Whales Pour Billions Into Ethereum As Wyckoff Pattern Predicts $10K Surge

June 4, 2025

Key Takeaways

- Ethereum trading volumes have surged since May 8, signaling renewed market interest.

- Top market figures observe large-scale whale accumulation amid positive ETH-BTC divergence.

- Wyckoff analysis suggests ETH is nearing a breakout, targeting $4K, with $10K in sight this cycle.

Ethereum has begun to dominate market chatter once again. Prominent crypto voice Lark Davis highlighted how Ethereum is witnessing renewed trading enthusiasm. Since May 8, ETH’s volumes have surged past average levels seen over recent months, pointing to growing engagement from both buyers and sellers.

Davis emphasized Ethereum’s resilience compared to Bitcoin, as ETH has retained more of its value percentage-wise following Bitcoin’s decline from its all-time high. This performance divergence could indicate Ethereum’s hidden strength.

According to Davis, the asymmetric long potential for ETH is growing, especially if Bitcoin holds steady or rallies. Such setups are favored in technical circles, suggesting that Ethereum could offer outsized returns compared to risk, a scenario often sought by seasoned investors.

Doctor Profit added another dimension to the narrative, revealing large-scale accumulation activity on-chain. The analyst noted that wallet data shows a sharp uptick in ETH purchases, particularly from whales and institutional players. Among them is BlackRock, reportedly ramping up its Ethereum positions at an unusual pace.

This intensified buying activity has fueled expectations for a near-term retest of the $3,000 mark. Doctor Profit maintains a confident stance that Ethereum will break toward $4,000 in the coming months, eventually aiming for an all-time high by late summer.

These developments come during a broader market phase where Ethereum seems to be outperforming its peers in resilience and institutional appeal. Wallet tracking tools confirm that whale addresses holding over 10,000 ETH have increased significantly over the past two weeks, reinforcing the idea of silent accumulation.

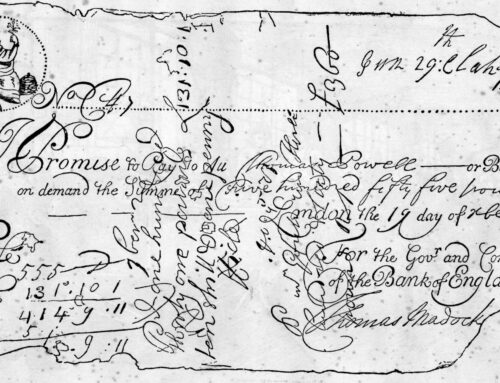

Ash Crypto detailed ETH’s recent price movements using a Wyckoff methodology, indicating what could possibly follow. His marked chart indicated that ETH fulfilled the essential phases of accumulation in the range of $1,800 to $2,600, including spring and test points, which are usually prerequisites for a dramatic price change.

The chart depicts the structure that ETH built through preliminary support, selling climax, and automatic rally, which finally ended up in a breakout towards the $3,000 zone. According to Ash Crypto, recapturing $3,100 would be significant.

With small adjustment, Ethereum can rally to $4,000, which would trigger a bigger markup phase. The final target of $10,000 in this cycle implies that the asset’s reaccumulation may be much more powerful than most people seem to expect.

Related Reading | XRP Surge As Webus Files Form 6-K With SEC for $300M Treasury Management Plan

Search

RECENT PRESS RELEASES

Related Post