What Price Will Ethereum Hit In 2025? Most Retail Traders Expect $5,000 Despite Massive ET

September 28, 2025

Ethereum spot exchange-traded funds experienced outflows of $795.6 million last week, marking the worst performance since their launch.

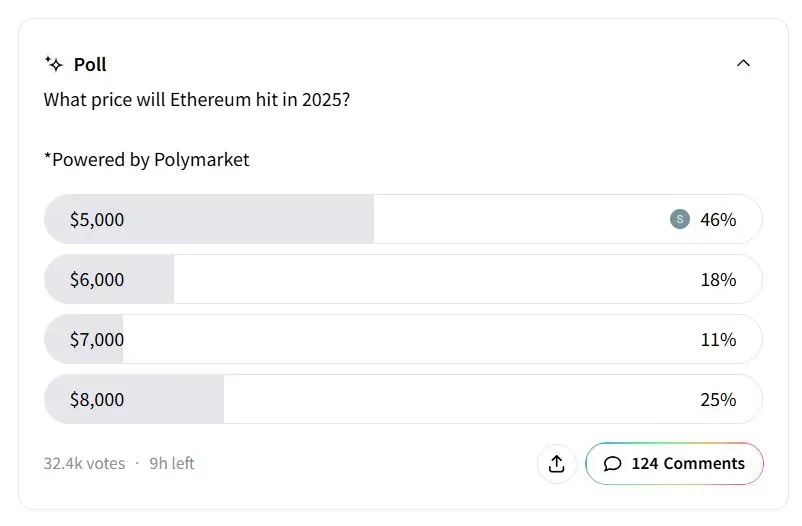

A majority of retail traders on Stocktwits expect Ethereum prices to reach $5,000 by the end of 2025, with some predicting even more impressive gains, despite the second-largest cryptocurrency experiencing some weakness in recent weeks.

According to a Stocktwits poll, in partnership with Polymarket, which garnered over 32,000 respondents, approximately 46% of retail traders anticipate that Ethereum will reach $5,000 by the end of the year. The poll also highlighted that 25% still believe Ethereum can jump up to $8,000, nearly double its current price. While 18% see a rise of up to $6,000, and 11% see gains of up to $7,000.

Retail sentiment on Stocktwits about Ethereum was in the ‘bullish’ territory at the time of writing, while retail chatter was ‘high.’

“If it breaks $4,300 this upcoming week, expect a green October,” one user wrote.

“Well, the ETFs are going to be back to massive buying tomorrow,” another trader said.

Ethereum prices rose 2.6% over the past 24 hours to $4,107.44, according to CoinGecko data, following a tepid week during which the token slipped below the $4,000 mark amid a broader pullback in crypto markets amid uncertainty over the Federal Reserve’s rate path and a looming U.S. government shutdown.

According to SoSoValue data, Ethereum spot exchange-traded funds experienced outflows of $795.6 million last week, marking the worst performance since their launch. The previous high was $787.7 million, which they booked in outflows for the week ended Sept. 5.

The dip comes after a strong August performance, during which the cryptocurrency touched an all-time high. “I think the Ethereum correction will be over in a few weeks. After that, ETH will rally above $10,000,” investor Ted Pillows said.

Several investors are hoping that the Ethereum and the broader altcoin markets will benefit from the relaxation of rules to approve digital currency ETFs, as well as the possibility of the U.S. Securities and Exchange Commission allowing staking. According to Fidelity, crypto staking is the process blockchain networks, such as Ethereum, use to validate transactions on the blockchain in exchange for a reward, making it a potential source of income for many.

Ethereum prices have gained over 23% this year despite the recent pullback, while Bitcoin is up 19.6%. In comparison, the Invesco QQQ Trust Series 1, which tracks the Nasdaq 100, is up 15.9% and the S&P 500 SPDR ETF has gained 12.3%.

Also See: Occidental Petroleum Stock In Focus As Oil Firm Looks To Sell Oxychem Unit For $10B: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Search

RECENT PRESS RELEASES

Related Post