Washington Lit the Fuse — Why Now Is A Good Time to Buy Bitcoin

July 6, 2025

Capitol Hill pulled an all-nighter on July 3, ramming through Donald Trump’s “One Big Beautiful Bill Act” by a razor-thin 218-214 House vote. The president signed the package — a $5 trillion expansion of the federal borrowing limit wrapped in eye-watering tax cuts — on Independence Day, teeing up the most radical shift in U.S. fiscal policy since LBJ.

Lobbyists for the “number-go-up” crowd had prayed for friendly language on airdrops, staking, and that annoying double tax on miners. Senator Cynthia Lummis even tried a hail-Mary amendment to stop miners being taxed twice (block reward and sale). All of it died on the cutting-room floor.

Why Bitcoin still wins

Here’s the kicker: the bill’s very awfulness is still rocket fuel for scarce, censorship-resistant assets such as Bitcoin.

- Debt spiral economics – A $5 trillion bump to the debt ceiling all but guarantees more Treasury issuance. History says politicians won’t match that with spending cuts; they’ll print. Debasement is bullish for hard-capped assets: there will never be more than 21 million BTC.

- Inflation hedging déjà vu – Gold and oil spiked within hours of the vote; Bitcoin tagged $109,000 and change. Nigel Green of deVere notes investors are “running for anything that can’t be printed.”

- 2024 halving tailwind – Supply growth has already been cut to ~0.8% a year. Add ETF inflows, corporate balance-sheet FOMO, and now a fiscal free-for-all: the demand/supply mismatch looks cartoonish.

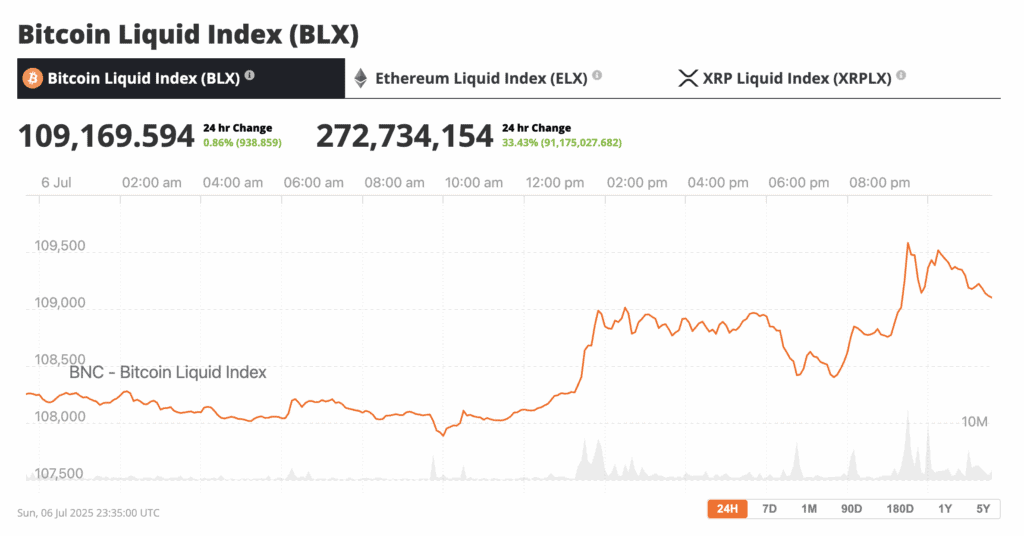

Put bluntly, it is likely that now is a good time to buy Bitcoin, because macro policy just told you it doesn’t care about the dollar’s purchasing power. In fact, Bitcoin quietly moved up on Sunday night to above $109,000. It’s just a 3% move away from a new Bitcoin all time high. So the long-awaited Bitcoin price predictions that suggested $200,000 was a realistic target for 2025 may yet prove to have been right all along,

Bitcoin looks strong and ready to tackle a new all-time high, source: BNC Bitcoin Liquid Index

The moral math nobody wants to do

Sure, the bill hands millionaires a 3 % after-tax bump, lifts SALT deductions four-fold for the upper-middle class, and juices estate-tax exemptions to $15 million. It funds that largesse by hacking at Medicaid and SNAP while slapping 20-30 % tariffs on allies. Even mainstream economists are calling it a “permanent re-ordering of the trade and spending model.”

That sounds grim—unless you’re parking value in an asset outside the monetary blast radius. More debt → higher inflation expectations → higher real-asset multiples. Bitcoin was built for exactly this scenario.

