U.S. trade uncertainty presents domestic opportunities for Southeast Asian renewables supp

April 23, 2025

On 21 April 2025, the United States (U.S.) Department of Commerce announced tariffs of up to 3,521% on solar imports from Southeast Asian countries, threatening the export-oriented strategies of regional clean energy manufacturers. However, the disruption also presents an opportunity for Southeast Asian renewables manufacturers to readjust toward rapid renewables adoption in domestic markets rather than focusing on exports to the U.S. This approach could help absorb export-led output that current and proposed U.S. tariffs might displace. More importantly, renewable energy can help Southeast Asian markets hedge against market-based shocks from USD-denominated commodity prices and currency fluctuations in uncertain economic and geopolitical times.

Solar technology trade between Southeast Asia and the U.S.

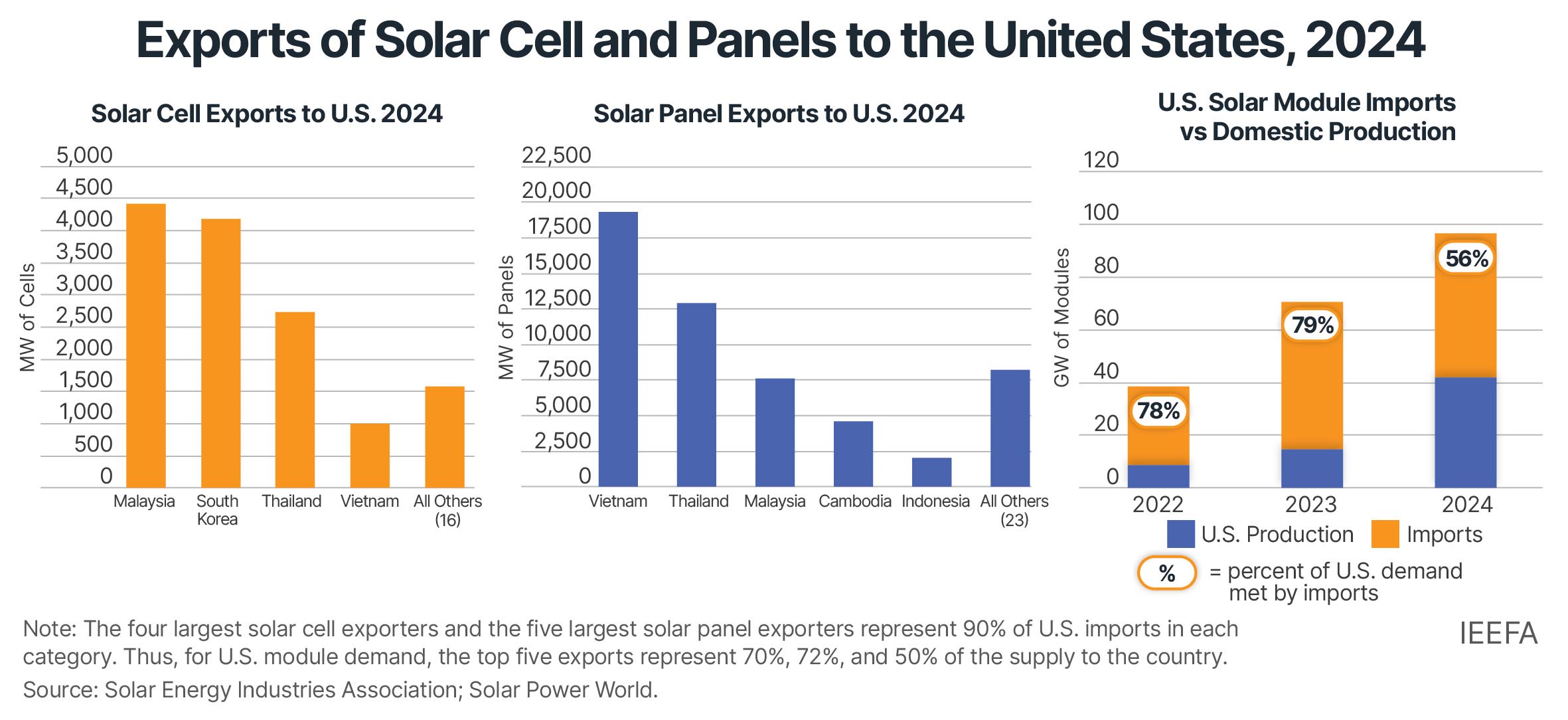

While the 2022 U.S. Inflation Reduction Act intended to incentivize a shift of solar manufacturing onshore, Southeast Asia has remained a major supplier of completed solar panel modules to the country. In 2024, the U.S. imported 55 gigawatts (GW) of solar panels, with 88% (or 48GW) coming from Southeast Asia. Countries in the region also supplied U.S. assemblers with 14GW of solar cells – the key input for solar panels. Overall, such imports helped to support 56% of U.S. demand in 2024.

Southeast Asia has remained a major supplier of solar cells and completed solar panels to the U.S. Solar cells are the elements that convert light to energy and are typically made from silicon. Solar panel modules are larger assemblies comprised of multiple solar cells, cell wiring, frames, glass, and other bonding and sandwiching materials needed to create a working power generation unit.

