US returns to Africa with investment-first strategy as competition for influence intensifi

January 30, 2026

ADVERTISEMENT

BI Africa

local

markets

The United States is recalibrating its Africa engagement around an investment-first strategy as competition for economic and geopolitical influence on the continent sharpens.

US returns to Africa with investment-first strategy as competition for influence intensifies

- The United States is shifting its approach to engaging with Africa, focusing on investment and infrastructure rather than aid

- This shift is exemplified by the Strategic Infrastructure and Investment Working Group, established in collaboration with the African Union

- The initiative supports Africa’s development priorities such as Agenda 2063 and the African Continental Free Trade Area

- By combining U.S. resources and technology with African goals, the partnership seeks to address challenges like infrastructure gaps

ADVERTISEMENT

Recommended articles

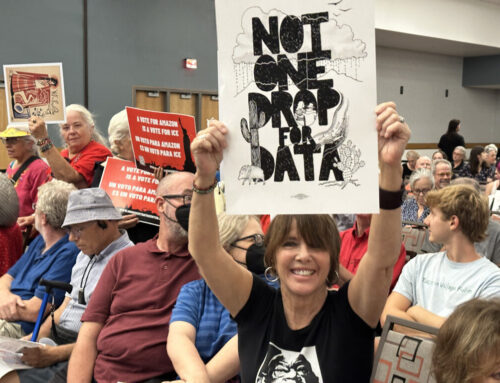

Moving away from traditional aid-led engagement, Washington is positioning private capital, infrastructure finance, and trade integration as its primary tools for sustaining relevance in an increasingly crowded strategic landscape.

This shift is reflected in the newly established Strategic Infrastructure and Investment Working Group between the United States and the African Union, agreed during talks in Addis Ababa between US Deputy Secretary of State Christopher Landau and African Union Commission Chairperson Mahmoud Ali Youssouf.

ADVERTISEMENT

This shift is exemplified by the Strategic Infrastructure and Investment Working Group, established in collaboration with the African Union

US government

In a joint statement announcing the working group, both sides said the framework would align with Africa’s core development priorities, including Agenda 2063, the Programme for Infrastructure Development in Africa (PIDA), and the African Continental Free Trade Area (AfCFTA).

The working group will serve as a coordination platform linking senior officials and technical experts to identify bankable projects and mobilise US private sector participation in areas such as transport corridors, energy systems, digital infrastructure, and regulatory harmonisation, sectors where external competition for partnerships and market access is intensifying.

The agreement reflects Washington’s recognition that Africa’s infrastructure gap has become both an economic constraint and a strategic arena, as rival powers expand their presence through financing, construction, and technology partnerships.

The initiative is closely linked to the African Continental Free Trade Area, which remains constrained by infrastructure gaps, weak logistics networks, and fragmented regulations

Google

ADVERTISEMENT

By combining the African Union’s convening power with US capital and financing tools, the partnership aims to strengthen critical mineral supply chains, expand logistics capacity, secure digital networks, and deepen two-way trade placing investment at the centre of the United States’ bid to maintain influence on the continent.

The creation of the working group signals a broader shift in how the United States is re-engaging Africa at a time of intense global competition for influence on the continent.

Rather than relying heavily on foreign assistance, US officials are increasingly framing with expanding consumer markets, critical resources, and rising geopolitical importance.

This recalibration is taking place as African governments seek alternatives to debt-heavy infrastructure financing and as Washington looks to counter the expanding footprint of rivals such as China and Russia through commercially driven engagement.

ADVERTISEMENT

The initiative is closely linked to the African Continental Free Trade Area, which remains constrained by infrastructure gaps, weak logistics networks, and fragmented regulations. By mobilising private investment into transport corridors, energy systems, and digital trade infrastructure, the working group could help reduce trade costs and improve cross-border connectivity which are key requirements for AfCFTA to function effectively.

The emphasis on “durable, profitable investments” signals a US approach focused on long-term commercial partnerships aligned with African-led priorities rather than donor-driven models. For African states, the framework offers a pathway to mobilise private capital while advancing continental integration goals.

For the US, it represents a strategic return to Africa through investment-led engagement, reflecting a belief that shared prosperity and trade integration, not aid dependency, will shape the next phase of the US–Africa relationship.

FOLLOW BUSINESS INSIDER AFRICA

ADVERTISEMENT

Search

RECENT PRESS RELEASES

Related Post