colleagues, and be inspired by others who are taking a similar financial journey. Come join us on Facebook and Reddit today and be part of our community!

I find myself in a very interesting place in the investing world where I get flak from real estate investors for “not understanding just how awesome real estate investing is,” while still getting flak from more traditional investors for investing in real estate—while also talking about and teaching about real estate. Like with politics, that’s probably a good sign. When you’re getting flak from both sides, you’ve probably struck the right balance.

Let’s talk about some of that balance today.

Real Estate Is a Second Job

The anti-real estate folks like to say that real estate is a second job. The real estate folks say, “Nah, it’s super easy and pretty darn passive income.” The truth is somewhere in the middle. If the default investing solution is to stick 20% of your gross income into index funds once a month (or even automate the process), then YES, real estate investing absolutely is going to take more work than that. But real estate investing is a spectrum, and you can choose your level of passivity. It ranges all the way from just automatically plopping money into a real estate index fund once a month to digging the hole yourself in which you’re going to build a house.

But there’s plenty of stuff in between. Like turnkey properties. You don’t ever have to even see the property you own across the country, and one hour a month is a reasonable expectation of time to spend on it. Or you could go with a private real estate fund. Yes, there’s some upfront due diligence required and the wiring of money to do, but after that, it’s basically mailbox money. I don’t even have to read the periodic emails that are sent out if I don’t want. A “second job” isn’t quite the right description for that, even if it is more work than maintaining a portfolio of index funds.

There Will Be 3am Toilet Calls

This is another favorite of the anti-real estate folks. Real estate aficionados view that statement as the primary sign of someone ignorant about how real estate really works because most of them have never had a 3am toilet call. They just don’t happen. And besides, if you’re serious about real estate, you’ve probably outsourced your management by the time you’ve got a handful of properties. If it happens, that 3am toilet call isn’t coming to you anyway.

But investing in direct real estate IS a little like being on call for an ED as a dermatologist. You’re not going to get called very often, but the possibility of it happening is always hanging over your head (kind of like that overseas deployment starting in 24 hours that I received in the military on a Friday night at 9pm while moonlighting).

More information here:

How to Start Investing in Real Estate

Why Is There So Much Hype in Real Estate Investing?

Huge Tax Breaks

The real estate folks love talking about huge tax breaks. However, most of the best tax breaks in real estate require a pretty serious commitment to the field. They’re just not happening for regular Joe and Jane with their accidental rental property. For example, Real Estate Professional Status (REPS) and the Short-Term Rental (STR) loophole allow one to use depreciation to offset a physician’s earned income. But REPS also requires you to either talk your spouse into being a real estate pro or cutting back on medicine AND working for 750 hours a year in real estate. That really is a second job.

Depreciation-protected income can be pretty awesome, too, but it’s truly only a tax deferral unless you’re willing to commit to holding real estate until your death. Again, it’s a major commitment for an investment.

The real estate folks tend to gloss over just how much of a pain it is to deal with a single Schedule E, much less a dozen of them. And 20+ K-1s are enough to drive even the most hardcore DIY tax preparer into the arms of a $10,000-a-year tax firm as they try to sort out which states they’ll be filing taxes in this year. Below a certain level of wealth, the additional cost and hassle of tax prep is eating up a pretty significant portion of any excess returns generated.

That said, depreciation-sheltered real estate income can be a far bigger tax break than that lower qualified dividend tax rate and $3,000 of losses a year from tax-loss harvesting. Ignore it at your peril.

