Where smart investors are moving cash in a volatile market

November 18, 2025

0:00 spk_0

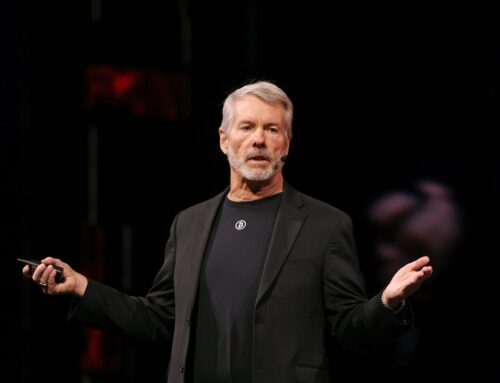

Welcome to Stocks and Translation, Yahoo Finance’s video podcast that cuts through the market mayhem, the noisy numbers, and the hyperbole to give you the information you need to make the right trade for your portfolio. I’m Jared Blickery, your host, and with me is Yahoo Finance senior reporter Ali Canal, who’s here to connect the dots and to be that bridge between Wall Street and Main Street.Today we’re gonna be talking about this bull market that will not quit alongside the investors who keep buying the dip. Our phrase of the day is price discovery. It’s how markets work at their core, but what happens under stress when prediction markets token.and 24/6 traded introduce their own set of new variables. And on today’s market show and tell, we take a deep dive into short interest. Can anyone say short squeeze? And this episode is brought to you by the number 27%. That is the stock market return outside of the US this year alone. We look at some international markets that are trouncing American stocks in 2025.And today we’re welcoming back Caleb Silver, who is editor in chief of Investopedia, also the chief business editor at People Inc. He is an Emmy nominated business journalist who spent about 3 decades translating markets for everyday investors, and this is his 5th appearance on stocks in translation. Caleb, welcome to the 5 timers. Good to be back. Yes, um, why don’t we start just by telling us what you think of the current markets rightnow?

1:27 spk_1

Yeah, a little chopper.Right now, a little windy out there, a little choppy in the stock market right now. Is it to be expected? These are the beginning of the 6 best months of the year for the stock market, but pretty good run. We’ve had a pretty good run off those April 2nd or 3rd lows. Uh, stock market was up some 30%. Lots of drumbeats around overvaluation, bubbles, fragility, too much weight in one sector of the market. We’ve heard it all, and it’s not crazy to see a little bit of a sell off here, but a nice little healthy sector rotation if you look at what’s happening inside.The market sector rotation, of course, the lifeblood of themarkets.

2:00 spk_2

So why now? Because we’ve been talking about market bubbles and all these risks to the stock market for quite some time, yet stocks just kept powering higher. Why are we seeing this sell off atthis point?

2:09 spk_1

Well, I think expectations have been just so high, and companies have been delivering results. Profit growth has been great. If you look at the numbers just for this quarter, profit growth is up 13% plus. And if you look at the tech companies, up more than that. So expectations are super high. If you’re not blowing out those expectations.There’s a little bit of a sell off here, but don’t forget, investors have had a great run riding about the same 10 to 12 stocks for the past 2 to 3 years, really since this bull market began in late October of 2022. little selling here, end of year, maybe rotating out into different sectors of the market, not crazy. Also, there might be some catch-up play from those global fund managers that were bearish for so long, so we might see this balance out over time.

2:47 spk_2

Right, well, thatall relates to our phrase of the day, price discovery. It’s a process whereChanging supply and demand pushes the price of a stock or asset toward the market’s best current estimate of its value. New information changes what buyers are willing to pay and what sellers are willing to accept, causing prices to move as the crowd updates its view of value. So Caleb, when we talk about price discovery, how do you think about that, especially within the context of this currentmarket?

3:14 spk_1

Yeah, well, usually we look at things like the equity risk premium, right? Where where are Treasury bonds trading right now? What’s my risk orThat’s my potential payout if I take a risk with higher risk assets like stocks. Uh, the fact is, for the first time in a long time, we see the bond market rallying. I was looking at the Bloomberg Ag index. That’s a sort of a compilation of some corporate bonds and and government bonds and mortgage backed securities. That is up 6.5% plus so far this year. That’s been in a bear market for years, which means yields are falling. Yeah, yields are falling, which is good for people that hold those bonds in terms of price, uh, but you rarely see that happen at the same time you see the stock market kind of having these.Uh, record highs even though we’ve been off that for a couple of weeks. So price discovery is pretty hard these days, especially when you have companies that are $5 trillion in market cap like Nvidias of the world or the or the uh uh palantirers of the world that have really super high valuations trading on a good profit growth, but at the same time, the evaluations are back to where we were back in the late 90s, 1990s, nosebleed days. So it’s hard to have discovery when you have these outsized gain by 10 to 12. I said big companies.