U.S. tariffs change the outlook for Southeast Asian solar exports

The U.S. International Trade Administration (ITA) announced the conclusion of its investigation regarding alleged product dumping by solar manufacturers in Cambodia, Malaysia, Thailand, and Vietnam on 21 April 2025. Anti-dumping and countervailing duty tariffs were levied on over 30 companies, ranging from around 14% to over 3,400%, with an average of 870%. Without ITA intervention, the specific tariffs on individual solar technology exporters in Thailand, Malaysia, Cambodia, and Vietnam will take effect on 09 June 2025. While currently robust U.S. demand for solar products could support some increased import costs, any price increases beyond 250% would make most Southeast Asian imports untenable.

Notably, the ITA trade measures are to be applied on top of already proposed general tariffs that the U.S. administration announced on 02 April 2025. While these tariffs are temporarily on hold for 90 days, the risks of relying primarily on exports to the U.S. for growth are clear for Southeast Asian producers, who should take immediate steps to diversify their end markets.

Minimizing economic risks by increasing domestic renewable energy capacity

Even before U.S. tariff changes were announced, a prolonged period of market volatility seemed likely throughout 2025 and beyond, with markets experiencing fluctuations in fossil fuel commodity prices, exchange rates, or base interest rates (due to potential high inflation). Additionally, there is now a significant risk of declining economic growth among Southeast Asian nations while trade disputes unfold.

However, with this challenge comes an opportunity for Southeast Asia’s energy sector much closer to home: domestic consumption. Emerging markets could mitigate risks by maximizing domestic energy supply from low-cost renewable energy. The technology represents a one-time, upfront investment with no ongoing, USD-denominated fuel costs. Every megawatt (MW) installed is a natural hedge against global market volatility.

Before the current trade uncertainty, Southeast Asian countries had already set targets for diversifying energy sources through large renewables additions. Indonesia, for example, has targeted 75GW of solar energy by 2040, adding 5GW per year. However, there is no need to wait that long, given volatile market-based fossil fuel prices.

China installed solar farms at a rate of 759MW per day in 2024, demonstrating that large quantities of renewables can be added to the grid in months. These investments accounted for 10% of the country’s GDP growth that year. This indicates the potential of renewable energy to insulate countries from global market shocks while helping utilize the renewable technology outputs created locally.

Solar and wind technology costs have continued their downward trend, with battery storage technology joining that trajectory. Renewables are the lowest-cost solution for every Southeast Asian country, particularly where utilities are trying to meet new, incremental demand.

Absorbing displaced green tech demand within Southeast Asia

Displaced U.S. demand for green tech output from Southeast Asian countries could be absorbed domestically and regionally. However, proactive, incentivized policies are needed to maximize the domestic installation of renewable energy projects. Indonesia lags behind the most, with solar making up only 0.2% of its total energy. Vietnam, the Philippines, Malaysia, and Thailand have also struggled to increase renewables output for different reasons.

Vietnam seems most prepared to use renewable energy to meet rapidly growing electricity demand. In addition to higher revised solar and wind targets, its new electricity law and implementing decrees encourage renewable development as part of the base national energy mix. On 15 April 2025, Vietnam revised its national power development plan, proposing to serve its growing energy needs by advancing its solar capacity target from 34GW to 73GW by 2030 and up to 296GW by 2050.

The Philippines is planning for its fourth round of bidding for renewable energy projects around mid-2025, aiming to add more than 9GW of capacity. The first two rounds, held in 2023, awarded 5.5GW of capacity, and the third round, completed in February 2025, attracted 7.5GW of proposals, exceeding the 4.5GW government target. However, there have been issues in completing these projects. The country’s complicated policy environment for securing grid interconnections has led to several awarded projects being cancelled or indefinitely delayed.

Malaysia’s recent National Energy Transition Roadmap establishes sustainability targets but does not include firm, supporting commitments to capacity or generation from renewables in the medium term. The country’s plans lean more toward false solutions like carbon capture, utilization, and storage (CCUS), which allow for the continuing monetization of fossil fuel deposits. However, the target is to achieve 153GW of installed solar by 2050. Given recent tariff changes, these plans could be accelerated.

Thailand depends primarily on natural gas, whether domestically produced, piped from Myanmar, or imported as liquified natural gas (LNG). However, with the reemergence of political turmoil in Myanmar, deliveries will likely erode as investment in new fields is suspended. Domestic gas supplies in the Gulf of Thailand are also declining, leaving the country highly exposed to USD-denominated LNG markets. The government is making plans to diversify its energy mix, and solar appears to be the most efficient solution, with 15.5GW targeted to be operational by 2037 and 76GW by 2050.

Insulating regional economies by transitioning from fossil fuels

The unexpected U.S. policy changes have left Southeast Asian businesses scrambling for more diversified markets. The impact of these shifts could expose or create economic weaknesses for each nation. At the same time, modern renewable technology production facilities will need to find new markets for their goods. By prioritizing the domestic use of green technology already produced within their borders, Southeast Asian countries can protect investments and jobs. Transitioning from volatile, USD-denominated fossil fuel and financial markets to local renewable energy offers a quick and cost-effective way to shield Southeast Asian economies from future uncertainty.

Search

RECENT PRESS RELEASES

Related Post