Where is Ethereum’s price headed? These four charts offer signals

April 11, 2025

- The cryptocurrency has performed dismally in the past year.

- Developer activity has been plummeting.

- Active addresses have remained stagnant.

Things are looking dire for Ethereum.

Its price has dropped 60% since December, developer activity and user engagement have declined, and the blockchain faces criticism to its layer 2 scaling roadmap, which some claim has inadvertently redirected value away from the core protocol.

The cryptocurrency has also failed to ride the wave of bullishness that coincided with US President Donald Trump’s second rise to power, which saw Bitcoin and the broader crypto market secure new records.

Ethereum, on the other hand, dropped to just over around $1,400 earlier this week — the same level it traded at in 2018. In short, Ethereum’s position as the backbone of the DeFi ecosystem is at stake.

“Ethereum is in a tough spot right now,” Eric Conner, an Ethereum core developer, said on X.

“It delivered on the core tech promises: smart contracts, rollups, proof-of-stake, scaling improvements. But we’re left wondering, do people actually want to use smart contract applications?”

The concerns about Ethereum’s future comes after years of efforts to improve the blockchain. The network’s transition to a proof-of-stake consensus mechanism in 2022 reduced its energy consumption by over 99%, and the proliferation of layer 2 solutions has enabled faster and cheaper transactions.

A fee-burning mechanism introduced in 2021 has also placed modest deflationary pressure on the supply of Ethereum.

Nonetheless, market sentiment remains subdued.

On Wednesday, Ethereum’s price bounced 12% to $1,680 amid a general wave of positive sentiment after Trump announced of a 90-day delay on tariffs, but the rally proved short-lived. It now trades at just over $1,500.

Not everyone shares the bearish sentiment, however.

One bull is Robert Mitchnick, head of crypto at investment giant BlackRock.

He has said that worries exhibited by Ethereum believers were “overdone,” and that there’s still plenty to be hopeful about — such as the addition of staking yield to Ethereum exchange-traded funds.

Here are four charts that tell Ethereum’s sobering story.

Ethereum’s price stagnates

Investors that bought into Ethereum in 2018 were likely expecting eye-watering gains by now.

Ethereum reached an all-time high of $4,848 in 2020, but these days, it’s back to the same levels seen in early 2018.

“The fact that you can still buy ETH at 2017 levels? It’s either the market’s greatest joke — or its greatest opportunity,” said Simon Dedic, CEO of Moonroock Capital on X.

“ETH at these levels is criminal.”

ETH to BTC ratio plunges

Ethereum is losing ground to Bitcoin at an alarming rate.

The ETH/BTC ratio plunged 50% since December, hitting a five-year low of 0.01917 Bitcoin per Ethereum. For every Bitcoin, investors receive more than 50 Ethereum.

Onchain analyst, James Check, noted that Ethereum has now underperformed Bitcoin for 85% of trading days.

“A truly remarkable decline,” he said.