4:17 spk_0

I’d love to get your take on what some of the browsers of Investopedia.com are looking at right now, because just like Yahoo Finance, you know, we, we survey retail audience and sometimes just what people are looking at can give you a lot of information about what might happen in the market. So what is that saying?

4:33 spk_1

Yeah, I was just digging into this recently. I, I like looking at it every day, but we like to look at it over a period of time, especially after a market moving event. So you had the government shutdown. We’re obviously looking at the impact of that, how was, you know, which one was the longest, how did it affect the economy, how did it.affect the stock market, but beyond that, as yields fall, as, as the, uh, the Fed is probably going to lower rates over the next year if you believe the dot plot, you’re seeing more and more people, and you could tell just by age group looking for ways to get out of money market funds, get out of high yield savings accounts as those yields come down below 4% or so looking into investing in ETFs. And if you look at ETF inflows this year, BFA research had a good piece on that last week, uh, record inflows into ETFs, equity ETFs, record inflows in.To tech right now. So a lot of our investors are looking at the same thing. Where should I put my money if I want to continue to ride, uh, this bull market and where’s a little bit safer of a place if I don’t want to buy individual equity? So they’re looking at the strongest ETFs. They’re looking at, you know, what’s inside of them, how they’re constructed right now, and they’re also looking, uh, also for, you know, weird omens like the Hindenburg omen.

5:36 spk_0

Oh, my favorite,yeah, that’ll grab some headlines when,

5:39 spk_1

you know,

5:39 spk_0

fires off 5 times ina row. Yeah,

5:41 spk_1

Hindenburg Oen obviously when, when you have a bunch of different technical indicators.Flashing warning signs on the market trades below 50 day moving average and you have a big split between advancers and decliners. They’re looking at that and they’re always looking some of them for opportunistic ways to play themarket.

5:55 spk_2

And when we talk about retail investors, there’s been this by the dip mentality that we’ve seen consistently. But at the same time, I am hearing from our strategists that there is some AI fatigue and that retail trading has slowed a bit compared to where we are. Uh, what’s your thoughts on the retail trader at this point?

6:14 spk_1

They’re aggressive and bullish pretty much all year. We survey our readers every two months. They’re cautiously optimistic. They’ve been that way for a while because they’ve been sitting on gains. April shook them a little bit, shook all of us a little bit, but they’re still cautiously optimistic. And if you look at flows, and I tracked this from, uh, retail investors investing outside of their defined contribution plans, outside the 401ks, split there, 5 months in a row of buying, continued buying and buying the same stocks, the same stocks that they hold, buy, protect, and love what they buy.Yes, they keep working. So if you look at the top buys just over the last few weeks, I was checking out, uh, Fidelity screener there you had Nvidia on that list. You even had Tesla on that list, always, uh, uh, uh, a, a highly traded stock. You had Palantirer, Microsoft Meta on that list as well. When you look at what they’re selling, they were selling some healthcare, they’re selling some chip stocks, but in general, the trend has been buying. That’s why you have those record inflows into equity ETFsthis year.

7:06 spk_0

Yeah, interesting to note healthcare. Maybe we’ll swing back to that later in the show, but now it is time for market show and tell. Today.We are tackling short interest, which is the number of shares investors have borrowed and sold, betting that a stock is going to fall, shown as a percentage of the shares that are available to trade. And when that percentage is high, means a lot of people are betting on a stock’s decline. And Caleb, you’re bringing in, uh, Jack in the Box, Ticker is JACK as an example, which has investors shorting about 35% of its shares. That’s the short interest. So tell us how you use this data, which is alsoOn a delayed basis.

7:43 spk_1

Yeah, first of all, A plus on the explainer. Are you Investopedia A plus for you there, but also I borrowed heavily from

7:49 spk_0

Investopedia.

7:50 spk_1

Ding, you guys have a great, uh, short interest screener on Yahoo as well, where I look some of this stuff up, where, uh, it is a little bit delayed, but you’re seeing where the biggest bets are against the single equity or an index in the case of the S&P 500 or the Nasdaq. So we want to see, uh, when you look at short interest, you want to look at how many shares are being shorted relative to the overall share account, right? You want to look at.They call the short interest rate ratio, how many days to cover. A lot of those shorts were called out and the float, which, as you mentioned, close to 35%. Guess what? Jack in the Box shares down 64% so far this year. So that’s a stock that investors have been betting against, which makes me sad because my grandfather used to take me to Jack in the Box and we were running errands around Southern California back in the 70s. So it’s sad to see that that happen, but it’s a good way to look at whether or not investors are bullish or bearish on a stock outside of the normal research you do. If you look.to the fundamentals of Jack in the Box, not great right now either, but the fact that there’s so much pessimism around it, it’s a good flag for retail investors whenever they’re considering buying a single stock.

