Veteran Analyst Brandt Says Ethereum Big Day Is Here

June 10, 2025

Veteran analyst Peter Brandt suggests that Ethereum may be on the verge of a breakout, saying, “Every dog has its day.”

Ethereum’s price has increased recently, particularly between June 9 and June 10, surging from around $2,400 to over $2,700. This uptick marks a significant rally for the cryptocurrency, continuing its bullish momentum after a brief dip.

While Ethereum has experienced considerable volatility in recent months, Peter Brandt, a veteran technical analyst, believes the asset is now setting the stage for a potential breakout.

A Potential Breakout in the Making

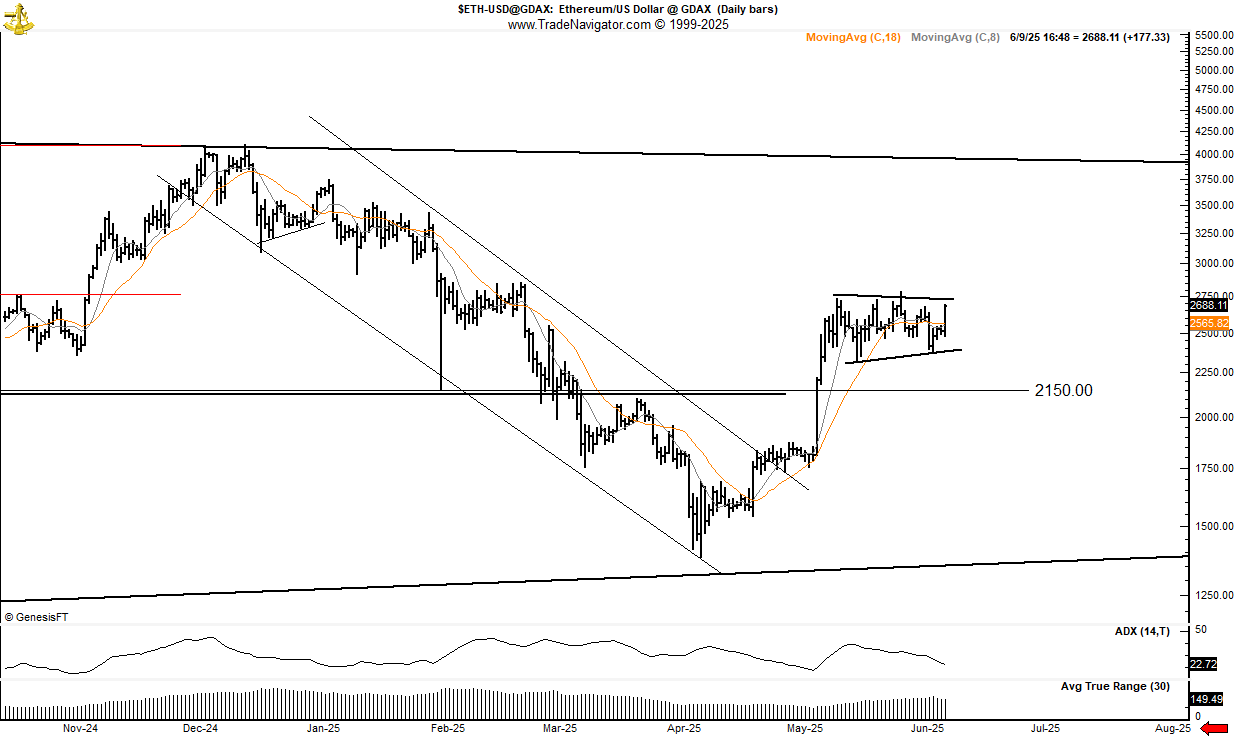

Brandt a potential turning point for Ethereum in a post on X. The accompanying chart highlighted how ETH has transitioned from a descending channel to a symmetrical triangle formation.

According to Brandt’s analysis, Ethereum has been moving within a descending channel since December 2024, when its price peaked above $4,000. Throughout this period, price movements remained capped within the channel’s boundaries, with resistance at the upper end and support at the lower end. Notably, Ethereum’s price tested key levels, including $3,700 in January and $1,390 in April.

However, after breaking out of this channel in mid-April, Ethereum’s price began to form the symmetrical triangle pattern, which typically signals consolidation before a breakout.

In this pattern, Ethereum’s price has been capped on both ends. On the downside, support has been tested multiple times, most recently on June 6 at $2,392. Meanwhile, resistance near the $2,700 mark has held firm several times since May.

Moving Averages and Market Sentiment

Ethereum’s 18-period moving average is trending upwards, signaling potential short-term bullish momentum. The moving average is currently acting as dynamic support, which may indicate an ongoing upward trend in the market. This aligns with the recent rally and provides further evidence that Ethereum may be gaining strength.

On the other hand, the ADX (Average Directional Index) currently sits at 22.72, suggesting that the current trend remains weak. The ADX reading below 25 typically indicates a market consolidating rather than in a strong directional move.

If Ethereum’s price falls below the $2,150 support level, it could signal a bearish breakdown, potentially leading to further declines toward the long-term support below the $1,390 mark.

However, Peter Brandt suggests that Ethereum may be on the verge of a breakout, remarking, “Every dog has its day — woof woof ETH.” This suggests now could be Ethereum’s time to shine after vastly underperforming Bitcoin.

On the upside, resistance is positioned just below the $4,000 mark. Should Ethereum continue its rally, it could surge by approximately 48.7%, moving from its current price of $2,689 to the $4,000 resistance level.

Inflows Into Ethereum: A Strong Market Signal

Meanwhile, the digital asset market has seen strong inflows, with Ethereum leading the pack. According to CoinShares data, digital asset investment products experienced $224 million in inflows last week, continuing a seven-week streak of positive growth.

Notably, Ethereum accounted for the largest share of these inflows, with $296.4 million entering the market. This marks the seventh consecutive week of inflows for Ethereum, pushing the total to $1.5 billion over this period.

In contrast, Bitcoin has seen outflows, with $56.5 million leaving the market. This shift in investor sentiment suggests that Ethereum is attracting more attention, further supporting the belief that the cryptocurrency could be positioning itself for a breakout.

Search

RECENT PRESS RELEASES

Related Post