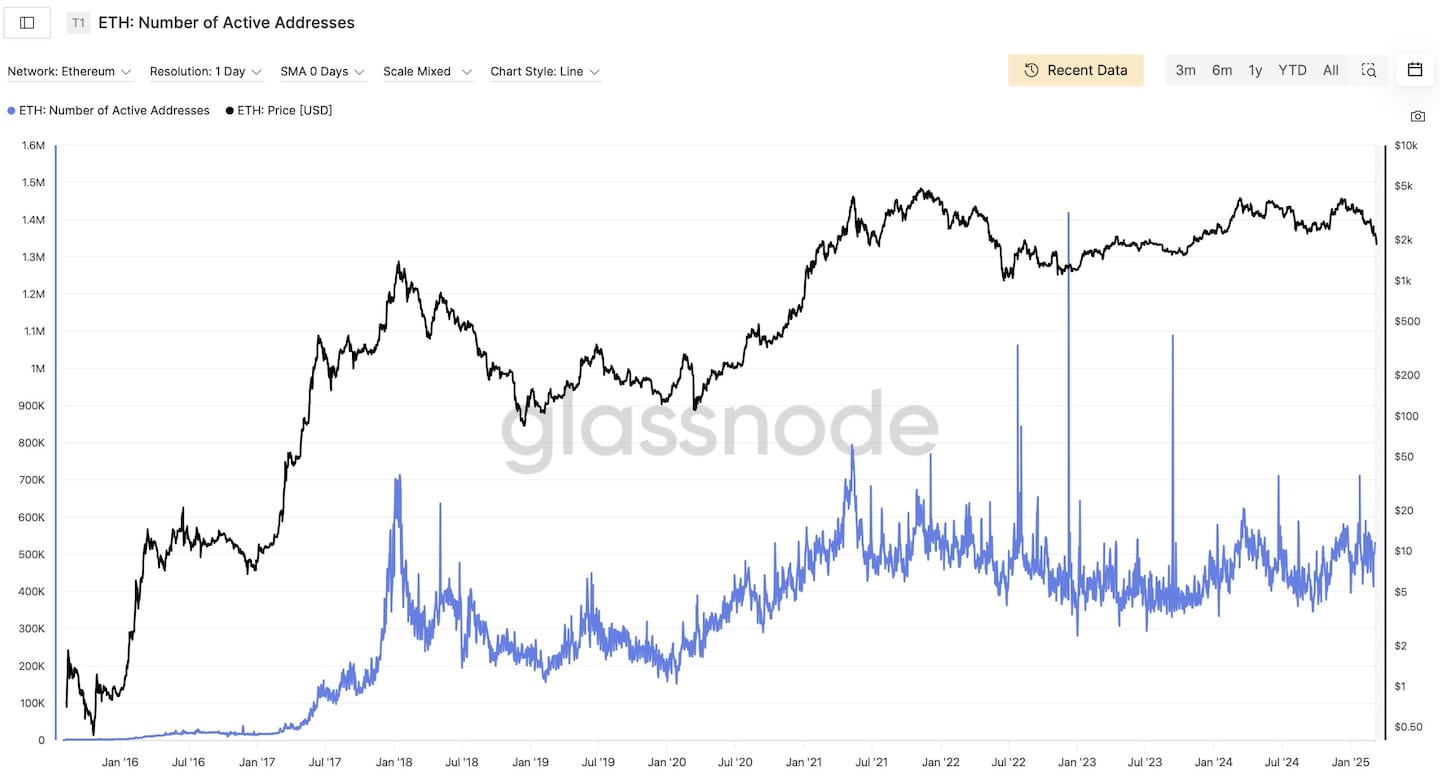

Active addresses plateau

Ethereum’s user growth has flatlined.

Despite brief spikes on activity, daily active addresses have hovered around 400,000 since 2018, according to Glassnode.

What’s more, usage of decentralised exchanges on Ethereum has also been dwindling. Daily unique traders have dropped to 40,000 addresses, a 12-month low, as per data from The Block.

“It’s time to face reality,” said web3 marketer Stacy Muur. “This isn’t the ‘efficiency zone,’ I’m afraid. This is stagnation.”