8:50 spk_2

Is there a way to look at the short interest in a stock and kind of determine whether or not that’s setting up for a short squeeze?

8:57 spk_1

Yeah, I think the more you see that pile up, especially in a short period of time, and then you look at who actually owns the stock, if it’s heavily owned by institutions or insiders, 2021. There you go. Yeah.Bring you back a few years to 2021. That was the game, right? The more the the short interest, the more that big institutions and hedge funds were betting against these stocks, the more that retail investors, especially in Me stock land, were squeezing these stocks by buying them and encouraging others to buy them, setting the price higher, and that makes the people that owned it that were shorting and have to pay up, uh, those shares that they borrowed. It’s pretty painful when you have a short position and the stock gets short, uh, squeezed and squeezed higher and you own it, you end up losing a lot more than you bet going in.

9:39 spk_0

Caleb, I want to ask you kind of a bigger picture question outside of the uh short interest uh conversation here, but using Jack as an example, also Chipotle, also Lululemon, we have a bunch of retail names and it, it seems to be a tale of haves and have nots, have nots. Does any of the uh basket of losers concern you right now, or is that just normal market wear and tear and rotation? Yeah,

10:03 spk_1

I think it’s alittle bit of that, but it’s alsoSo, uh, some of these stocks may have lost sort of that momentum. And right now it’s all about momentum. There’s a few metrics that really matter right now in the stock market, price being one of them, but the other one that’s super important is revenue per employee. I think we’ve talked about it before, maybe on this show, but I think that’s the, the, the single most important metric that big investors are focused on. How much are you squeezing out of your workforce and guess which company has the highest revenue per employee in the stock market? You first.

10:31 spk_0

Oh gosh Microsoft, yeah,

10:33 spk_2

I would say Apple.

10:34 spk_1

Second, Nvidia, Nvidia about $3 million about $3 million per employee. They squeeze a lot of and they make actual product. You think some of these other software companies that don’t have to produce anything would have that. Apple again makes a product that gets a lot of revenue out of its employees. So that’s a good signal, uh, when you’re looking especially at AI and this demand for.Gross margin improvement if you’re using AI or if you’re investing so much, how much are you getting out of it and how much are you getting out of your workforce? Not a great sign for the workforce either.

11:02 spk_2

Alright, well, hold that thought. We need to take a short break, but coming up we’re talking international stock markets trouncing the US and a runway showdown that puts price discovery right in the crosshairs of new trading technology. Stay tuned.This episode is brought to you by the number 27%. That’s how much the MSCI all Country World Index, basically global stocks outside of the US, is up this year. Meanwhile, the US-based S&P 500 has climbed a very respectable 15%, but many countries are far and above those two markets. We have 70% gains in Korea, 40% in Spain, over 30% in Hong Kong and Brazil, and Caleb, it’s so interesting because I was just talking about.This with my little brother, and he said, I’m not diversified enough outside of the US. Is it too late though, considering some of these valuations? Well,

12:00 spk_1

I think a lot of people are now questioning the emerging markets trade and how strong some of these markets have been all year. What’s crazy is that these markets have been strong all year despite tariffs. Now, China is also outperforming the US despite all the threats of tariffs, but even if you look at countries like Poland and Greece, they are trouncing the United States, not big stock markets, not very liquid and.Really held a lot of growth stocks, but they’ve sort of been immune to a lot of the political and trade and tariff noise that’s been out there. Is it too late? It’s never too late, but now you got to be selective because we’ve had really good runs in a lot of these countries. Now what do these countries depend on? They depend on good trade and good demand. A lot of them that export to the United States. South Korea is top of that list, uh, so it depends on good relations and if the good relations are good and there’s more trade deals that make it beneficial for the companies, let’s say a Hyundai or or or other countries inside South Korea.It could be OK to stick with it. It is very rare though to see international markets outperform the US for an extended period of time. It’s very much a US stock market around the world. No, you know, not being nationalistic here. It’s just the biggest market, the most liquid in the world. So this is very rare and it doesn’t last forever. I wouldn’t say it’s too late, but I wouldn’t go all in or even load up half of the boat with international stocks at this point.