Washington’s Crypto Week consolation prize

The Hill hasn’t forgotten digital assets entirely. Lummis is already back with a standalone mining-tax fix and a $300 de minimis exemption for everyday crypto spend. Meanwhile, House GOP leadership has dubbed the week of July 14 “Crypto Week,” aiming to pass:

- CLARITY Act – the long-delayed regulatory framework;

- Anti-CBDC Surveillance State Act – kills any Fed-issued digi-dollar;

- GENIUS Act – stablecoin rulebook.

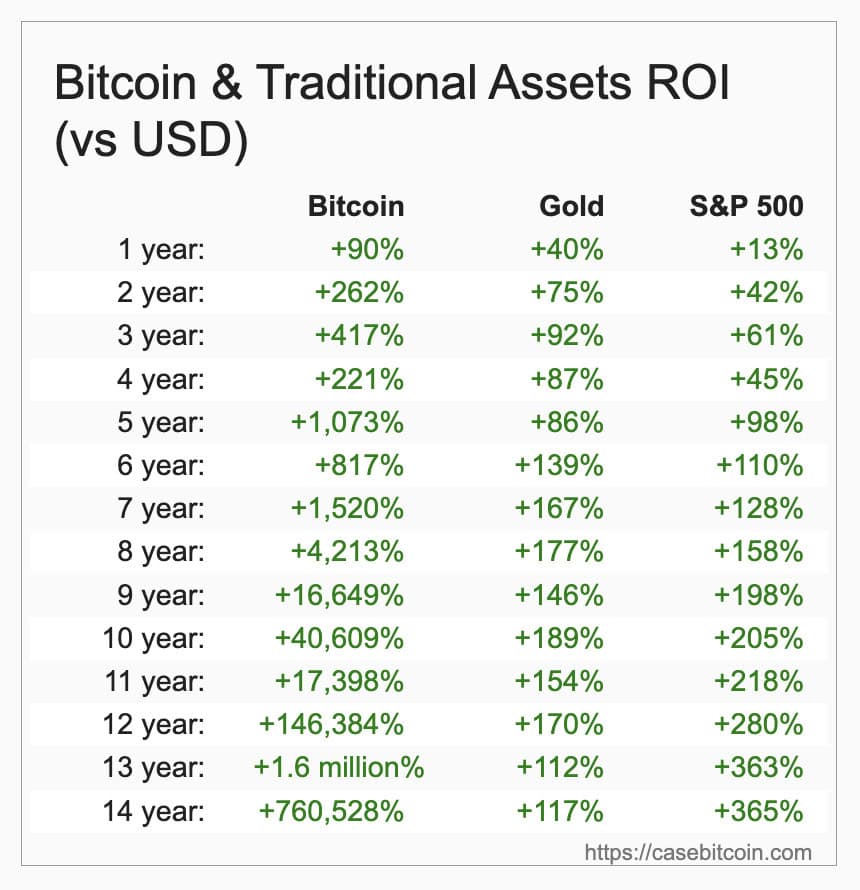

If those land, regulatory overhang evaporates just as fiscal madness peaks. That combo could make today’s price look quaint. Bitcoin tends to outperform other asset classes, so it simply doesn’t make sense to bet against Bitcoin.

Never bet against Bitcoin, Source: Case for Bitcoin

| Macro trigger | Why it matters for BTC | What the skeptics miss |

| Debt-to-GDP on track to breach 140% by 2028 | Hard-cap scarcity narrative, institutional treasury demand | Fiat alternatives aren’t scarce; BTC is. |

| Tariff shock + supply-chain redirection | Imported-goods inflation → real-yield repression | Rate hikes can’t fix tariff-driven CPI; debasement will. |

| High-net-worth tax giveaways | Wealthy Americans get extra dry powder | They’re already crypto-curious and tax-efficient. |

Add them up and the risk/reward skews violently positive. This isn’t “number go up” euphoria; it’s macro math.

The caveats — Manage your risk

- Volatility is the entrance fee. A 30 % drawdown is still possible.

- Congress might rediscover fiscal prudence (lol) — in which case gold and BTC both cool off.

- Regulatory rug pulls remain possible, though less likely with a pro-crypto GOP House/Senate.

Trump’s Big Beautiful Bill is a fiscal sugar high that may leave Main Street with a hangover—but it gifts Bitcoin a “perfect storm” narrative: soaring debt, entrenched inflation, and zero political will to stop printing. If you’ve ever asked when is the best time to invest in Bitcoin, the market just flashed a neon sign: now is a good time to buy Bitcoin.

Search

RECENT PRESS RELEASES

Related Post