US$200 Million Bridge Loan Approval Might Change the Case for Investing in Ivanhoe Electri

November 17, 2025

-

Ivanhoe Electric recently secured credit approvals for a US$200 million senior secured multi-draw bridge loan from a group of international financial institutions to support early-stage construction at its Santa Cruz Copper Project in Arizona.

-

This financing milestone marks significant institutional backing for Ivanhoe Electric’s efforts to advance a major new copper operation in the United States, setting a clear path toward project execution and future production.

-

We’ll explore how this fresh capital injection, reducing early construction risk, shapes Ivanhoe Electric’s investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

For investors considering Ivanhoe Electric, the big picture centers on early-stage execution risks balanced against the substantial upside of a large-scale US copper project. Historically, the company’s narrative revolved around funding uncertainties, operational hurdles, and the long timeline to potential production. The recent approval of a US$200 million bridge loan for the Santa Cruz Copper Project is a material catalyst; it directly addresses critical near-term funding risk and offers tangible institutional support. With this new liquidity, the most immediate risk of construction delays recedes, potentially smoothing the path toward the planned 2026 groundbreaking and the target of first copper cathode production in late 2028. However, the big, looming risks remain: Ivanhoe Electric is still unprofitable, revenue remains minimal, and the project requires significant further capital outlays before it can become cash-generative. For now, the financing milestone shifts focus from survival questions to execution and market risks, but long-term success is still dependent on smooth project delivery, market copper prices, and further financing. Yet, regulatory hurdles and future project financing still cast a long shadow investors cannot ignore.

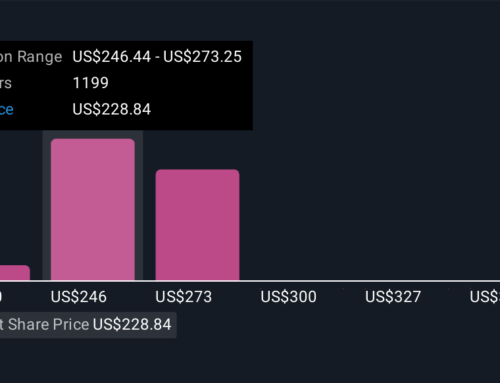

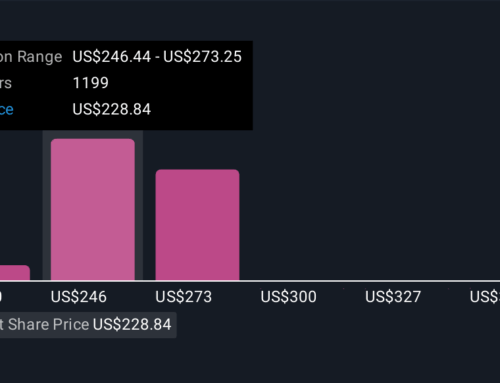

Insights from our recent valuation report point to the potential overvaluation of Ivanhoe Electric shares in the market.

The Simply Wall St Community shows wide divergence in fair value estimates for Ivanhoe Electric, ranging from as low as US$0.29 to the analyst consensus of US$19.50 across three perspectives. While the recent bridge loan tackles early construction risks, the company’s continued lack of meaningful revenue still shapes how you might view these opinions. Explore how community viewpoints stack up against ongoing execution challenges.

Explore 3 other fair value estimates on Ivanhoe Electric – why the stock might be worth as much as 52% more than the current price!

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

-

A great starting point for your Ivanhoe Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

-

Our free Ivanhoe Electric research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Ivanhoe Electric’s overall financial health at a glance.

Early movers are already taking notice. See the stocks they’re targeting before they’ve flown the coop:

-

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

-

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

-

Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include IE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post