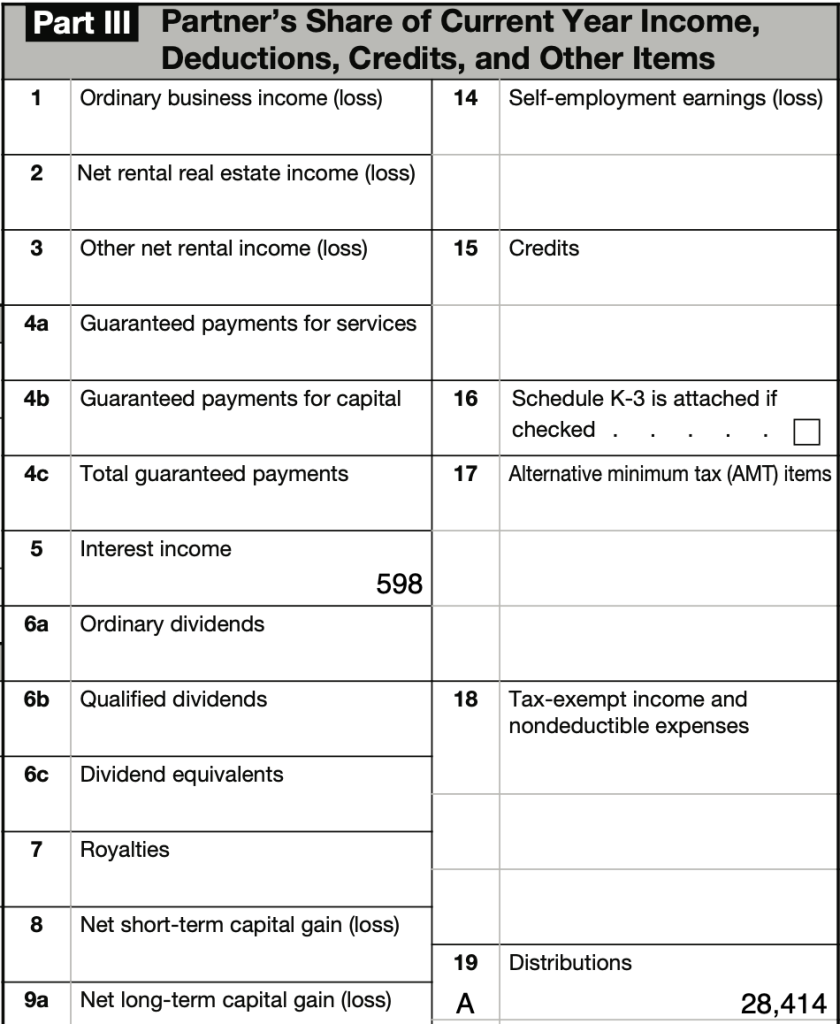

Here’s my 2024 K-1 from blog sponsor DLP’s Housing Fund.

Let me interpret this for those of you not used to looking at K-1s. The fund sent me (well, technically, I reinvested) $28,414, but I only paid tax on $598. And that doesn’t include another $6,083 of appreciation during 2024, which I also have not yet been taxed on and won’t be until I exit this investment (if I exit it before death, that is).

The Stock Market Is a Casino

Real estate fans love to point out volatility on the stock market as some sort of bad thing. But the truth is that the only reason stocks seem more volatile than real estate is because they’re marked to market every day (actually, every few seconds while markets are open). Real estate investments can be just as volatile once you do that. Don’t believe me? Put them on the market. A real estate index fund goes up and down in price at least as much as any other stock index fund. Liquidity and volatility are a feature, not a bug. It’s just more hidden in the private real estate world.

More information here:

The 60+ Worst Mistakes You Can Make in Real Estate Investing

Diversification Always Matters (My Syndicated Investment Goes to Zero)

Stocks Are Paper

They also love to say that stocks are just “paper assets” and that real investments can be touched and felt and walked around. But talk to anyone who has ever worked for a publicly traded corporation about how real their business (and your investment) is. It isn’t paper. Thousands of people go to work there every day in real factories and real dealerships and real gas stations and real grocery stores and make real products and provide real services to real people. This demonstrates just as much ignorance to an informed stock investor as talking about 3am toilet calls does to an informed real estate investor.

Other People’s Money

Real estate investors typically use more leverage than stock investors, although many publicly traded corporations have substantial debt levels as well. The verbiage around this can get ridiculous at times, though. I roll my eyes every time I hear the term “other people’s money.” No matter how much debt you use to purchase an investment, you still own the entire thing. When it falls in price, you own the entire loss, and vice versa. When you’re investing with borrowed money—whether in real estate, stocks, or anything else—it would behoove you to chart a moderate course. Too much leverage will get you in trouble eventually, as will lousy terms. But if you put 40% down on a property, you’re pretty darn insulated from financial catastrophe.

Infinite Returns

Another stupid phrase I’ve written about before is “infinite returns,” which real estate investors use to describe their investment once they’ve pulled an amount equal to the original principal out of their investment. Give me a break. I think index fund investors should start doing this. Go ahead. Put $100,000 into an index fund. Next year, when it’s worth $112,000 or $104,000, pull your original $100,000 back out, put it into another index fund, and then start referring to that $4,000-$12,000 left behind as “infinite returns.” Using that phrase just tells me you don’t know how to honestly calculate an investment return.

More information here:

A Tale of 2 Sponsors: How My Real Estate Investments Have Had Vastly Different Results

You Can Dial Back Real Estate Risk

Syndications Are a Scam

I hear this one, too. Someone knows someone who lost principal in a private real estate deal, and they generalize it to every private real estate deal. Every private business, including every private syndication, is unique and must be evaluated on its own terms. There’s a reason you have to be an accredited investor to invest in them. You really do need to 1) be able to evaluate it for investment potential without the assistance of an advisor, attorney, or accountant, and 2) be able to lose your entire investment without it affecting your financial life.

But don’t kid yourself that every syndication has crummy returns. Lots of them do fine or even awesome. Like with any other investment, you need to diversify. Private real estate funds are an easy way to do that. Instead of getting just one property for your $100,000, you might get 15 of them. If you just bought one stock and it tanked, you wouldn’t be surprised. But you are when you just buy one syndication and it tanks?

If you want the truth about real estate investing and you want to avoid all the hype, we have three resources you should check out:

Interested in exploring private real estate investing? Start your due diligence with those who support The White Coat Investor site:

* Consider these introductions—not recommendations. WCI has a financial relationship with every company listed, most are for accredited investors, and you are responsible for your own due diligence.

What do you think? Why are there so many lies and hype out there when it comes to real estate investing?

Search

RECENT PRESS RELEASES

Related Post