13:11 spk_2

So considering you, you were just saying that longer term, the US usually always outperforms international markets, should you then beJust diversified within the US and not really be looking outsidetoo much.

13:22 spk_1

Well, back in the day we were a globalized economy and we may still be a globalized economy despite what you might hear from Washington right now. So it’s always good to have a little international exposure and you never know when you’re going to get one of these markets breaking out, but you don’t have to go out and look at the map and go put pins in them and try to pick them individually by the MSCI all world index, make it a part of your portfolio, make emerging markets a part of your.Portfolio, especially if you think the trade winds, and I mean that literally are going to be favorable towards these countries going forward. Good time to own some of them inside the portfolio, but I wouldn’t go all just US and then half, uh, outside the US, make it a piece, not the entire half.

14:02 spk_0

I’mwondering, since we’re talking big picture here, if I could get your opinion on gold and some of the precious metals, also the dollar and crypto, what do you see this complex? Where do you see it now? Yeah,

14:14 spk_1

to be some sort of a correlation, and the only correlation, let’s start with Bitcoin, is that it’s a risk asset. It is the epitome of risk assets.

14:21 spk_0

C Corelations change a lot with Bitcoin.

14:23 spk_1

Absolutely they do. And the fact that you even had Bitcoin and gold rallying as much in, uh, together this year is pretty strange, uh, when you think about why Bitcoin was allegedly created. But it just shows you how the investor base in Bitcoin has matured. We still have probably most of it owned by a very small handful of people, but the retail exposure has been broad. Institutions.are jumping in by the end of next year. We’re gonna have it in our 401ks if we want it. Uh, so it’s gonna, it still has room to grow, but it has been much a very much a risk on risk off asset. And the fact that it’s had this tremendous plunge over the last few weeks, actually, if you look at Bitcoin, that’s nothing crazy. That happens pretty often with Bitcoin.

14:59 spk_0

80% is crazy, but we’re not even close to

15:01 spk_1

that. Not even close. Anybody that’s been a Bitcoin holder for a long time knows that this is a very small bump in the road. You look at the dollar, that is all trade, right? That is trade and also a belief in.Health of the US economy. Now, the most widely held assets in the world are the dollar and the US Treasury. So if you look at the yields on the Treasury and you look at the dollar and it’s still down about 10% or so this year, it’s been that way for a while, yeah. That tells you that a, it’s part of the tariff policy, and B, there isn’t that much confidence in the growth aspect in the growth prospects for the US economy as seen by the biggest holders of ourassets.

15:36 spk_2

Now I recently talked to some economists who say that theThe dollar was consistently overvalued and that this correction maybe was needed and we could see that play out over potentially the medium to long term. Do you, do you agree with that or do you think we’re going to see this bounce back in the dollar anytime soon?

15:53 spk_1

I don’t disagree with what with what that person told you, and I also think, you know, a lower dollar is actually pretty good for a lot of our companies that do business outside the US. So I think that’s part of this administration strategy too. I think depressing the dollar one way or the other.Is actually beneficial and I don’t think that they mind it. So I don’t think it’s gonna be this way forever and a very strong dollar could make it very tough for a lot of the countries starting to do business or continuing to do business outside this country if tariff negotiations continue to ease a little bit and there’s more business to be done country to country. You kind of want the dollar where it is. Look at the profits that the American companies are making these days.

16:31 spk_0

Caleb, you said something towards the beginning that I just wanted to reiterate here that uh.Rotation, market rotation is the lifeblood of a bull market. I think it’s Ralph Alcampo, CMT who said that he’s known as the godfather of technical analysis. He’s also Jay Wood’s uncle, and Jay Woods, another regular here, another five-timer, by the way. Where am I going with this? I wanted to talk about healthcare because we’ve seen, uh, this is healthcare is the number one performing sector this quarter. So we’re thinking since October 1st and also what happened October 1st, that was the very beginning of the shutdown. So,I don’t know if that’s a reaction to it, but what do you think of, uh, the rotation that we’ve seen over the last month and a half or so? Yeah, well,

17:11 spk_1

defense wins playoffs and when things get a little tense at the end of the game, you want your defense to stand up. Healthcare’s a pretty good proxy for that, as are financials, which have also been a relatively strong sector. So there’s that. But there’s also the fact that prices are going up across the healthcare.Complex and I’m talking about health care insurance premiums one way or the other, those are going up next year. Health care costs in general are going up next year and beyond. So that’s one of the places we’ve seen a lot of inflation a lot of that or some of that goes to the bottom line of some of the health care providers, but it’s not as if the growth is gonna be that extraordinary where if all of a sudden it looks like there’s yet another leg of growth in tech.And then we might find that out when Nvidia reports results, then, uh, you know, you’re gonna want to be in those aggressive sectors, so you can see that rotation rotate back as soon as there’s a feeling that the coast might be a little clearer for tech.

