Where Will Apple Stock Be in 1 Year?

October 30, 2025

Apple (AAPL +0.64%) stock has delivered a muted performance on the market so far in 2025, rising just 5% as of this writing. The tepid returns can be attributed to a poor first half, when the tech giant’s expensive valuation, tariff-related concerns, and worries that it is falling behind in the artificial intelligence (AI) race led investors to press the panic button.

Specifically, Apple stock lost 18% of its value in the first six months of 2025. But what’s worth noting is that it has gained impressive momentum lately, rising 23% in the last three months. What’s more, it looks like Apple is on track to close the year on a high, and it won’t be surprising to see it carry forward that momentum into 2026. Here’s why.

Image source: Getty Images.

Apple’s latest iPhone lineup is reportedly a sales hit

Apple unveiled its iPhone 17 series last month, and the good part is that its latest devices seem to be gaining impressive traction among customers. Counterpoint Research points out that sales of the iPhone 17 models were 14% higher than last year’s models in the U.S. and China in the first 10 days they were on sale in these markets.

The research firm added that the base iPhone 17 model is selling like hotcakes, with its sales rising 31% across the U.S. and China. In fact, sales of the base iPhone 17 model doubled in China in the first 10 days. These are encouraging developments for Apple, considering that the U.S. and China accounted for 60% of its overall revenue in the third quarter of fiscal 2025 (which ended on June 28).

The company’s sales grew in both these markets, and the early reports about iPhone 17 sales suggest that Apple could end the year on a solid note. Even better, Apple has the potential to carry forward the iPhone sales momentum into 2026 as well. That’s because, according to Dan Ives of Wedbush Securities, around 315 million iPhone users haven’t upgraded their devices in four years.

This probably explains why this year’s Apple event attracted a bigger audience than in 2024, when the rollout of its first-ever AI-enabled iPhones should have ideally attracted more viewers. Digital market intelligence provider Similarweb points out that the global unique visitors on Apple’s website for the latest iPhone event were up by 12% as compared to last year.

Today’s Change

(0.64%) $1.73

Current Price

$271.43

What’s more, the number of visitors when the pre-orders began jumped by almost 16%. Of course, this spike can’t be taken as a concrete signal of an increase in iPhone sales, but it does indicate that there is stronger interest in Apple’s latest devices. And that interest is probably why Counterpoint suggests that early sales of the device have been strong.

Moreover, the 315 million iPhones that are currently in an upgrade window could allow the company to ship more than the 236 million units that Morgan Stanley is expecting Apple to ship next year. As it turns out, Apple has reportedly increased its production forecast of iPhone 17 models for the beginning of 2026 by six million units to 94 million.

That run rate suggests that Apple is indeed on track to crush Morgan Stanley’s expectations, which could eventually result in more upside.

How much upside can investors expect?

Apple’s 12-month median price target of $256 indicates that Wall Street isn’t expecting any upside from the stock in the coming year. The stock is currently trading at just over $260.

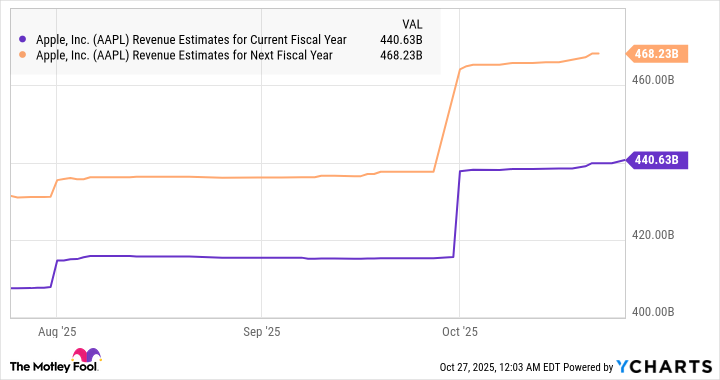

However, don’t be surprised to see Apple going past that price target. The company is expected to deliver almost $440 billion in revenue in the current fiscal year (which has just begun), and that estimate has jumped significantly of late.

AAPL Revenue Estimates for Current Fiscal Year data by YCharts

There is a possibility that the estimate will move higher if iPhone sales continue to track ahead of expectations. Assuming Apple manages to end fiscal 2026 with even $450 billion in revenue and trades at 10 times sales after a year (in line with its current sales multiple), its market cap could jump to $4.5 trillion.

That would translate into a 15% pop from current levels to $302. However, don’t be surprised to see Apple delivering bigger gains as the market could reward it with a higher sales multiple if it can indeed clock stronger-than-expected growth. That’s why investors can consider buying this tech stock as it has the potential to sustain its rally in 2026.

Search

RECENT PRESS RELEASES

Related Post