When Past Shutdown Ended, Bitcoin Soared 96% and 157%

November 11, 2025

After 41 days of partial government closure, the United States may soon reopen. At the same time, President Donald Trump announced a “tariff dividend” plan —a proposed $2,000 benefit for every American citizen —seen as a strong fiscal stimulus signal.

These two developments have sparked investor speculation: Are investors driving Bitcoin toward a new breakout as liquidity returns to the U.S. economy?

Sponsored

According to journalist Nick Sortor on X, the Continuing Resolution was passed in the Senate by a 60:40 vote. This decision paves the way to end the 41-day-long government shutdown, the longest in recent history.

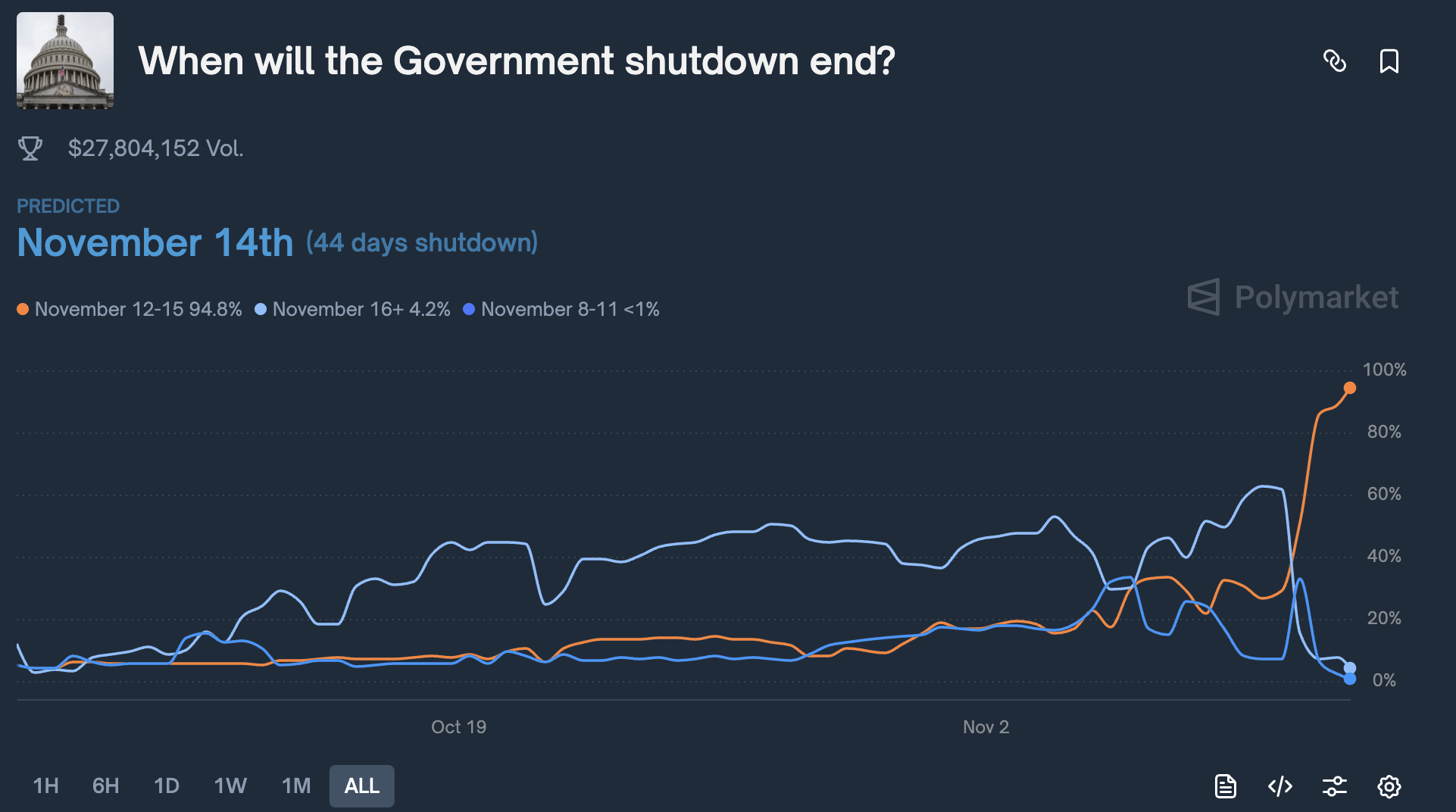

However, the bill still requires final approval from the House of Representatives and the President’s signature before officially taking effect. This process could be completed in the coming days. Polymarket prediction data shows that more than 90% of investors are confident the US government shutdown will officially end this week.

News of the government reopening began spreading across social media earlier this week, sending US equities, gold, silver, and Bitcoin (BTC) higher.

“News that the government shutdown is ending sent stock futures, gold, silver, and Bitcoin rallying. The deal means it’s back to business as usual in Washington, DC. Deficits and inflation will rise, and investors will continue to seek alternatives to depreciating US dollars,” economist Peter Schiff commented.

Sponsored

Historically, Bitcoin has reacted strongly after previous US shutdowns ended. According to a post shared on X, Bitcoin surged 96% and 157% following similar resolutions in February 2018 and January 2019.

However, it’s worth noting that Bitcoin’s past rallies may have coincided with broader market recoveries rather than being caused solely by the end of the shutdown. Moreover, even if history repeats, such price increases typically lag by several weeks amid shifting macroeconomic conditions.

Although the bill has not yet been signed into law, the Senate’s approval has already sent a positive psychological signal to the market. The expectation of returning liquidity could prompt investors to rotate into risk-on assets such as Bitcoin. In the short term, BTC may sustain its upward momentum if the final legislative steps are completed. This could potentially trigger a broader “risk-on” wave across global markets.

Sponsored

Just before the reopening process began, President Donald Trump unveiled the “tariff dividend”, a proposed $2,000 payment for every American citizen. He also introduced several eye-catching financial proposals, including 50-year mortgage loans, direct insurance payouts, and cutting subsidies for insurance firms. This move signals a strong commitment to expanding fiscal spending in 2026.

If implemented, the “tariff dividend” could inject hundreds of billions of dollars into the economy, creating spillover effects across financial and crypto markets.

However, as noted by Ian Miles Cheong, citing financial advisor Scott Bessent, the “tariff dividend” might not be a direct cash payment. Instead, it could take the form of tax relief or a “no tax on tips” policy.

Sponsored

Regardless of form, it remains a potential fiscal stimulus measure that could increase liquidity. This could bolster consumer spending, which is favorable for Bitcoin.

The current macro backdrop mirrors the setup preceding Bitcoin’s powerful 2020 rally. Bitcoin once again emerges as a dual-nature asset, both a store of value and a high-risk, high-reward investment.

Currently, Bitcoin stands on the edge between a bullish breakout and a potential bear trap. If new fiscal measures are fully implemented and liquidity genuinely returns to the system, BTC could mark the beginning of a new growth cycle. Conversely, if policies face delays or scaled-down implementation, Bitcoin may experience a short-term correction phase. This could lead to a renewed accumulation phase before long-term growth resumes.

Currently, the BTC price remains surprisingly stable near $105,300, despite selling pressure that has spiked by more than 1,300% as short-term wallets flood exchanges. In another analysis, the 65-month liquidity cycle is nearing its peak in Q1-Q2 2026. It suggests a 15-20% correction in Bitcoin as valuations overheat, though timing remains uncertain.

Search

RECENT PRESS RELEASES

Related Post