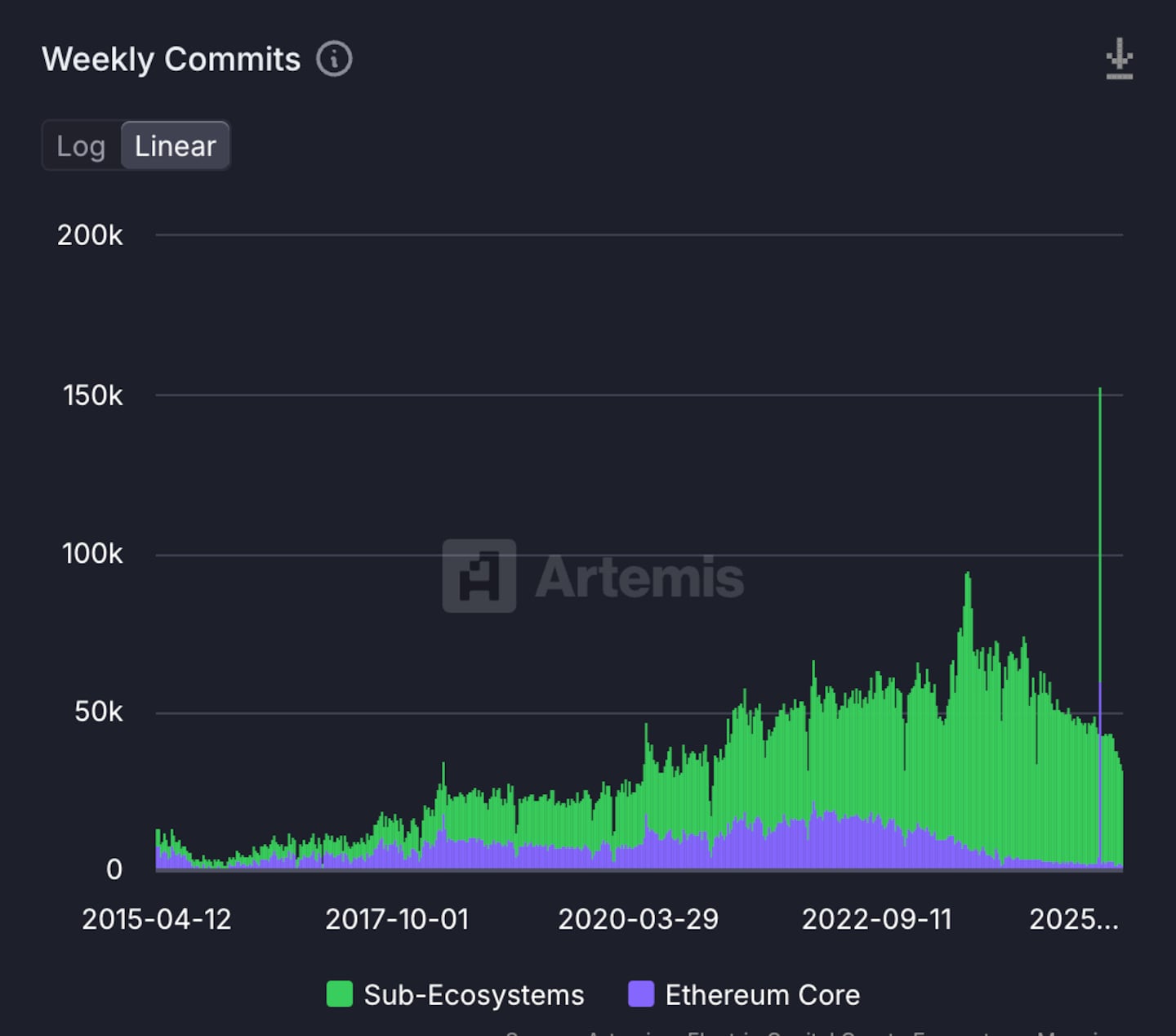

Developer decline

Developers are not that active on Ethereum anymore.

Artemis data shows that weekly code commits — a measure of contributions to the network — have plummeted to 5,000 from 15,000 in 2025. That’s a 67% decline.

Meanwhile, active developers soared to 2,000 in late 2021 amid the rollicking DeFi summer.

Since then, interest has fallen off a cliff, with 400 weekly active developers in 2025, a 80% drop.

Despite Ethereum’s short-term price rally, these charts don’t offer the most optimist outlook. And it’s not easy to pinpoint what will turn Ethereum’s luck around.

For now, investors might only have their conviction to lean on.

Pedro Solimano is a markets correspondent based in Buenos Aires. Got a tip? Email him at psolimano@dlnews.com.

Related Topics

Search

RECENT PRESS RELEASES

Related Post