17:58 spk_0

Excellent example. We got to stick with trading here uh because we’ve got a market’s take on a classic Hollywood Gab show staple. We call it who wore it better.Today’s runway showdown is all about how prices get set in today’s markets. On the right catwalk is the oddsmaker strutting in in a flashy jacket, phone in hand, checking live yes no odds like it’s a sports book for stocks. On the other side we have the spreadsheet strategist gliding down the one runway in a tailored suit, arms full of color coded models for every ticker, as well as earnings printouts. Both are trying to answer the same question. What is this stock really?Right now, the oddsmaker leans on guts, odds and momentum. The strategist leans on numbers, patterns and patience. So in this current market environment, Caleb, who wears it better? The flashy oddsmaker or the button up strategist? Yeah.

18:50 spk_1

Well, the oddsmaker is having a lot of fun right now when you think about all the different ways that you can bet on probability, whether it’s in the capital markets or whether it’s in sports right now or even politics. You can bet on just about everything right now.And if you look at where the action is and a lot of the speculation, you could say the oddsmakers are doing a little bit better. And another way to tell is that strategists keep revising their targets because, right, and yeah, we get that every year. That’s part of the deal. Uh, hey, you know, 2 months ago, I think I’m gonna put a new price target on the S&P 500 because I’m feeling a little bit more bullish or bearish or whatever. That happens all the time, so they’re constantly moving their targets around. So it’s hard to argue that they’re doing better. That said, there are a few out there in the Ed Yardannis of the world.And others who actually stay pretty consistent with their, with their year-end picks, so I don’t want to disparage too much, but it is this confluence of things that are happening at the same time. This has been a big year for the, the, the smashing together of the betting markets, the poly markets of the world. I know Yahoo Yahoo’s done a deal with them. I literally has done a deal with them. CBOE is doing a deal with them, but you also have more people betting on sports, 37 million online sports bets right now. People doing a lot of day trading, a lot of options.trading. This is all slamming together in younger generations like that quick action. I like to bet on the probability of the coin toss. Hopefully that is their entrance way into long-term investing because that’s where the real money is made, but it is fun and if that’s what brings them in, come on

20:13 spk_2

in. I was gonna ask about that. Like what are the long term ramifications of that if you have, you know, sports betting and all these other types of betting platforms emerging? Does that get more people into the market and then drive gains even higher so you have a bigger pool ofretail traders?

20:26 spk_1

Yeah, let me roll it back to Robin Hood.Introducing free trading back in the day. Now that was the to a lot of people jumping into the stock market. Then you had COVID and you had, uh, you know, the, the roaring kitties of it all, and people, everybody all of a sudden on Wall Street bets is an expert media. All of those things coming together really has really brought us to this point. And now the fact that you can bet and really bet money on just about everything and tie it together, that’s fascinating. Plus we have the 24/6 markets opening up in Texas. We have the tokenization of just about everything, so.Picture this. There is Amazon.com, the stock AMZN, and then there’s the tokenized AMZN that trades 24/6. Talk about

21:05 spk_0

leverage too in the future. We talk

21:07 spk_1

about price discovery. Well, which stock, where’s the real price? Is it on the stock that stops trading at 4 p.m. every day? Not really, but stops trading it every day at 4 p.m., or is it in the tokenized version of Amazon that is trading around the clock and can be off 510 25% points by the time you wake up in the morning?

21:24 spk_0

You know, I think we need to have a separate conversation about a potential Minsky moment for all of this, uh, the new markets activity that we’re seeing here, but we got to wind things down, had a rip roaring discussion not only about price discovery and the nature of it, learned a lot here, but also a short interest and you don’t knock that out because even though it’s a lagging indicator, it can be a powerful tool to predicting market squeezes. And also we took a look at the international side of trade this year.And a lot of people in the US that might have flown over your head, but there are some markets outside the US that are going gangbusters this year. So don’t say that there is no potential for diversification outside the US, at least not right now. And on that note, we got to bring it to a close. Uh, be sure you check out all the other episodes of our video podcast on the Yahoo Finance site and mobile app. We’re also on all your favorite podcast platforms, so be sure to like, leave a comment, and subscribe wherever you get your podcast. We’ll see you next time on Stocks and Translation.

Search

RECENT PRESS RELEASES

Related Post