Warren Buffett Is Dumping Apple and Bank of America Shares and Buying This Red-Hot AI Stoc

December 11, 2025

This tech stock checks many of the important boxes that Buffett and his managers often look for.

After leading Berkshire Hathaway (BRK.A +0.99%)(BRK.B +1.03%) for 60 years, Warren Buffett is stepping down as CEO at the end of this year at the age of 95. During that span, Berkshire Hathaway has become the poster child for conglomerate holding companies and has been a routine market-beating stock for its investors.

Leading up to Buffett’s departure, Berkshire has been making moves, primarily on the selling side. Notably, it reduced its stake in Apple (AAPL 0.27%) and Bank of America (BAC +0.89%) quite significantly in the past couple of years.

As of the end of the third quarter, Berkshire Hathaway has reduced its Apple shares to just over 238 million, representing 21.4% of its stock portfolio. It has reduced its Bank of America shares to just over 568 million, making up 9.6% of its stock portfolio.

Image source: Alphabet.

Arguably more notable than Berkshire Hathaway’s recent sales, though, is a recent investment made in Alphabet (GOOG 2.27%)(GOOGL 2.42%) because the company has historically steered clear of high-growth tech companies. Now, as Buffett nears the end of his time as CEO, the company owns around 17.8 million shares of the tech giant.

Why the reduction in Apple and Bank of America shares?

Berkshire Hathaway hasn’t released an official “this is why we made these moves” statement, but there are two main reasons they make sense. In Apple’s case, its valuation relative to projected earnings growth is starting to look a little disconnected.

Advertisement

Apple is trading at 33.6 times its projected earnings over the next 12 months, which is higher than the other “Magnificent Seven” stocks except Tesla and Nvidia. That’s a high premium for a company whose earnings have been relatively modest in recent quarters.

Berkshire Hathaway

Today’s Change

(1.03%) $5.07

Current Price

$495.50

In Bank of America’s case, this was likely a time to take profits from a stock that Berkshire has made tens of billions of dollars from. Buffett’s company began its significant stake in Bank of America in 2011, and since then, the stock is up markedly.

Selling those shares now is a chance to lock in huge profits at a favorable corporate tax rate, which is likely to be higher if (or rather when) it’s adjusted. With the profits from both sales, Berkshire Hathaway has increased its large stake in U.S. Treasury bills, which now stands at over $320 billion.

Berkshire Hathaway’s entrance into the AI world

Buffett has publicly said that he regrets not investing in Alphabet years ago after noticing that insurance company Geico (a Berkshire Hathaway subsidiary) was paying Alphabet $10 per click on its Google ads. But you know what they say: Better late than never.

Alphabet is one of the few tech companies in Berkshire Hathaway’s portfolio, but there’s a case that it could be the most promising, especially as it solidifies its position as a key player in artificial intelligence (AI).

It has pioneered key AI research, is creating chips that should challenge Nvidia’s current stronghold, owns a network of data centers, and has consumer-facing apps like its generative AI tool Gemini, which is receiving regular praise as a top-of-the-line option.

I don’t think Berkshire Hathaway made this investment solely because of AI, but I imagine it helped seal the deal with the direction the technology is going.

When in doubt, follow the cash

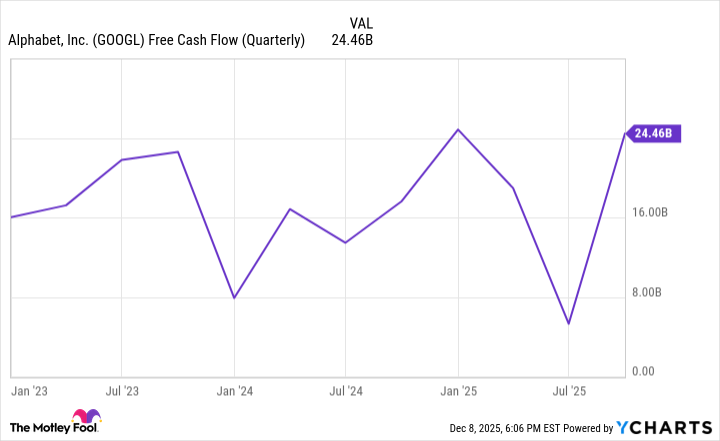

Buffett and his managers have always been fans of cash-flow-heavy businesses, which isn’t always the case with high-growth tech stocks. However, when it comes to Alphabet, it’s most definitely the case. In the third quarter, it achieved its first-ever $100 billion quarter ($102.3 billion, to be precise) and generated nearly $24.5 billion in free cash flow.

GOOGL Free Cash Flow (Quarterly) data by YCharts.

Revenue is important, but free cash flow is more noteworthy in some cases because it’s money Alphabet can use for things like expanding its business, making acquisitions, buying back shares, and paying dividends. It also helps that the company ended the third quarter with nearly $98.5 billion of cash, cash equivalents, and marketable securities, giving it a lot of leeway to invest aggressively in its business.

Alphabet has a strong balance sheet, a competitive moat in Google Search, and recently began paying a dividend. Those are three boxes the company checks that could further explain why Berkshire Hathaway chose to make the move now.

Search

RECENT PRESS RELEASES

Related Post