Whales Clash Over Ethereum as ETH/BTC Balances on a Knife Edge

November 24, 2025

Institutional money is pulling Ethereum in opposite directions, with one major treasury piling into ETH while a top ETF issuer sends coins to Coinbase. At the same time, the ETH/BTC pair is clinging to a crucial support zone that could decide whether Ether outperforms Bitcoin again or drags the broader market lower.

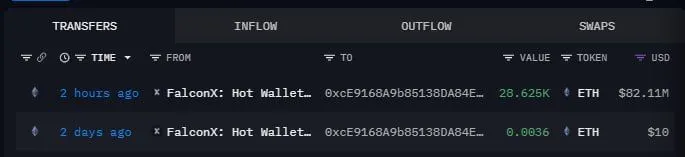

Bitmine moved 28,625 Ether worth about 82.11 million dollars from a FalconX hot wallet to a new address, according to on-chain transfer data. The inflow appeared two hours ago on Arkham, showing one of the largest recent single purchases tied to the firm.

Bitmine FalconX ETH Transfer. Source: Arkham Intelligence / X

At the same time, the transfer followed an earlier small test transaction recorded two days ago. That pattern matches typical behavior for large buyers who confirm a route before sending the full amount. The latest move lifted Bitmine’s recorded accumulation for the week and pushed the associated wallet deeper into high-value territory.

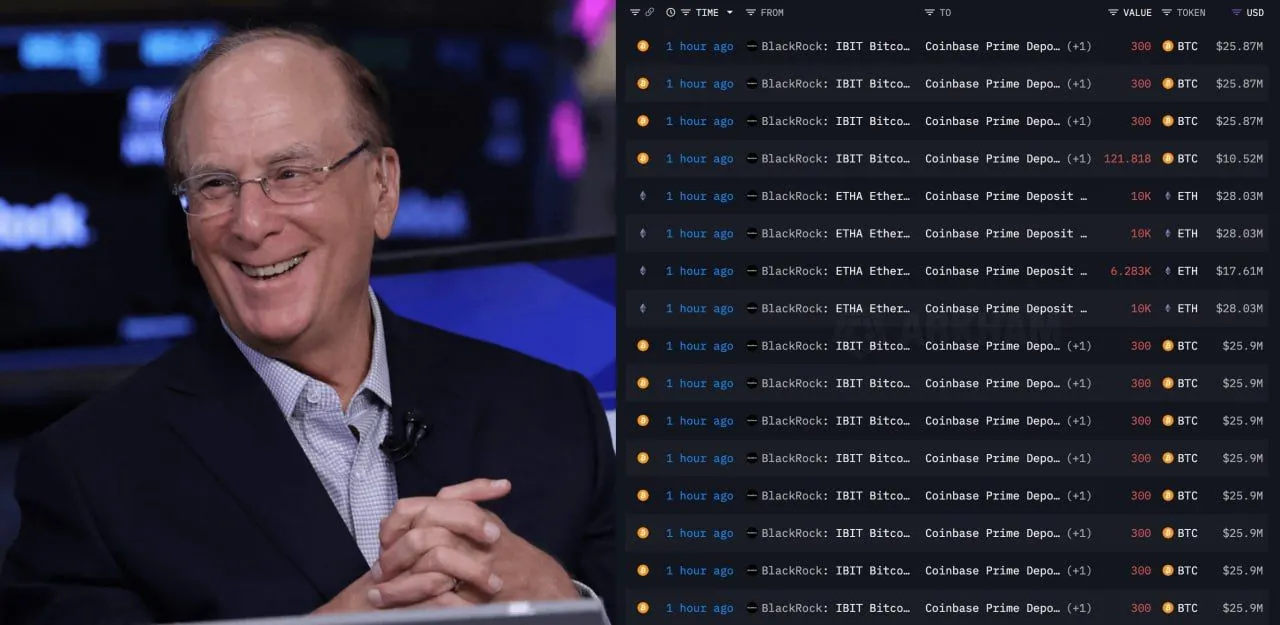

In contrast to Bitmine’s recent large-scale buying, BlackRock has been moving significant amounts of Bitcoin and Ether out of its IBIT and ETHA ETF wallets within the past hour. Arkham’s transfer log shows a steady stream of outflows from BlackRock-linked addresses toward Coinbase Prime deposit wallets, marking one of the firm’s most active selling periods in recent weeks.

BlackRock Crypto Outflows. Source: Arkham Intelligence / X

The latest transfers include repeated batches of 300 Bitcoin per transaction, each worth about 25.9 million dollars. The list also shows several moves of 10,000 Ether at roughly 28.03 million dollars per batch. Additionally, one mid-sized transfer of about 6,283 ETH appeared alongside the larger flows, bringing the combined total of BTC and ETH moved within the hour to roughly 500 million dollars.

Meanwhile, the pattern suggests ongoing activity rather than a single liquidation event. The repetition of identical BTC lots and synchronized ETH transfers indicates a coordinated adjustment within BlackRock’s ETF settlement structure. These movements come ahead of a scheduled speech by former President Donald Trump, which has amplified speculation but does not clarify the motive behind the transfers.

Ethereum is now sitting on a key support area against Bitcoin, as the ETH/BTC pair grinds sideways above a grey demand zone on the daily chart. The level comes after a sharp rally earlier this year and a months-long pullback that has pushed price back toward the former breakout region.

ETH BTC Support Zone Daily. Source: CryptoMichNL / TradingView / X

In his latest update, trader Michaël van de Poppe said the main question for the coming weeks is whether ETH can hold this zone and bounce. If buyers step in here and defend support, he noted, Ethereum is likely to start outperforming Bitcoin again as the ratio turns higher.

However, he added that a clear breakdown from this area could signal “significantly lower numbers” for the broader crypto market. In that case, renewed weakness in ETH/BTC would underline risk-off sentiment and point to more downside before any sustained recovery.

Search

RECENT PRESS RELEASES

Related Post