This is what’s important about Cuban’s bullish Netflix bet

October 19, 2014

Jon Najarian | @optionmonster

CNBC.com

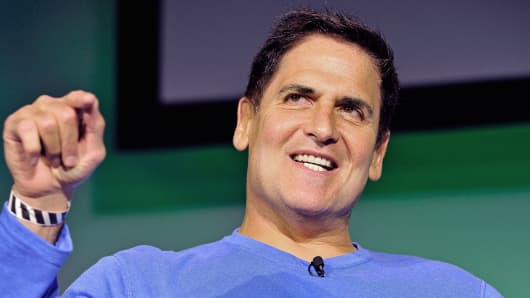

When Mark Cuban tweeted out that he bought Netflix Friday, he clearly moved the market in that security.

Mark’s a smart guy, with lots of money, 2.5 million followers on Twitter, owns the Dallas Mavericks basketball team and has a very popular syndicated show on television and cable that rhymes with Mark Bank (Shark Tank). I’m happy to say that Mark is also a friend.

Read MoreMark Cuban: I’ll take more Netflix, please

But what you should pay attention to isn’t that a wealthy investor just bought $17 million worth of NFLX (he said he bought 50,000 shares today). What you should pay attention to is that he started his bullish positioning in NFLX through options.

Smart investors like Mr. Cuban understand the value of both leverage and liquidity in options. Likewise, so do Warren Buffett, Bill Gates, Michael Dell and most of the movers and shakers in Silicon Valley.

They use options to help with share repurchases by selling put options. They generate alpha (risk-adjusted measure of the so-called active return on an investment) by selling call options against their stock holdings. They limit downside by purchasing puts.

What did Mark do when NFLX was in free fall on Friday? He took advantage of the fear that is always present on such a harsh sell-off and sold big, fat, pumped up put premiums to those that were panicking. I’ve seen him do that before, during the downgrade of the U.S. debt in August, 2011, for instance.

He told me he thought the panic in the market was excessive, and that the puts on the S&P 500 were just too tempting to resist, so he sold them.

He became ‘the house’ just as Warren Buffett’s GEICO is ‘the house,’ when it sells insurance policies and gets those billions of dollars in premiums. If the stock stays above the strike price of the puts, Mark will keep that premium he collected. He is thus rewarded for assuming the risk of insuring the downside of Netflix beneath that strike.

Another reason I like this strategy of selling puts when panics set in is it accomplishes what so many guests on CNBC tell us all too frequently. If I had a dollar for every time a guest said, “I like XXX okay here, but really like it $5 lower,” I would be on the Forbes 400 with Mark!

Read MoreNetflix: Anatomy of a disaster

But think about this, when you sell puts, you can define the level you are willing to buy, so you truly can say, “I like NFLX, but not at $350, I like it at $340.” Just sell the $340 puts and instead of just talking the talk, you’re walking the walk. And the best part is if shares are above $340 (or whatever put strike you elected to sell) you keep that big, pumped up premium, just like Buffett, Gates and Cuban!

“Fast Money” trader Jon Najarian is a professional investor, money manager, media analyst and co-founder of optionMONSTER and tradeMONSTER. He worked as a floor trader for 25 years and before that, he was a linebacker for the Chicago Bears. Follow him on Twitter@optionmonster.

Search

RECENT PRESS RELEASES

Related Post

COMMENTSJoin the Discussion