Why Bit Digital (BTBT) Is Down 11.6 Percent After Pivot to Ethereum Staking and AI Infrast

October 23, 2025

- Earlier this month, Bit Digital announced a major business transformation, shifting away from Bitcoin mining to focus on Ethereum staking, high-performance computing, and AI infrastructure, supported by a US$150 million convertible note raise and the accumulation of over 150,000 ETH.

- This shift has sparked increased institutional and insider interest, highlighting how Bit Digital’s move positions it as a prominent Ethereum treasury and staking platform amid broader regulatory changes and growing acceptance of digital assets.

- We’ll examine how Bit Digital’s renewed focus on Ethereum staking and AI infrastructure signals a turning point for its investment narrative.

Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

Advertisement

Bit Digital Investment Narrative Recap

To own Bit Digital shares today, an investor needs to believe in the company’s transformation from Bitcoin mining to an Ethereum-focused model, leveraging ETH staking, high-performance computing, and AI infrastructure to fuel future growth. The shift to Ethereum as a primary business driver, underpinned by growing institutional interest and recent capital raises, is likely to become the most important short-term catalyst. However, the business also faces a significant risk from concentration in ETH and market volatility, which could sharply impact near-term financial performance.

Among the recent announcements, Bit Digital’s completion of a US$150 million convertible note offering stands out as highly relevant. This funding directly enabled the company’s large-scale ETH accumulation, reinforcing its position as a leading Ethereum treasury platform and supporting its efforts to accelerate expansion into staking and AI infrastructure, both of which could influence returns over the coming quarters.

Yet, in contrast to these growth ambitions, investors should keep in mind the ongoing risk that heavy reliance on ETH exposes Bit Digital to unusually high earnings and revenue swings if market conditions shift or if…

Read the full narrative on Bit Digital (it’s free!)

Bit Digital’s narrative projects $376.7 million revenue and $35.3 million earnings by 2028. This requires 56.4% yearly revenue growth and a $88 million earnings increase from -$52.7 million.

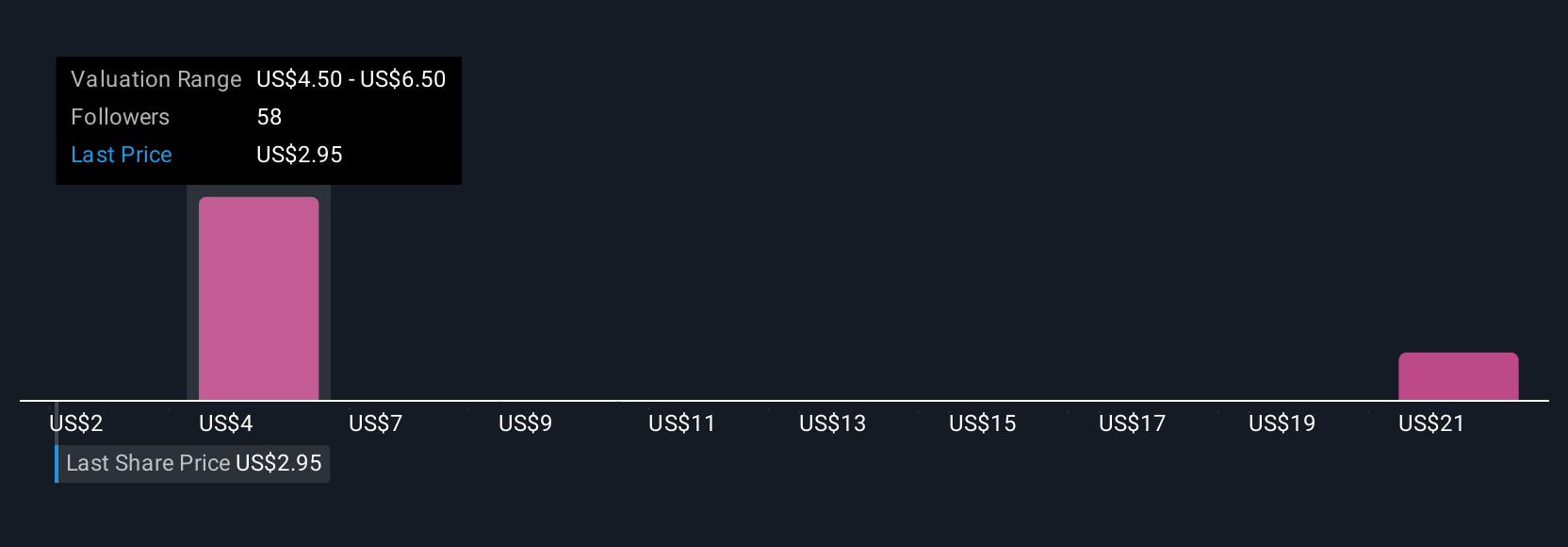

Uncover how Bit Digital’s forecasts yield a $5.70 fair value, a 59% upside to its current price.

Exploring Other Perspectives

Twelve Simply Wall St Community perspectives place Bit Digital’s fair value between US$5 and US$27.50 per share, capturing substantial divergence. With high ETH concentration risk central to the outlook, such wide views highlight how quickly market fortunes could change, take a look at the full range of community insights to see how your views compare.

Explore 12 other fair value estimates on Bit Digital – why the stock might be worth over 7x more than the current price!

Build Your Own Bit Digital Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bit Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bit Digital research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Bit Digital’s overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post