What Investors Are Paying for Cannabis Sector’s Forward EBITDA

June 5, 2018

May 29, 2018 | 6:57 AM

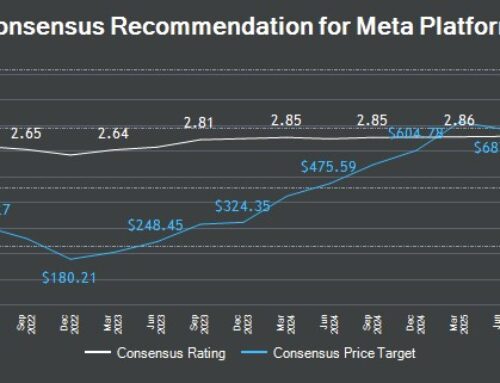

Enterprise-value-to-EBITDA multiple

Similar to what we saw in the previous part of this series, the forward EV-to-EBITDA multiple takes into account the estimates for analysts’ one-year forward EBITDA estimates. Let’s see how this multiple has changed in the past two weeks.

The enterprise-value-to-EBITDA multiples for Canadian-licensed producers (yellow line in the above chart) moved sideways in the last two weeks compared to the week before that. The median multiple was 28x as of May 25, indicating that a marginal investor paid on average 28x per unit of forward EBITDA last week.

Canopy Growth (WEED) traded at 98.6x, while Cronos Group (CRON) traded at 51.8x. Aurora Cannabis (ACB) (ACBFF) traded at 49x, and Aphria (APHQF) traded at 35x as of the week ended May 25. Cannabis producers (HMMJ) OrganiGram, CannTrust, and Hydropothecary traded at 21x, 20.3x, and 37x below the median.

The rapid expansion will stress the expenses of these companies, which will negatively impact EBITDA and lead to higher valuations in the near term.

Be sure to read our previous report, How Cannabis Stocks’ Valuations Looked Last Week.

Search

RECENT PRESS RELEASES

Related Post